O2 and Virgin Media are merging to form BT-busting connectivity giant

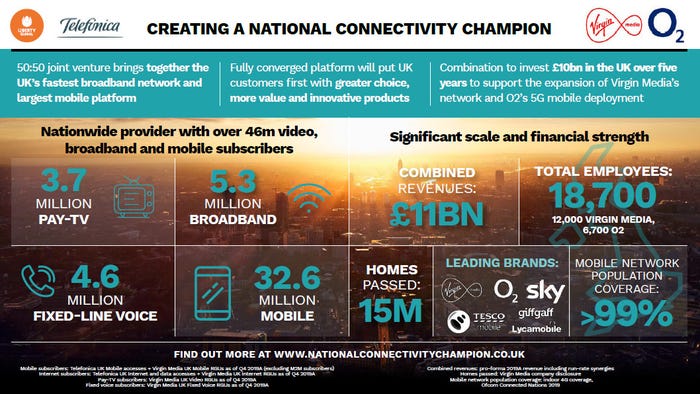

Telefonica and Liberty Global have confirmed plans to merge UK operations, O2 and Virgin Media, to challenge the connectivity market leader BT.

May 7, 2020

Telefónica and Liberty Global have confirmed plans to merge UK operations, O2 and Virgin Media, to challenge the connectivity market leader BT.

Since the end of the Supply Chain Review, the UK telecoms market has been relatively mundane, operating as one would largely expect, however this merger throws a cat amongst the pigeons. All of a sudden, the UK has become on the most interesting markets to watch, with the promise of a second convergence connectivity business to rival market leader BT.

“Combining O2’s number one mobile business with Virgin Media’s superfast broadband network and entertainment services will be a game-changer in the UK, at a time when demand for connectivity has never been greater or more critical,” said Telefónica CEO Jose Maria Alvarez-Pallete. “We are creating a strong competitor with significant scale and financial strength to invest in UK digital infrastructure and give millions of consumer, business and public sector customers more choice and value.”

“We couldn’t be more excited about this combination,” said Mike Fries, CEO of Liberty Global. “Virgin Media has redefined broadband and entertainment in the UK with lightning fast speeds and the most innovative video platform. And O2 is widely recognized as the most reliable and admired mobile operator in the UK, always putting the customer first. With Virgin Media and O2 together, the future of convergence is here today.”

Talks emerged earlier this week, though they certainly got to the official confirmation stage quicker than many were expecting.

As part of the agreement, a 50-50 joint venture will be created, with the promise to spend more than $10 billion on network development over the next five years. Synergies are expected to be as much as £6.2 billion, with 46 million subscribers, 15 million homes passed for broadband, 99% population coverage for mobile, 18,700 employees and £11 billion in revenue.

Full details on the deal can be found on a new website, proudly proclaiming the creation of a national digital champion.

This all sounds very promising, but when the merger is complete in mid-2021, which brand will survive?

What should a merged O2/Virgin Media company be called?

Create a new identity (43%, 77 Votes)

O2 brand should be kept (37%, 67 Votes)

Virgin Media should be retained (20%, 35 Votes)

Total Voters: 179

“In the long run, we believe it would be better for the JV to retain the O2 brand at the expense of Virgin Media,” said Kester Mann of CCS Insight. “Both have a strong presence, but O2’s respected customer service, highly loyal customers and sponsorship of the O2 arena mean it is impossible to drop. A multi-brand approach serves only to duplicate costs and risks confusing customers.”

For convergence to work, there can only be one brand which survives. BT’s £12.5 billion of EE has arguably not paid off to date as the two brands still exist, effectively creating two separate business units inside the same group. There might be convergence benefits from an operational perspective, but to realise the gains from a customer and commercial angle, the businesses have to be fully consolidated and coherent.

BT has never really been able to take advantage of its assets. It has the largest mobile network, the largest broadband network, the largest public wifi footprint and the largest bank accounts to throw cash at content. Its inability to evolve into a convergence-defined business has opened the door for O2 and Virgin Media. But the question is whether the duo can learn from these mistakes.

Ultimately this is a major threat to the BT business, not because this is a combination which can potentially match the scale and depth of BT services, but these are also two currently healthy businesses which are coming together.

Financial Results for O2 and Virgin Media to March 31 (UK sterling (£), millions)

O2 | Virgin Media | |

Total | Year-on-year | |

Revenue | 1,739 | 2.9% |

Profit | 516 | 2.4% |

Sources: Liberty Global Investor Relations and Telefonica Investor Relations

Usually, when mergers and acquisitions are discussed, one of the parties is a significantly stronger position than the other. It can still be good news, but there is plenty of work to do during the integration stages to ensure the new company is fighting fit. This is not the case with O2 and Virgin Media.

Virgin Media might have experienced a bit of a downturn over this three-month financial period, but this could likely be attributed to dampened customer acquisition amid the COVID-19 outbreak, while O2 has demonstrated year-on-year increases once again.

While these are healthy businesses right now, some might have suggested limited success in the convergence game would have caught up eventually. This is a very encouraging move forward, getting ahead of negative impacts, though a renewed assault on TV/content is needed. Neither, despite what Virgin Media claims, have done very well in this segment.

Current subscriber numbers for O2 and Virgin Media

Mobile | Broadband | Content | |

O2 | 35,266,217 | 29,085 | * |

Virgin Media | 3,179,500 | 5,271,000 | 3,687,400 |

Source: Omdia World Information Series

*Too early to tell how successful the partnership with Disney+ to add a content element to O2 bundling has been

One area which should be allocated to the risk column, though it is a very minor risk, is the prospect of regulatory intervention.

“Unlike when O2 attempted to join forces with Three in 2015 but was blocked by the European Commission, I don’t expect there to be any major hurdles to this deal going through,” said Dan Howdle, consumer telecoms analyst at Cable.co.uk. “After all, with BT’s purchase of EE given the all-clear in 2016, it’s difficult to see how a case could be made to block it.”

These are both telecoms companies, but service overlap is minimal. Core competencies lie in different segments, and while there have been attempts to launch into parallels, success has been woeful. These are complementary companies with little material service overlap.

When considering whether competition authorities will be interested, you have to ask whether the merger would make single business units stronger or is the company stronger by association with parallel services. O2’s mobile business will not be enhanced materially by Virgin Media’s MVNO proposition, and Virgin Media will not benefit from O2 at all in the fixed connectivity game. There does not seem to be any case for objection on the grounds of competition.

Aside from the direct impact for both Virgin Media and O2, the rest of the market could be spurred into action.

“Vodafone UK appears the biggest loser as the deal lays bare its weak position in the market for converged services,” said CCS Insight’s Mann. “It also looks certain to scupper its virtual network partnership struck with Virgin Media in 2019. We think this deal will trigger a ripple effect on the UK market: Vodafone, Three, Sky and TalkTalk will all be assessing their positions and further deal-making can’t be ruled out.”

This is a challenge to the industry and will create a rival to BT in mobile, broadband, convergence and enterprise. However, it is also worth remembering the ‘also rans’.

Unless the ambitions of rivals are inspired by this threat, the prospect of a tiered connectivity industry could emerge, with those offering bundled services on top and the pureplay service providers on the bottom.

The UK has quickly become one of the worlds’ most interesting telecoms markets, thanks to the permutations which could be inspired by this merger.

About the Author(s)

You May Also Like

_1.jpg?width=700&auto=webp&quality=80&disable=upscale)

.png?width=800&auto=webp&quality=80&disable=upscale)