BT to cull up to 55,000 jobs in transformation effort

UK operator group BT plans to shed more than 40 percent of staff, all in the name of agility.

May 18, 2023

UK operator group BT plans to shed more than 40 percent of staff, all in the name of agility.

The revelation appeared as a small bullet point in the telco’s full-year results – published on Thursday – under a section outlining BT’s transformation plans for the rest of this decade.

In addition to redundancies, the plan includes extending Openreach’s FTTP network to up to 30 million premises passed, with a targeted take-up rate of 40-55 percent. It also wants to sign up 8.5 million retail fibre customers, compared to 1.8 million today.

On the mobile side, BT plans to extend 5G coverage to more than 98 percent of the population, up from 68.1 percent, and wants to grow the number of active 5G connections from 8.6 million to up to 14.5 million.

BT understandably wants all these new customers to be thrilled with their service, and so it has set an objective of increasing its net promoter score (NPS) from 22.1 to between 30 and 35.

But it is the headcount reduction that really stands out in all this. BT wants to reduce its overall workforce from 130,000 to around 75,000-90,000 by fiscal 2028-30, which means a lot of people are going to be heading out the door over the next few years.

“By continuing to build and connect like fury, digitise the way we work and simplify our structure, by the end of the 2020s BT Group will rely on a much smaller workforce and a significantly reduced cost base. New BT Group will be a leaner business with a brighter future,” said BT CEO Philip Jansen, in a statement.

Unsurprisingly, trade union Prospect has already requested an urgent meeting with Jansen.

“Prospect are deeply concerned by the scale of these cuts. Announcing such a huge reduction in this way will be very unsettling for workers who did so much to keep the country connected during the pandemic,” said a statement from John Ferrett, Prospect National Secretary.

“Prospect has a partnership agreement with BT which governs how the company and the union manage change in the organisation,” he continued. “We will be ensuring that the partnership agreement is fully adhered to during any consultations with BT over job reductions.”

The unwelcome news appeared alongside another mixed set of results for BT, which is doing well operationally, but doesn’t seem to be able to convert that into financial growth.

In the three months to 31 March, Openreach’s FTTP footprint grew by an impressive 702,000 premises, averaging 54,000 per week. BT said it had a record quarter for consumer fibre uptake – its subscriber base surged 50 percent year-on-year.

“Openreach is competing strongly and it’s clear that customers love full fibre. The Openreach board has reaffirmed its target to reach 25 million premises with FTTP by the end of 2026 and plans to further accelerate take-up on the network,” said Jansen. “In Consumer we’re delivering for customers with strong growth in FTTP and 5G, and we’re also seeing green shoots in B2B with a return to revenue growth in the final quarter in Global and the creation of our newly integrated Business unit.”

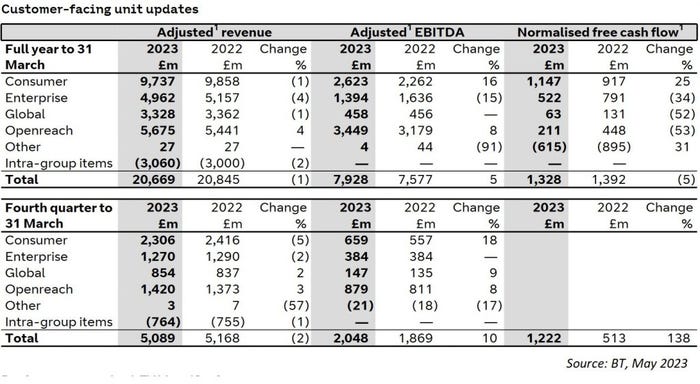

As for its quarterly financial performance, revenue was down 2 percent to £5.09 billion, led by declines at Consumer and Enterprise of 5 percent and 2 percent respectively, which offset growth at Openreach and Global. Adjusted EBITDA jumped 10 percent to £2.05 billion, thanks primarily to big increases at Consumer (18 percent) and Openreach (8 percent).

It is a similar picture for the full year. Group revenue fell slightly to £20.67 billion from £20.85 billion last year, as growth at Openreach was more than offset by declines across the rest of the business – Enterprise in particular reported a 4 percent drop to £4.96 billion.

Adjusted EBITDA grew 5 percent to £7.93 billion, led by BT Consumer, which saw earnings jump by 16 percent to £2.26 billion. Enterprise struggled again, reporting a 15 percent decline to £1.39 billion. Group pre-tax profit fell 12 percent to £1.73 billion.

Looking ahead to fiscal 2024, BT expects to grow both revenue and EBITDA on a pro forma basis. It reckons capex excluding spectrum to fall within the range of £5.0-£5.1 billion, and normalised free cash flow of £1.0-£1.2 billion.

Get the latest news straight to your inbox. Register for the Telecoms.com newsletter here.

About the Author(s)

You May Also Like

_1.jpg?width=700&auto=webp&quality=80&disable=upscale)

.png?width=800&auto=webp&quality=80&disable=upscale)