IDC forecasts a whopping $1.4 trillion in European ICT spending

European ICT spending will reach $1.1 trillion in 2022 and close to $1.4 trillion by 2026, driven by software investments, according to forecast by IDC, a telecoms market research firm.

August 2, 2022

European ICT spending will reach $1.1 trillion in 2022 and close to $1.4 trillion by 2026, driven by software investments, according to forecast by IDC, a telecoms market research firm.

Growing at 5% (CAGR) between 2021–2026, the technology investment will be predominantly driven by spending in software, underpinned by the growth seen in “artificial intelligence platforms, collaborative applications, and software quality and life-cycle tools.” according to the IDC report.

However, the report states the hardware sector, impacted by inflation, an expected recession, as well as the Russia-Ukraine war, will decline 0.1% this year. Most evidently impacted will be spending on devices as Europe is hit with a cost-of-living crisis and product shortage as well as suspended shipments, although of course the latter isn’t a European only issue.

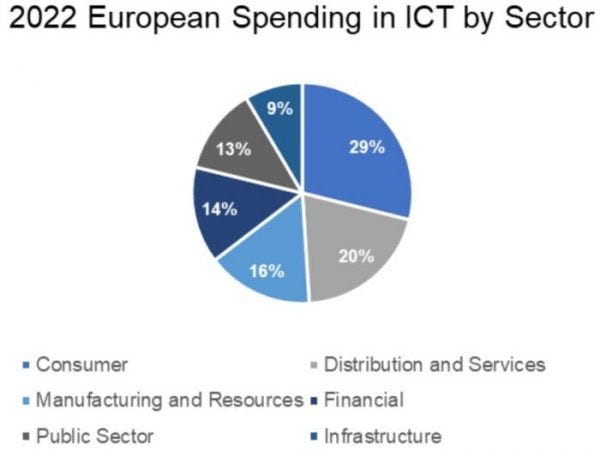

In terms of sectors, consumer, banking and discrete manufacturing are forecast to be the biggest spenders, taking up almost 46% of total ICT spend this year combined, driven by a desire to achieve process automation to minimise disruptions from the aforementioned crisis.

Source: Worldwide ICT Spending Guide Enterprise and SMB by Industry 2022, July V2 2022

“European companies are caught in a series of challenges including skill shortages, supply chain disruptions, post–COVID-19 recovery, high inflation, rising costs of living, and armed conflict in Eastern Europe.” said Andrea Minonne, research manager, IDC UK. “Technology has proved to be a solution to many of these challenges as organizations are looking at automation and real-time decision making to maximize their performance in such challenging times”.

With several hardware companies pulling out of Russia, the research firm has also forecast overall ICT spend there will decline 23% in 2022 while software will remain on a growth trajectory due to “resilience of the technology and the reliance on domestic businesses”.

Indeed, this is a huge sum forecast for Europe, a region in a quandary and a financial squeeze, but a lot of that spending might well go towards the cloud. According to forecasts from earlier in the year by Dell’Oro and Gartner, both telecom and ICT research firms, data centre spending are to increase 61% by 2026 while public cloud is to account for more than half of global enterprise IT spending by 2025.

Get the latest news straight to your inbox. Register for the Telecoms.com newsletter here.

About the Author(s)

You May Also Like

_1.jpg?width=700&auto=webp&quality=80&disable=upscale)

.png?width=800&auto=webp&quality=80&disable=upscale)