Vodafone UK Enterprise Director, Phil Mottram, talks consolidation and convergence

As Vodafone’s UK Enterprise Director, Phil Mottram is keen to point out when we meet in at Vodafone’s offices in Paddington, it’s not his place to comment on the pro and cons on the consolidation currently underway in the UK consumer telecoms market. Specifically, of course, this refers to the proposed acquisitions of EE by BT and O2 by 3 (Hutchison Whampoa), or as we like to call them at Telecoms Towers: BTEE and O5.

April 2, 2015

As Vodafone’s UK Enterprise Director, Phil Mottram is keen to point out when we meet at Vodafone’s offices in Paddington, it’s not his place to comment on the pros and cons on the consolidation currently underway in the UK consumer telecoms market. Specifically, of course, this refers to the proposed acquisitions of EE by BT and O2 by 3 (Hutchison Whampoa), or as we like to call them at Telecoms Towers: BTEE and O5.

This is a reasonable excuse, but his media training is also presumably a factor, and being quoted in the press commenting on your competitors often results in awkward conversations replete with aggressive rhetorical questions from your CEO, so it’s probably not worth the risk. But BTEE and O5 are the undeniable elephants in the room, especially as Vodafone is conspicuously absent from the current round of corporate shenanigans, leading to speculation that it risks being left behind in the UK market as the distant third in terms of subscribers.

While being careful to stress he is making no direct reference, one way or the other, to the aforementioned acquisitions, Mottram is keen to point out that Vodafone may have done all the UK acquiring it needs to do three years ago. “Vodafone bought Cable & Wireless in 2012, which was the number two fixed operator in the UK and also brought a lot of good customers with it as well as some pretty good datacentres and people,” he says.

“I wasn’t around at the time Vodafone made the acquisition but you can see a lot of sense as if you’re a mobile operator you’re clearly buying a lot of network infrastructure anyway, to backhaul the mobile traffic around the network, so C&W assets just to underpin the mobile infrastructure probably make sense. But then when you think about what’s going on in the market from an enterprise perspective: you had convergence around voice and data around ten years ago and now you have fixed and mobile coming together.”

Convergence is a persistent theme on tech sector commentary. The urge to aggregate all our gadgets into one seems compelling and the technology is an industry that prides itself on addressing new demand instantaneously. The smartphone is close to the ultimate consumer converged device, which is a major catalyst being the current telco industry trend towards multiplay: offering as many communications services as possible in one big bundle.

Asked to validate his claim that business telecoms is experiencing a similar shift, Mottram cites a couple of recent customer conversations. “I was speaking to a customer who was the CEO of an eight million pound printing business with offices around the UK and some offshoring in India,” he says. “He had recently bought a converged solution. I asked him why he had bought it and his initial response was ‘I just wanted one bill’.

“Where they seem to make most of their money is on the last-minute jobs, where the margins are much higher. Before the converged solution some of his staff had mobiles, some fixed, but he said the issue was you never want to miss a call from a customer because it could be a last-minute order. With the converged solution the incoming call is handled by our network and if the caller has selected the sales team, and none of them answer, it will then route the call directly to his mobile.

“Another good illustration of where it’s useful is if you wanted to set up, say, a taxi company in Reading, Slough and Windsor, ten years ago you would have needed to open three offices. Now you can have three different local numbers, but you don’t need any offices as the calls get routed straight to the drivers.”

The essence of technology and convergence is to put a greater number of tools at customer’s disposal and Mottram thinks a key feature of business telecoms is enabling companies to punch above their weight. “If you look at why some current mergers and acquisitions in the telecoms market are happening, it’s because people realise that at some point in the future this is the way all telecoms will be bought. This is definitely the way the market is going and it gives small companies the ability to pretend to be big companies,” he says.

Such is the evolution of the market that the perceived difference between fixed and mobile is rapidly diminishing. Both businesses and consumers are tired of opaque, Byzantine contracts apparently designed to make you pay for stuff you don’t need and telco companies have realised that simplicity and transparency are now highly desired commodities.

Mottram thinks Vodafone is well positioned to capitalise on this trend. “We compete with other telco service providers who typically are either very much in the mobile camp or the fixed camp, but if you look at my revenues in the UK they’re split 50/50 between fixed and mobile,” he said. “Also, because we bought Cable and Wireless nearly three years ago we’ve had a reasonable amount of time to get a good solution together, which we launched 12 months ago.”

“So ten years ago it was about voice and data convergence, now we’re seeing fixed and mobile coming together and that’s why we’re winning customers like the printer, the taxi firm, the big public and private sector institutions. That’s why you’re seeing some of the current market consolidation, with the realisation that you’re not going to survive if you’re just one, you need to be both.”

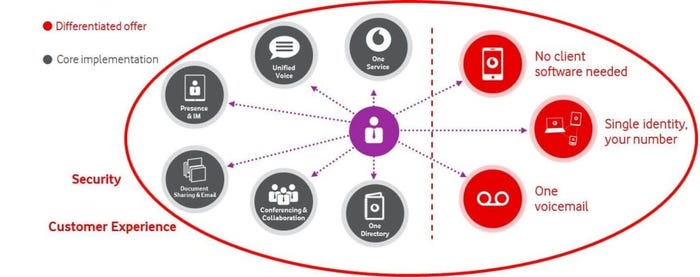

Vodafone’S Unified Communications Offering

Another key area Mottram feels Vodafone is in a strong position is its global reach. The company raised a serious amount of cash when it sold out of its stake in Verizon Wireless, and while most of that is being handed back to shareholders, Vodafone is in the middle of a £6 billion investment programme funded by the deal, called Project Spring. “The company’s plans are pretty ambitious – when they complete the roll out my understanding is we will have the best coverage from a network perspective, outstripping all global competitors,” said Mottram.

“The global stuff is all about enterprise. If you’ve got 20 offices in 20 different countries ideally you want them all on one network. There’s a fixed element of infrastructure that links those offices and we can provide that and the chances are we can also knit together a proposition for mobile users in those countries too. So then it becomes one communications conversation, one point of contact for the customer, the technology all comes together and you can do smart stuff around call routing.”

So, outwardly at least, Vodafone is pretty sanguine about the consolidation among many of its UK competitors. One reason for this is its focus on the global business market where it has been a pretty active investor itself. As it watches its UK competitors pay huge sums for content such as Premiership football, then struggle to accommodate the resulting calls on its networks, Vodafone may conclude the business market is where the smart money is.

Read more about:

DiscussionAbout the Author(s)

You May Also Like

_1.jpg?width=700&auto=webp&quality=80&disable=upscale)

.png?width=800&auto=webp&quality=80&disable=upscale)