Global Open RAN and vRAN market growth slowed in Q1

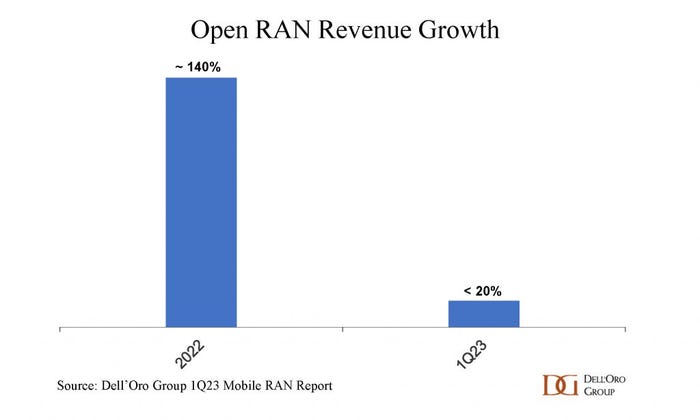

New stats from research firm Dell'Oro suggest that the 2023 Open RAN market won't see a repeat of last year's stellar performance.

May 25, 2023

New stats from research firm Dell’Oro suggest that the 2023 Open RAN market won’t see a repeat of last year’s stellar performance.

Global Open RAN revenue increased by 10-20 percent in the first three months of the year, while the vRAN market grew by 20-30 percent. In the first quarter of last year, Open RAN revenue more than doubled.

Dell’Oro said the slowdown this year was caused by growth tailing off in North America, which offset continued strong performance in Asia Pacific. Logically that makes sense, because this time last year, US operator Dish was racing to roll out its cloud native Open RAN network in order to meet its coverage obligation deadline. Having met that deadline, the pace of its deployment has probably eased off a little.

Indeed, “since both Open RAN and vRAN are still driven by a few large service providers, the slower growth in the first quarter was for the most part in line with expectations, reflecting more so the state of the 5G rollouts with some of the advanced operators than a shift in the overall Open RAN/vRAN market sentiment,” explained Dell’Oro vice president Stefan Pongratz, in a research note.

“There are also signs that activity is improving beyond the early adopters but it will of course take some time for the sum of these smaller early majority type deployments to move the broader market,” he added.

As Pardeep Kohli, CEO of network software provider Mavenir, pointed out earlier this month, that when it comes to Open RAN, there is a world difference between a greenfield deployment and brownfield deployment.

Such is the scale of the challenge, Mavenir has raised an additional $100 million of funding mainly to help it develop new AI and automation tools that will make it easier and less costly for telcos to operate multi-vendor networks that include a mix of proprietary and Open RAN equipment.

Despite the slower growth, Dell’Oro is still generally bullish on Open RAN. It reiterated its prediction that Open RAN will account for 6-10 percent of the total global RAN market this year.

The same cannot be said for multi-access edge computing (MEC) though.

On Tuesday, Dell’Oro lowered its full-year outlook for the MEC market by more than 20 percent, citing a slowdown in China’s maturing 5G standalone (SA) market, and subdued interest from enterprises. It did not share what its original forecast for this year was, but in January it predicted that mobile core network (MCN) and MEC revenues would achieve a CAGR of 2 percent between 2022 and 2027, reaching more than $50 billion in total.

“Several factors are contributing to the slower uptake,” said Dell’Oro research director Dave Bolan, in a statement. “Some examples are: standalone private networks have garnered more attention and emphasis than MEC, which we define as extensions to Mobile Network Operators (MNOs) networks; lack of applications with well-defined return-on-investment (ROI); competition from Hyperscale Cloud Providers (HCPs), and upcoming Wi-Fi 7.”

“We believe enterprises are evaluating all of these choices before moving forward with more aggressive MEC deployments. As a result, we are lowering the MEC forecast for 2023,” he said.

Get the latest news straight to your inbox. Register for the Telecoms.com newsletter here.

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)

.png?width=800&auto=webp&quality=80&disable=upscale)