Ericsson highlights North America and services growth in solid Q2 2015

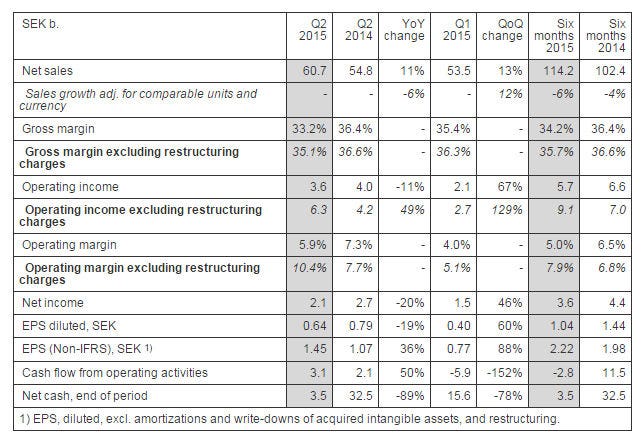

Swedish networking giant Ericsson reported an 11% annual increase in revenues in what it described as a solid Q2 2015, although if you adjust for constant currency revenues were down 6%.

July 17, 2015

Swedish networking giant Ericsson reported an 11% annual increase in revenues in what it described as a solid Q2 2015, although if you adjust for constant currency revenues were down 6%.

Speaking to Telecoms.com, Ericsson CFO Jan Frykhammar said “It was a solid report. Earnings were stronger than in the first quarter, very much driven by improvements in the networks business, which was the weak point in the first quarter. If we exclude the restructuring charges we’re back to around 10% operating margin, which is good as our ambition is to have the business sustainable at that level.”

The key turnaround seems to be sales in North America, which Frykhammar had called out as a weakness in Q1. “North America has been stabilising – we feel it’s not declining anymore, which it has been for a few quarters, but it’s not skyrocketing either,” he said. “The US dollar has strengthened a lot against the Swedish Krona in the past year and since we are very much a dollar company, 40-45% US dollars in any given quarter, we are strongly impacted by such moves. Frykhammar also pointed significant restructuring charges in Q2, especially from its Swedish operations.

“So far this year it has been about emerging markets, with Middle East, India, China and sub-Saharan Africa continuing to be very strong,” said Frykhammar when asked about other quarterly highlights. “We have strong year-over-year growth in the professional services business at 21% and managed services is growing 26%. What is declining is network roll-out and that’s obviously linked to the mobile broadband business. Professional services together with software, especially BSS/OSS, is developing really well for us, and the focus we’ve placed on targeted areas such as cloud, TV & media, BSS/OSS and so forth is starting to pay off.

“So in summary stabilisation in North America is important, as is good growth in services, which we expect to continue for the rest of the year, together with continued high pace of 4G deployment in mainland China and then BSS/OSS are the highlights.”

Bengt Nordstrom, CEO of mobile consultancy Northstream, thinks these results highlight the general slowdown in network roll-out business. “The results indicate that the long period of high investment by operators in America and Europe in mobile broadband and LTE macro-infrastructure is coming to an end. Operators in these regions now want lower-value investments for improving their networks’ capacity and performance.

“It’s likely that China has two to three quarters left of intensive LTE macro roll-out, after which it too will follow America and Europe and become a market centred on lower-value hardware, software and services for existing networks.”

Here’s the Q2 summary table.

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)

.png?width=800&auto=webp&quality=80&disable=upscale)