Nokia shares plunge on weak Q1 2018 numbers

Finnish networking vendor Nokia had a disappointing Q1, with profits sinking year-on-year, resulting in a 7% share price decline at time of writing.

April 26, 2018

Finnish networking vendor Nokia had a disappointing Q1, with profits sinking year-on-year, resulting in a 7% share price decline at time of writing.

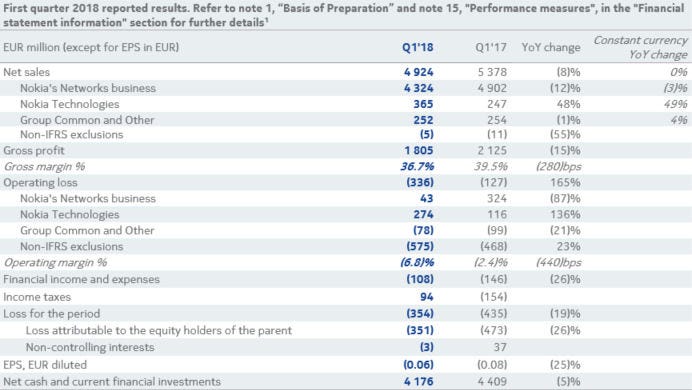

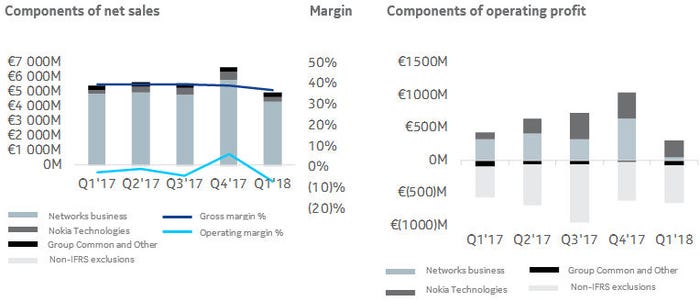

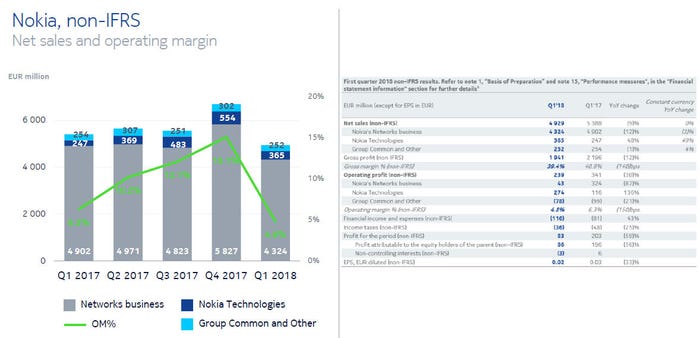

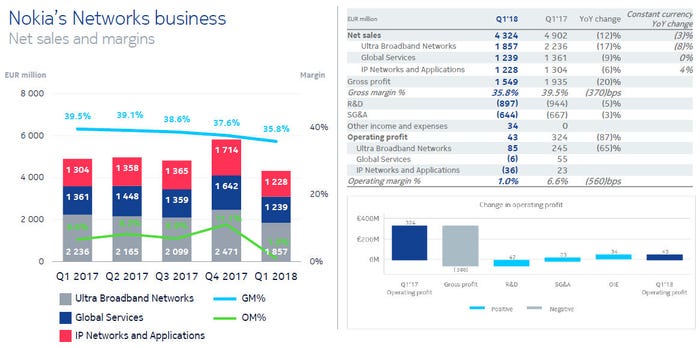

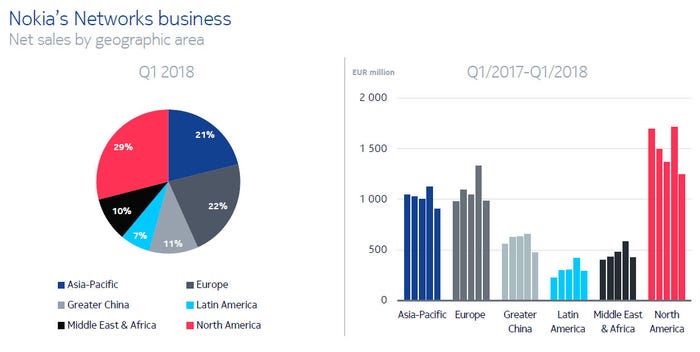

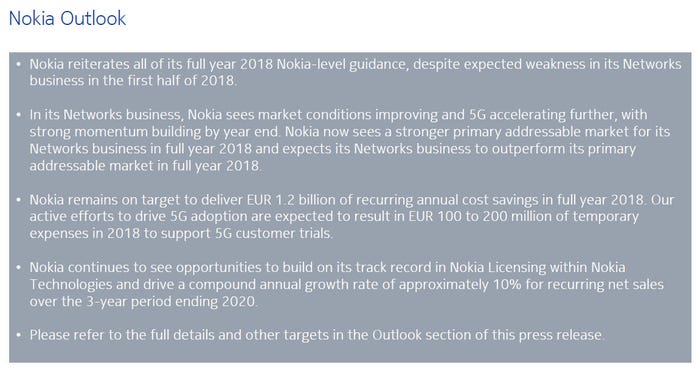

Revenues at Nokia’s core networks business declined 12% YoY, but were only down 3% once its accountants had finished working their currency magic. The problem was that only yielded an operating margin of 4.8%, down from 6.3% a year ago, resulting in a YoY operating profit plunge of 87% for networks. Total group operating profit fell well short of analyst expectations.

Since the ‘other’ category continues to run at a loss, the only reason Nokia made any operating profit at all in the quarter was a 48% jump in revenues for the technologies division which, since it mainly deals with intellectual property licensing, is much higher margin and thus saw its operating profit jump by 136%.

“We see strong momentum building for the full year despite a slow start in Networks,” said Nokia CEO Rajeev Suri. “I have considerable confidence that Nokia is well-positioned to out-perform a strengthening Networks market and meet our full-year 2018 guidance.

“Our confidence is based on strong order intake and backlog in Q1; our end-to-end strategy is resonating with customers, resulting in strong cross-sell activity and a year-on-year doubling of the multi-business group pipeline; we have clear visibility to 5G deals for large-scale commercial rollouts in United States in the second half of the year; and are successfully executing our diversification strategy, with consistent double-digit profitable growth with enterprise and webscale customers.

“While our Networks gross margin in Q1 decreased on a year-on-year basis, the primary underlying reasons for that – regional and product mix – are largely temporary in nature and expected to improve in the second half of 2018. It is also important to understand that we did not see significant degradation of margins at the overall product level. We remain on track to deliver on our EUR 1.2 billion cost savings commitment.”

It looks like North America softened, so Nokia ended up selling a higher than usual proportion of low-margin stuff, such as optical networking gear rather than software, to less affluent regions. Nonetheless Suri made a point of sounding bullish about the second half of this year and seems to think the 5G cash is already coming in, which is pleasantly surprising.

We’ll leave you with some selected slides below and finish (no pun intended) by contrasting Nokia’s numbers with Ericsson’s, which seemed to indicate a turning for the corner and were rewarded with a big share price jump that has been sustained. What a difference a quarter makes.

About the Author(s)

You May Also Like

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)

.png?width=800&auto=webp&quality=80&disable=upscale)