TIM sees Italian earnings hike and non-telco opportunities post NetCo sale

TIM expects domestic earnings to grow considerably once it has offloaded its networks business, and is also looking at opportunities that seem to be outside of the traditional telco model.

March 7, 2024

The Italian incumbent late on Wednesday published details of a new three-year strategic plan outlined by chief executive Pietro Labriola and approved by the board that is due to be presented at its Capital Markets Day on Thursday. It also shared a list of proposed names for a new board of directors that will oversee the plan, including naming a new chair, but made no comment on its ongoing bid to broker a deal for subsea networks business Sparkle.

Indeed, Sparkle is still included in TIM's financial targets for 2024-2026, the period covered by its new industrial plan, dubbed Free to Run.

The reasoning behind the name is pretty clear: TIM is looking to shake off the shackles of its legacy as a network builder and crack on with operating at a retail level. It said as much itself: "The sale of the fixed network will allow TIM to operate with fewer financial and regulatory constraints and a greater focus on industrial components," reads the introduction to the plan.

TIM's view on what the post-network future will look like seems pretty optimistic, particularly given how competitive the Italian market is. And TIM in particular will face a greater competitive threat ahead, should Vodafone and Fastweb get their merger deal inked and over the line, bringing together their respective mobile and fixed broadband strengths. Amongst other things, the Free to Run plan outlines the telco's desire to improve fixed-mobile convergence at its Consumer business, and boost ARPUs on both sides.

"In parallel, the 'Customer Platform' model will be developed, with a focus on 'beyond connectivity’ revenue growth through new partnerships and opportunities in the household and SME sector," TIM said. It didn't provide further detail at this stage, but it sounds very much like the classic telco looking to adjacent markets approach.

On the enterprise side, TIM said it aims to grow revenues by focusing on the cloud in particular, leaning on partnerships with global operators and the Polo Strategico Nazionale, the Italian cloud hub project TIM is spearheading.

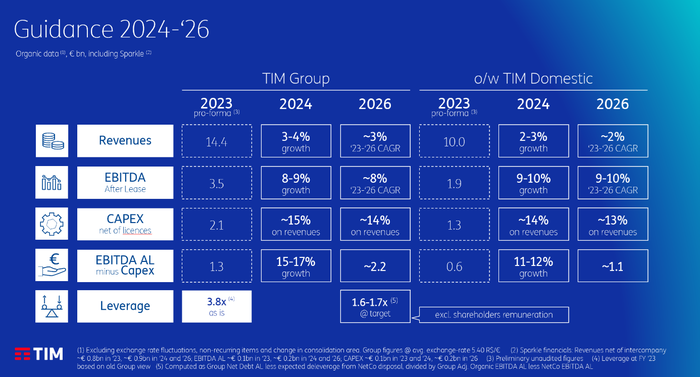

All of which should contribute to a 2% CAGR in domestic revenues between 2023 and 2026, from a pro forma figure of €10 billion last year; again, that includes Sparkle. The telco expects 2%-3% growth this year. At group level it is looking for 3%-4% revenue growth this year and around 3% CAGR over the duration of the plan (see chart below).

Interestingly, TIM is guiding for greater domestic earnings growth than at group level, with organic EBITDAaL expected to come in at 9%-10% this year and over the course of the plan from a pro forma figure of €1.9 billion last year.

It also highlighted debt reduction at group level, putting its debt/EBITDAaL ratio at 1.6x-1.7x during the lifespan of the plan, down from 3.8x last year. And it is shooting for positive Equity Free Cash Flow After Lease in both Italy and Brazil in the same period.

Delivering on the plan will be the responsibility of Pietro Labriola, who the board as expected confirmed as their choice for CEO and company director as part of a wider reshaping of its membership.

The board, headed by outgoing chair Salvatore Rossi, backed plans to reduce its membership to nine, but lack of agreement on its composition means it presented a slate of 15 candidates, nine men and six women, 10 of whom would be newcomers. The final make-up of the board will be determined by shareholder vote next month.

The most interesting name on the list is that of proposed new chair Alberta Figari, a lawyer specialising in M&A, corporate finance and equity capital markets transactions. That's a solid background for someone looking to steer TIM through the NetCo sale and also the likely divestment of Sparkle to the government. Nonetheless, she will have her work cut out.

About the Author(s)

You May Also Like

_1.jpg?width=700&auto=webp&quality=80&disable=upscale)

.png?width=800&auto=webp&quality=80&disable=upscale)