The cracks in America’s China chip strategy are widening

China’s semiconductor seems to be booming, despite increasing US moves to suppress it.

January 29, 2024

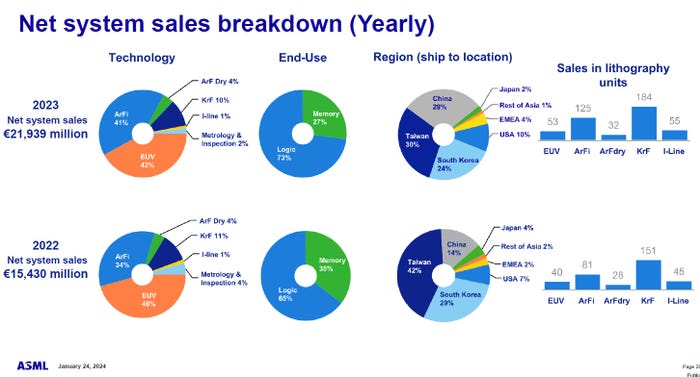

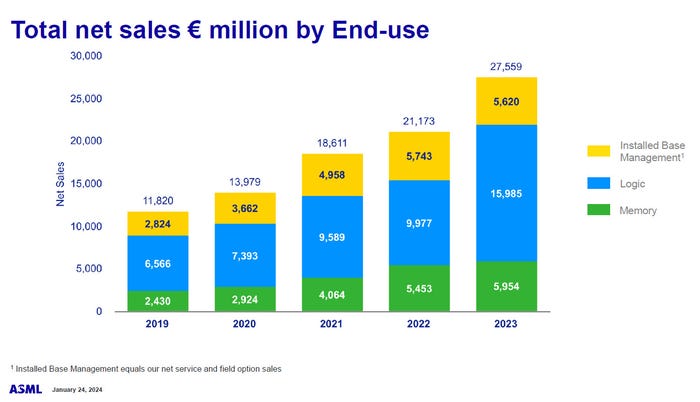

In its recent earnings announcement Dutch semiconductor tool maker ASML, which has cornered the market in much of the kit needed to make the most advanced chips, announced a record year in 2023. Net system sales were up 42% year-on-year, with tools for logic (i.e. processors, as opposed to memory) chips driving nearly all of that growth. Furthermore, China’s share of ASML’s system sales more than doubled.

The US has been hassling ASML and the Dutch government to restrict sales into China for a while now but its efforts have apparently so far been in vain. Perhaps cognisant of the continued flourishing of its relationship with China, the US leant on the Dutch government once more at the start of this year, resulting in it revoking the license for ASML to export some stuff.

“A license for the shipment of NXT:2050i and NXT:2100i lithography systems in 2023 has recently been partially revoked by the Dutch government, impacting a small number of customers in China,” said an ASML announcement published at the start of this month. “We do not expect the current revocation of our export license or the latest U.S. export control restrictions to have a material impact on our financial outlook for 2023.

“In recent discussions with the US government, ASML has obtained further clarification of the scope and impact of the US export control regulations. The latest US export rules (published October 17, 2023) impose restrictions on certain mid critical DUV immersion lithography systems for a limited number of advanced production facilities.”

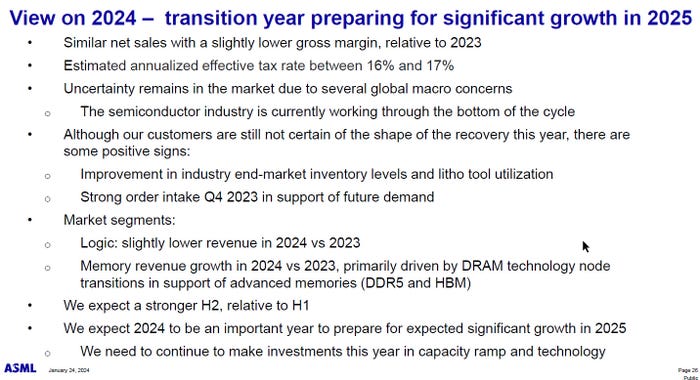

While no direct mention was made of the US restrictions in ASML’s 2024 outlook, it does expect growth of logic chip kit sales to evaporate. This is put down to general macro and cyclical factors but maybe ASML was just being discrete about the effect of US shenanigans.

One of the reasons America’s game of trade suppression whack-a-mole is so difficult to win is that people will usually find a way of fulfilling commercial demand. Customs officials in South Korea recently uncovered a major smuggling racket responsible for loads of US-made chips evading the bans and making their way to China.

Meanwhile, the FT reports that the world is set for a supply glut of certain types of chips, thanks to oversupply from China’s biggest chipmaker, SMIC. Since SMIC is a couple of generations behind the latest semiconductor manufacturing processes, this glut will be composed of ‘foundational’ chips, which are typically simpler ones found in a wide variety of embedded applications. The FT piece infers this may be part of a retaliatory tactic from China and notes how difficult it will be for the US and its allies to do anything about it.

The other main pillar to America’s geopolitical semiconductor strategy is to throw huge amounts of taxpayer money as chipmakers to encourage them to build and expand manufacturing capacity on US soil. This was embodied in the conveniently acronymed CHIPS Act. But progress has been slow, leading to inevitable calls for even more money to be chucked at the initiative.

The FT video below outlines the geopolitical chip war, mainly from a US perspective. Its strategy of trying to exclude one of the biggest countries in the world from an entire market seems quixotic in its futility. Trade will usually find a way while, as China has also discovered, brute spend alone isn’t enough to transform its domestic chip sector. There are so many moving parts involved, most of them outside direct US jurisdiction, that its hard to see how this strategy can succeed in any significant way.

About the Author(s)

You May Also Like

_1.jpg?width=700&auto=webp&quality=80&disable=upscale)

.png?width=800&auto=webp&quality=80&disable=upscale)