Report finds hyperscale data centre capacity doubling every four years

Edge services and now generative AI (GenAI) are fuelling exponential growth in data centre demand.

April 18, 2024

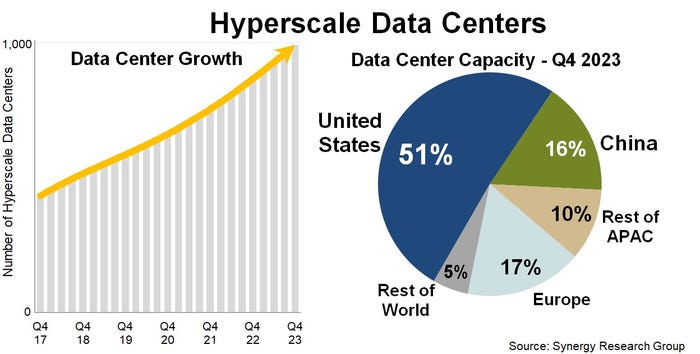

New figures from Synergy Research Group reveal that the number of large data centres operated by hyperscale cloud providers – like Amazon Web Services (AWS), Google Cloud and Microsoft Azure – reached 992 worldwide at the end of 2023, and topped 1,000 in early 2024.

As a result, hyperscale data centre capacity has doubled over the last four years, and is expected to double again during the next four. Synergy expects some 120-130 new and progressively larger and more capable facilities to come online every year during the forecast period.

Indeed, recent highlights include Microsoft and Amazon separately pledging to invest billions of dollars in their respective cloud operations in Japan. Google is similarly expansive. Last autumn it shared plans to extend its cloud infrastructure to various new locations, including Kuwait, New Zealand, South Africa, Sweden, and Thailand.

According to Synergy, the big three now account for 60% of global hyperscale capacity, followed by Meta, then Alibaba, Tencent, Apple and TikTok parent ByteDance.

According to a separate report from consultancy JLL in January, global data centre capacity reached 10.1 zettabytes as of the end of 2023, and is expected to reach 21 ZB in 2027, representing a compound annual growth rate (CAGR) of 18.5%.

Hyperscale hype isn't limited to those household names. Private equity is keen to get in on the action, and investors are throwing cash at lesser-known providers that, for one reason or another, stand a good chance of carving out their own niche.

Vantage Data Centers in January welcomed $6.4 billion worth of equity investment that will help to fund the deployment of hyperscale facilities. Last September, KKR took an $800 million stake in Singtel's data centre business. Just last week, EdgeConneX – which is owned by Swedish buyout firm EQT – secured another $1.9 billion of sustainability-linked funding to support its EMEA data centre expansion.

On a regional basis, the US accounts for the largest share of hyperscale capacity (51%), followed by Europe (17%) and then China (%). Asia Pacific sits fourth on 10%.

According to Synergy's chief analyst John Dinsdale, hyperscalers tend to locate their flagship data centres in their home markets – which goes some way towards explaining why the US accounts for such a large share of global capacity – and that self-owned data centres are much larger than leased ones. However, "there are plenty of exceptions to these trends," he said.

"We're also seeing something of a bifurcation in data centre scale," he continued. "While the core data centres are getting ever bigger, there is also an increasing number or relatively smaller data centres being deployed in order to push infrastructure nearer to customers."

According to IDC, demand for locally-hosted GenAI workloads is expected to drive continued spending on edge compute infrastructure and related services going forward. The research firm said last month annual spending is on track to reach $350 billion by 2027, up from $232 billion this year.

Yet more good news for hyperscalers.

"All major growth trend lines are heading sharply up and to the right," concluded Dinsdale.

You May Also Like

_1.jpg?width=700&auto=webp&quality=80&disable=upscale)

.png?width=800&auto=webp&quality=80&disable=upscale)