UK and US smartphone markets in steep decline

The latest numbers from industry trackers Strategy Analytics reveal UK smartphone shipments fell 14% in Q4 2018.

February 13, 2019

The latest numbers from industry trackers Strategy Analytics reveal UK smartphone shipments fell 14% in Q4 2018.

The main culprit is UK smartphone market leader Apple, which seems to be having a bit of a nightmare all over the world right now. Apple shipped 700,000 fewer iPhones in Q4 2018 than it did in the year ago quarter, which is a drop of 19%. Second placed Samsung suffered a similar decline, dropping 400k shipments. Meanwhile third placed Huawei actually managed to increase its shipments by 200k, which meant it stole a big chunk of market share from the big two.

“Despite fear of trade wars and Brexit, Huawei has cracked the UK smartphone market,” SA’s Neil Mawston told Telecoms.com. “If current growth trends continue, Huawei will overtake Samsung as the number two UK smartphone player later this year. Samsung’s UK smartphone marketshare has halved in the past five years, and it must take urgent steps to arrest the decline, before it is too late, but he ‘big 3’ brands still made up three in four of all smartphones sold in the UK last year.”

“UK smartphone shipments declined 14 percent annually from 8.5 million units in Q4 2017 to 7.3 million in Q4 2018,” said Rajeev Nair of SA. “United Kingdom is the largest smartphone market in Western Europe and it is suffering from weak sales, due to longer replacement rates, a lack of wow designs, and Brexit uncertainty causing consumers to hold off on some new purchases.”

“Samsung clung on to second place with 19 percent smartphone marketshare in the UK during Q4 2018, down from 21 percent a year ago,” said Woody Oh of SA. “Samsung is facing intense competitive pressure from Huawei, who is targeting Samsung’s core segments in the midrange and premium-tier with popular models such as the P20. Huawei’s UK smartphone marketshare has leapt from 8 percent in Q4 2017 to 12 percent in Q4 2018. Huawei is growing fast in the UK, due to heavy co-marketing of its models with major carriers like EE.”

UK Smartphone Shipments (Millions of Units) | Q4 ’17 | Q4 ’18 | Growth YoY (%) |

Apple | 3.7 | 3.0 | -19% |

Samsung | 1.8 | 1.4 | -22% |

Huawei | 0.7 | 0.9 | 36% |

Others | 2.3 | 2.0 | -15% |

Total | 8.5 | 7.3 | -14% |

UK Smartphone Vendor Marketshare (%) | Q4 ’17 | Q4 ’18 | |

Apple | 43.5% | 41.1% | |

Samsung | 21.2% | 19.2% | |

Huawei | 7.8% | 12.3% | |

Others | 27.5% | 27.4% | |

Total | 100.0% | 100.0% | |

Source: Strategy Analytics |

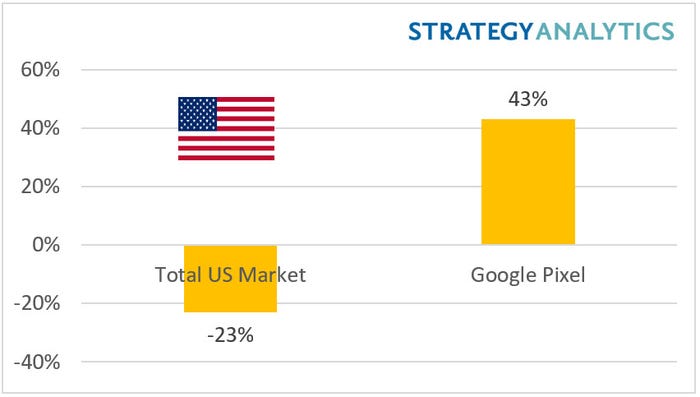

SA has also been looking at the US market recently and while the shipment decline is even worse on the other side of the pond, it seems that Google’s Pixel brand is starting to get some serious traction over there.

“Google’s Pixel 3 range benefited from weakness at Apple, Samsung, ZTE and others,” blogged Mawston. “Apple saw longer replacement rates, due to its battery-replacement program encouraging owners to hold on to existing iPhones for longer. Samsung struggled, due to soft sales of the flagship Galaxy S9 model. ZTE was shunned by authorities and carriers and demand for its smartphones collapsed. Google Pixel 3 is starting to resonate with US consumers who are searching for something new, such as eSIM connectivity or AI.”

About the Author

You May Also Like

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)