BT makes slow and steady start to the Kirkby era

New BT boss Allison Kirkby has begun her tenure by presenting a solid but not particularly inspiring set of financial results.

February 1, 2024

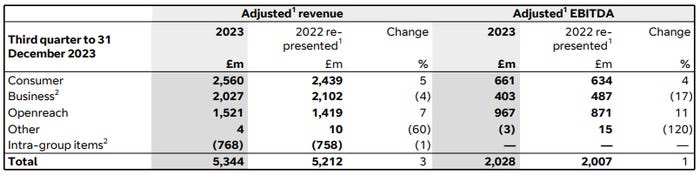

Revenue for the final three months of 2023 was up slightly to £5.3 billion from £5.2 billion, while adjusted EBITDA was flat at £2 billion. The performance was driven by growth at Openreach and Consumer, offset slightly by BT Business, which is still grappling with costs and declining sales of legacy products.

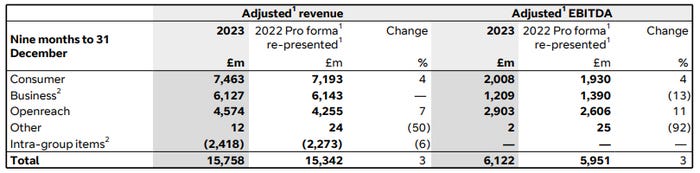

In the nine months to 31 December, revenue inched up 3 percent to £15.8 billion due to higher prices and sales of fibre products and services at both Openreach and Consumer. This drove pre-tax profit up 15 percent to £1.5 billion.

While the financials might not set pulses racing, operationally speaking, BT's performance has been more noteworthy.

Openreach's FTTP build rate increased to 73,000 premises per week, and passed a record 950,000 in the final quarter. It now reaches 13 million premises, and building to a further 6 million is already underway.

FTTP net additions at Openreach totalled 432,000 in BT's fiscal Q3. It now has 4.4 million connections on its footprint, with a take-up rate of 34 percent.

BT's retail FTTP base surged 46 percent year-on-year to 2.4 million, of which 2.3 million are Consumer customers. Its 5G base jumped 30 percent to 10.3 million.

"BT Group has delivered another quarter of revenue and EBITDA growth, while rapidly building and upgrading customers to our full-fibre broadband and 5G networks, and we continue to be on track to achieve our financial outlook for the year," said Kirkby.

It will be interesting to see how BT evolves under its new CEO.

Under Kirkby's predecessor, Philip Jansen, the UK incumbent retreated from the glitzy but costly sports TV market, returning BT to its roots as a network and connectivity services provider. This meant accelerating Openreach's fibre deployment; merging Enterprise and Global Services to create BT Business; and relaunching EE as the preferred brand for its consumer operation.

It also meant axing 13,000 jobs; closing 90 percent of BT's offices; moving headquarters; and incurring the wrath of both union workers over a pay rise, and customers over inflation-busting price increases.

A more succinct way of summing up the Jansen era is to describe it as a ship-steadying exercise, and that is highlighted both by BT's financial performance and the decline in its share price over the last five years.

Revenues and earnings have been more or less stable, benefiting last year from those previously-mentioned price increases. But there's no escaping the fact that during Jansen's tenure, BT shares have lost around 50 percent of their value, reflecting perhaps the absence of new and exciting growth engines.

Kirkby of course has an intrinsic link to all of this, joining the board a month after Jansen became CEO.

But while Jansen had the pressure of bringing stability and renewed focus, Kirkby perhaps has the harder job of answering the question: OK, what now?

"We are providing great digital connectivity and services, while laying the foundations for future growth that will benefit our customers, investors and the UK," she said on Thursday. "As I assume the role of chief executive, we remain committed to our purpose and our strategic focus, and I am looking forward to leading BT Group into its next phase of development."

About the Author(s)

You May Also Like

_1.jpg?width=700&auto=webp&quality=80&disable=upscale)

.png?width=800&auto=webp&quality=80&disable=upscale)