Covid-19 drives wearable device spending

Consumers will spend significantly more on wearable devices this year than they did last, with the Covid-19 pandemic proving to be a strong market driver, according to new data from Gartner.

January 11, 2021

Consumers will spend significantly more on wearable devices this year than they did last, with the Covid-19 pandemic proving to be a strong market driver, according to new data from Gartner.

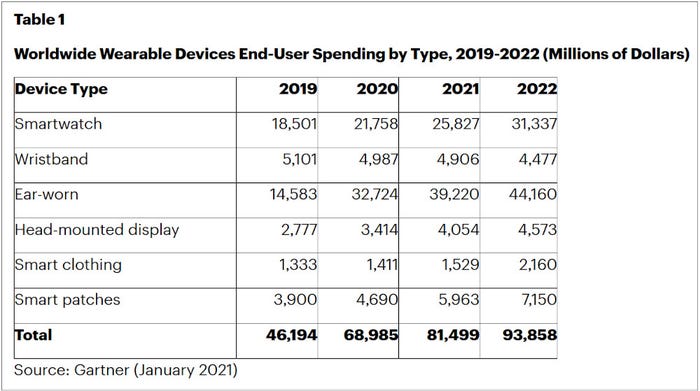

Global end-user spending on wearables such as smart watches and ear-worn devices will will reach US$81.5 billion in 2021, up 18.1% year-on-year, the analyst firm said, identifying growth in remote working and an increased interest in health-monitoring as a result of the pandemic as big catalysts for purchase.

Indeed, its figures show that spending on ear-worn devices more than doubled last year to $32.7 billion on the back of remote workers – of which there are now more than ever – upgrading their headphones for video calls and consumers buying headphones to use with smartphones. Ear-worn device spending is forecast to carrying on growing, albeit at a smaller rate, to reach $39.2 billion this year, an increase of just shy of 20%.

The second-biggest category, smartwatches, is experiencing steadier growth at 17.6% last year and a forecast 18.7% in 2021.

While one cannot argue that the pandemic is driving a greater interest in health and fitness-tracking, a key application of a smart watch, it’s probably not too wide of the mark to suggest that some people are not so much interested in the data as they are tracking these sorts of metrics as a result of there being little else to do during lockdown periods. Personal anecdote alert: I dusted off an old wristband device during the first lockdown purely to give some sort of structure to my government-sanctioned exercise sessions.

Spending on wristband devices is waning (mine had been in a drawer for a number of years) as consumers presumably select more advanced devices instead, falling to below €5 billion last year and forecast to drop further over the next two years.

There is growth predicted in all other categories of wearable device though, and Gartner highlighted smart patches in particular, a new category in this forecast. Smart patches stick to the skin and are used for health monitoring.

“Smart patches have been around for some time, but adoption has been slow due to strict regulatory compliance and resistance from both users and medical staff to adopt automated drug administration,” said Ranjit Atwal, senior research director at Gartner. “The shift to e-health, especially during Covid-19, will transform users’ perceptions of automated health provision and increase the demand for smart patches,” he predicted.

Smart patches will also benefit from a growing miniaturisation trend, which is making more wearable devices unnoticable to the casual observer and even users themselves.

“Continued advances in miniaturization and integration will enable further use cases and benefit adoption of smart garments, printed wearables, ingestibles and smart patches,” Atwal said. “These discrete and nearly invisible wearables will be particularly relevant and accepted by traditionally reluctant end-users, such as elderly patients who require medical applications but don’t want to call attention to the device or their ailment.”

Gartner predicts that by 2024, miniaturisation capabilities will advance to the point that 10% of wearable technologies will become unobtrusive to the user. As someone who regularly misplaces her smartphone and has to ring it to locate it under the bed or wherever, progress like that throws up all kinds of challenges…

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)

.png?width=800&auto=webp&quality=80&disable=upscale)