The battle for smart speaker market domination goes global

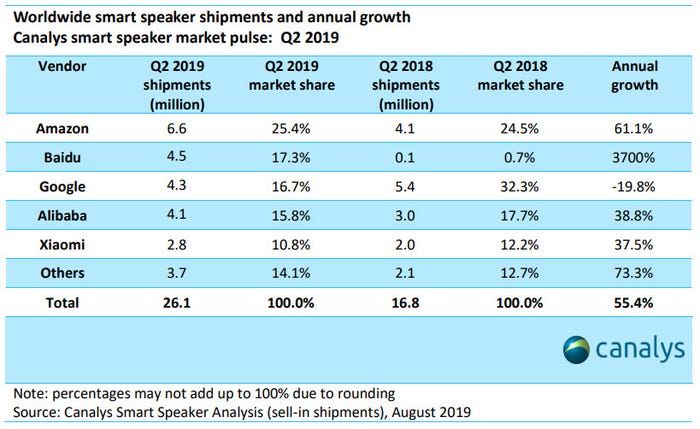

The latest smart speaker market data from Canalys shows significant gains from Chinese vendors and an international shift from the US giants.

August 27, 2019

The latest smart speaker market data from Canalys shows significant gains from Chinese vendors and an international shift from the US giants.

The whole sector is on a bit of a tear, with unit shipments jumping 55% year-on-year, showing there is considerable appetite among the general population for totally surrendering the details of their lives to internet behemoths. Perhaps desensitized by their own government’s Orwellian levels of intrusiveness, the Chinese seem especially keen to embrace voluntary surveillance.

As a consequence shipments of the smart speakers made by Baidu, the Chinese equivalent of Google, exploded to 4.5 million in Q2 2019 from a standing start a year ago. China, with its population of 1.4 billion technophiles, can do that for you, but Baidu must be doing something even Alibaba and Xiaomi aren’t because it has overtaken both of them, as well as Google itself, to grab second place among global vendors.

“Aggressive marketing and go-to-market campaigns built strong momentum for Baidu in China,” said Canalys Research Analyst Cynthia Chen. “The vendor stood out as a key driver of smart displays, to achieve 45% smart display product mix in its Q2 shipments. Local network operator’s interests on the device category soared recently. This bodes well for Baidu as it faces little competition in the smart display category, allowing the company to dominate in the operator channel.”

So it looks like standalone smart displays are lumped in with the speakers and that’s what Baidu is doing well. There’s little sign that the company will be honest enough to rebrand its smart displays from ‘Xiaodu’ to ‘Lao da ge’ but you never know. Rather worryingly for Google, the other reason it lost second spot is that its own shipments declined year-on-year.

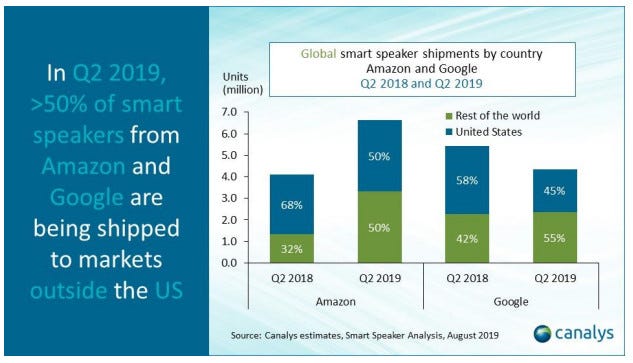

“Amazon and Google are focused on growing their business outside the US,” said Canalys Senior Analyst Jason Low. “Google’s transition to the Nest branding while pivoting to smart displays proved to be a challenge, especially as it has begun rolling out its Nest Hub smart display globally. Google urgently requires a revamped non-display smart speaker portfolio to rekindle consumer interest, as well as a robust marketing strategy to build its Nest branding outside of the US.”

You can see evidence of this international pivot in the chart below, with at least half of Amazon and Google’s shipments now coming from outside the US, compared to more like a third a year ago. “Despite feeling upbeat about the market outlook, vendors are wary about the price sensitivity towards the relatively new category of smart displays,” said Low.

About the Author(s)

You May Also Like

_1.jpg?width=700&auto=webp&quality=80&disable=upscale)

.png?width=800&auto=webp&quality=80&disable=upscale)