Nokia drops €347 million on Comptel to kick-start software push

Nokia fancies itself as a software player, so what better way to start than the acquisition of a Finnish OSS company?

February 9, 2017

Nokia fancies itself as a software player, so what better way to start than the acquisition of a Finnish OSS company?

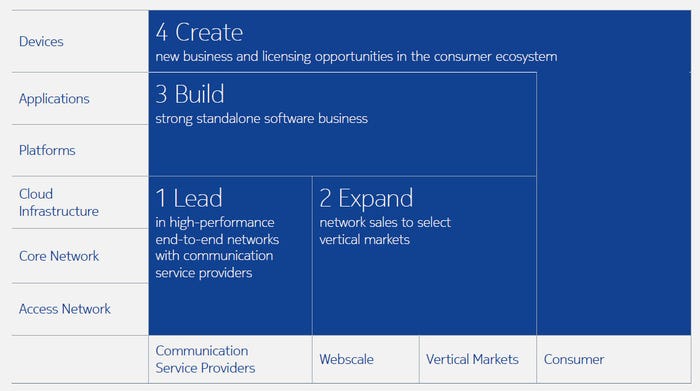

That seems to be the logic behind dropping €347 million on Comptel, which has been involved in telecoms software for 30 years. As Nokia detailed at its recent capital markets day diversification is vital in an era when operators are reluctant to spend in networking gear and a standalone software business was identified as the single most important direction to move towards (see slide below).

According to the announcement Comptel brings ‘critical solutions for catalogue-driven service orchestration and fulfilment, intelligent data processing, customer engagement, and agile service monetization.’ Can’t argue with that.

It was, of course, only a matter of time before the term ‘end-to-end’ crept into the M&A rationale. The combined offerings, we’re told, will ‘enable a dynamic closed loop between service assurance and fulfilment that simplifies management of complex heterogeneous networks.’ This will result in ‘complete, end-to-end orchestration of complex NFV and SDN deployments.’

Ultimately NFV and SDN are the elephants in the room hosting any conversation about the future direction of telecoms vendors. Nokia and its competitors all want to be able to offer a one-stop-shop for the transition to virtualization and can only do so if they’re good at software. So it’s easy to see why Nokia wants to bolster its OSS capabilities as that’s the area of telecoms software concerned with making sure everything works.

“The timing of the Comptel purchase is important as our customers are changing the way they build and operate their networks,” said Bhaskar Gorti, president of Nokia’s Applications & Analytics business group. “They are turning to software to provide more intelligence, automate more of their operations, and realize the efficiency gains that virtualization promises. We want to help them by offering one of the industry’s broadest and most advanced portfolios. Comptel helps us do that.”

“Together with Nokia we would create an agile and innovative player which can challenge current market leaders head-to-head,” said Juhani Hintikka, President and CEO of Comptel. “Throughout the past five years we have been working hard to sharpen our thought leadership and competitiveness by rebuilding the brand, product portfolio and values driven culture. I am 100% confident that we are now capable, ready and passionate to take the next step in scaling and expanding our business beyond the ordinary with a new set of resources that Nokia would provide us.”

This move will put further pressure on Ericsson, which has its own OSS offerings and is under similar pressure to diversify away from networking gear, and is unlikely to be the last example of this type of telecoms software M&A we’ll see. Light Reading has further analysis on the move here and here.

How ready is your organization to implement artificial intelligence solutions?

Can’t see it before 2019 (59%, 16 Votes)

We’ll begin in 2017 (22%, 6 Votes)

We have some in place now (11%, 3 Votes)

2018 is more realistic (7%, 2 Votes)

Total Voters: 27

About the Author(s)

You May Also Like

_1.jpg?width=700&auto=webp&quality=80&disable=upscale)

.png?width=800&auto=webp&quality=80&disable=upscale)