Nokia rolls with the COVID-19 punches in Q1 2020

Finnish kit vendor Nokia managed a solid set of numbers in the first quarter of this year, despite supply hassle created by that most disruptive of viruses.

April 30, 2020

Finnish kit vendor Nokia managed a solid set of numbers in the first quarter of this year, despite supply hassle created by that most disruptive of viruses.

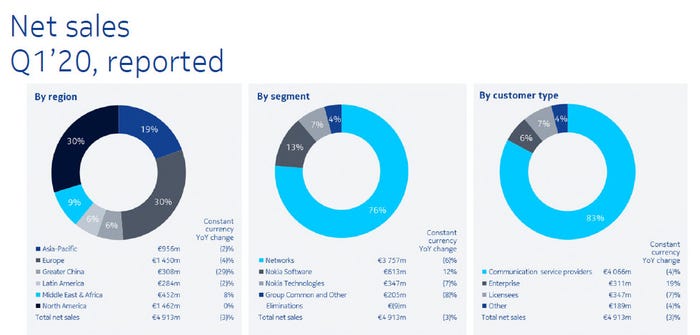

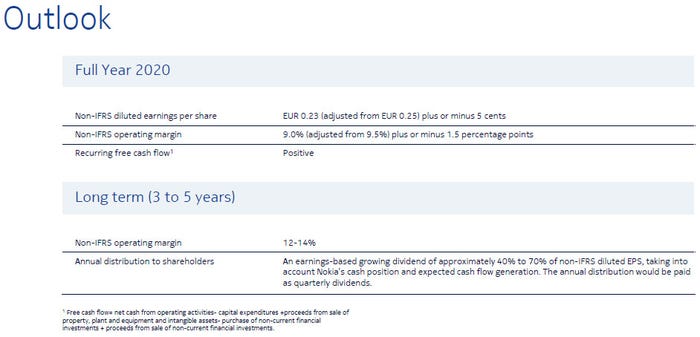

Revenues were down a little bit, year-on-year, but they would have been slightly in the black if not for €200 million worth of supply disruption causes by that goddamn coronavirus. On the other hand the operating loss was significantly reduced from €524 million a year ago to €76 mil in the most recent quarter, which translated to a non-IFRS net profit of €33 mil, indicating the cost reduction programme is going more or less according to plan.

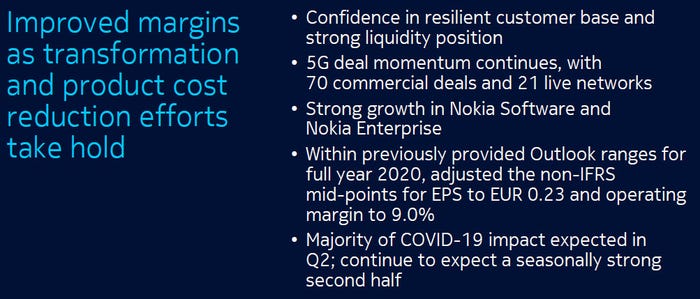

“Nokia’s solid first quarter results showed broad year-on-year profitability improvements as our transformation and product cost reduction efforts started to take hold,” said CEO Rajeev Suri in his prepared commentary. “On a year-on-year basis, group-level non-IFRS operating margin was up by 3.6 percentage points; Networks gross margin increased by 3.5 percentage points; Nokia Software had an excellent quarter with sharp margin improvements and strong momentum with customers in North America; and, Nokia Enterprise delivered double-digit sales growth.

“These improvements are, of course, coming at a time of unprecedented change, given the impact of COVID-19. Our top focus areas are protecting our employees, maintaining critical network infrastructure for customers, and ensuring we have a strong cash position. In Q1, we saw a top line impact from COVID-19 issues of approximately €200 million, largely the result of supply issues associated with disruptions in China.

“We are adjusting the mid-points within our previously disclosed Outlook ranges for full-year 2020 to reflect the increased risks and uncertainty presented by the ongoing COVID-19 situation. We expect the majority of this COVID-19 impact to be in Q2 and believe that our industry is fairly resilient to the crisis, although not immune.

“We did not see a decline in demand in the first quarter. As the COVID-19 situation develops, however, an increase in supply and delivery challenges in a number of countries is possible and some customers may reassess their spending plans. Pleasingly, despite the majority of our R&D employees working from home, we have not seen any impact on our roadmaps, and, in fact, some key software releases are proceeding ahead of schedule. Additionally, we saw a massive increase in network capacity demands.”

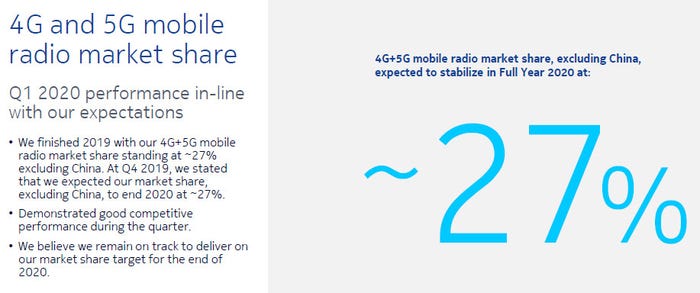

You can see selected slides from the Nokia presentation below. Note the 29% decline in Greater China sales, which seems to be offset by improved fortunes in the Middle East and Africa. Nokia seems to have been totally excluded from the Chinese market when it comes to the 5G RAN build-out, but its core and fixed line fortunes in the region remain unclear. Investors seemed happy enough with the numbers on the whole, with Nokia’s shares up 4% at time of writing.

About the Author(s)

You May Also Like

_1.jpg?width=700&auto=webp&quality=80&disable=upscale)

.png?width=800&auto=webp&quality=80&disable=upscale)