Ericsson managed to extract more profit from less revenue in Q1 2024

Swedish kit vendor Ericsson continued its run of revenue declines last quarter, but its efficiency measures are paying dividends.

April 16, 2024

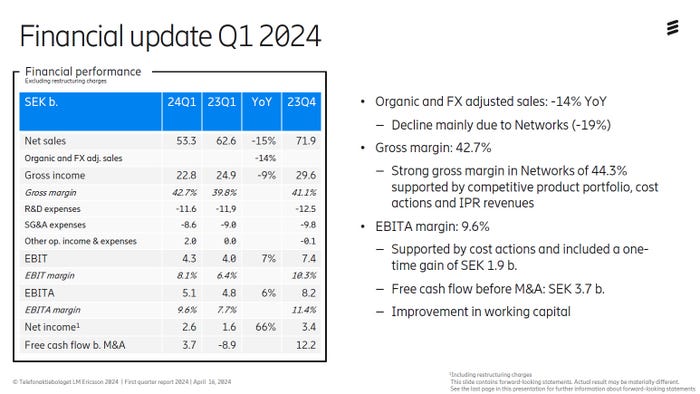

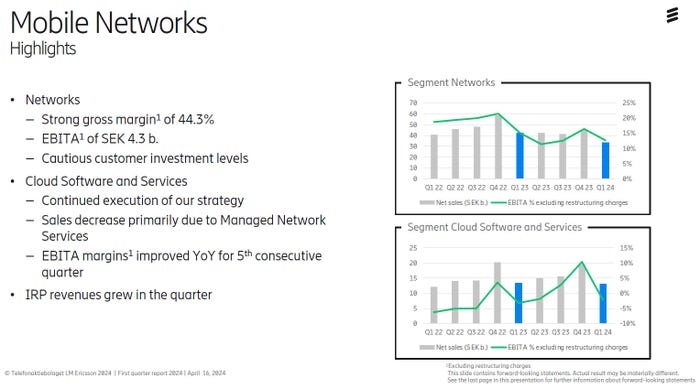

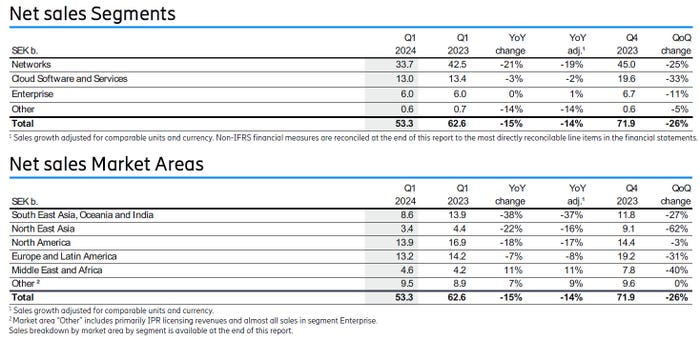

Quarterly organic sales were down 14% year-on-year, thanks to a 19% decline at Ericsson’s biggest unit – networks. But gross income was only down 9% year-on-year, gross margin was up almost three percentage points, and net income was up an impressive 66%, albeit from an exceptionally low year-ago level. This was apparently better than investors expected, with Ericsson shares up around 8% at time of writing.

"We expect a further decline in the RAN market, at least through the end of this year, as customers remain cautious with their investments and the pace of investment in India continues to normalize,” said Ericsson CEO Börje Ekholm. “Dell’Oro estimates the global RAN equipment market will decline by -4% in 2024, which may prove optimistic.

“If current trends persist, we expect our sales to stabilize during the second half of the year, benefiting from recent contract wins and the normalization of customer inventory levels in North America. Our enterprise strategy aims to leverage network capabilities to increase telecoms industry revenue growth above the level that traffic growth alone could deliver. While near-term dynamics are challenging, we remain fully committed to our long-term targets."

Ekholm was referring to the AT&T deal win, which has apparently yet to deliver significant revenues. As you can see in the table below, North America is Ericsson’s biggest region. It’s also its most profitable. It seems US operators have been using up inventory rather than buying new kit, but they have to run out eventually and Ericsson is betting that process will start in the second half of this year.

We had our usual chat with the head of Ericsson’s Networks business, Fredrik Jejdling, and he said another reason for the improved margin is the ‘strong product portfolio’, the inference being that you can charge more for better gear. He stressed that the cost efficiencies aren’t eating into R&D investment but noted there are more efficient ways of doing it, such as making use of the latest generative AI tools.

“We are managing what is in our control as we prepare for the uptick in the market,” said Jejdling. We asked if there are any more major layoffs planned and, while the answer was no, he stressed that prior announcements have improved Ericsson’s agility when it comes to adapting to market conditions. Jejdling also reiterated Ekholm’s call for the EU to be a bit more helpful when it comes to the region’s telecoms competitiveness.

As ever, Ericsson was open and honest about its current situation. The macro environment remains challenging and, in that context, staying on top of margins is more important than ever. The whole industry has its fingers crossed that things do pick up later this year. If they do, Ericsson’s next challenge will be to upscale just as efficiently to meet that renewed demand.

About the Author(s)

You May Also Like

_1.jpg?width=700&auto=webp&quality=80&disable=upscale)

.png?width=800&auto=webp&quality=80&disable=upscale)