Premium priced phones now represent over half the market revenue

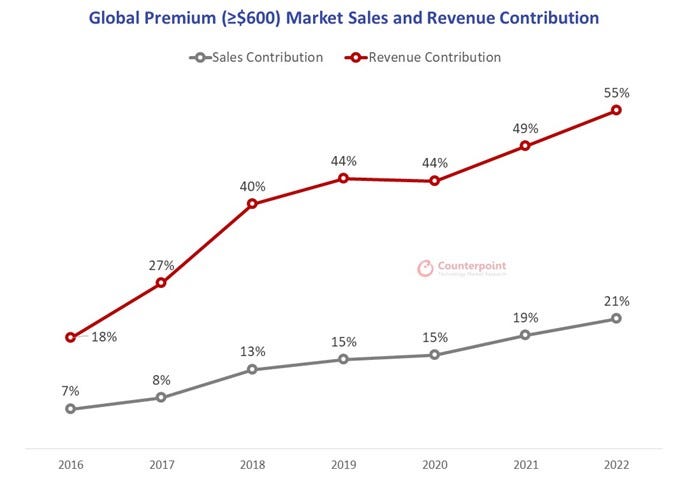

Despite ongoing global economic woes, more expensive phones – specifically ones that cost over $600 – represented 55% of overall handset revenue last year.

March 21, 2023

Despite ongoing global economic woes, more expensive phones – specifically ones that cost over $600 – represented 55% of overall handset revenue last year.

It’s the first time the premium market revenue has represented ‘more than half’ of the global smartphone market, which fell by 12% overall in 2022 according to a report from Counterpoint Research. Premium phones also accounted for more than one-fifth of total global smartphone sales.

In fact, handsets priced at $1,000 and above grew a barnstorming 38% last year. Counterpoint attributes this to ‘affluent consumers’ being more immune to the macroeconomic difficulties (the cost of living crisis) experienced over the last year or so than those with less money, leading to a decline in the lower priced phones and a rise in more expensive ones.

It also says something called ‘premiumization’ has something to do with it – a trend whereby demand in the premium segment is driven by upgrades both in mature markets like Western Europe and the US, but also in emerging economies where consumers on their third or fourth device start upgrading into the premium market.

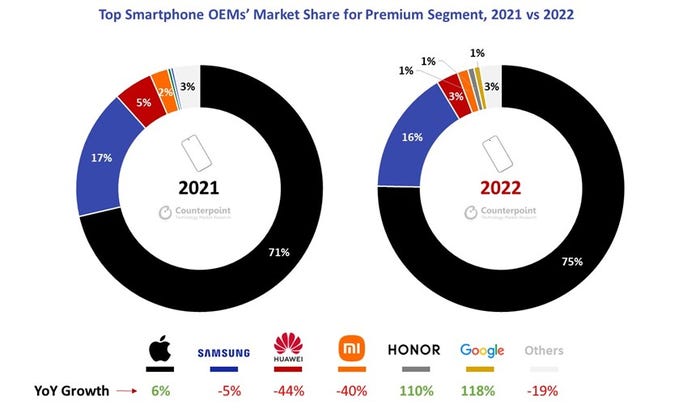

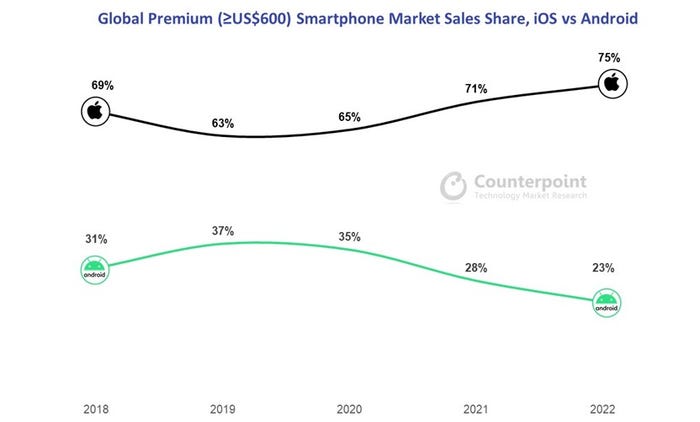

Apple did particularly well, as it tends to, growing 6% YoY in the premium market, and now accounts for three-fourths of the total sales in the segment. Apparently Apple could have done even better were it not for iPhone 14 Pro and Pro Max supply disruption in the run up to Christmas. Stickiness to the Apple ecosystem in mature markets and growth in emerging economies due to its ‘aspirational brand’ were highlighted as causal factors for this growth.

However the report also says Android devices could see a new wave of growth in 2023 as more OEMs launch foldable devices in the premium segment, and foldable devices in China expand to markets outside the country.

Specifically it expects to see Chinese brand Honor to make a global push in 2023, off the back of an expanded market share in China, apparently driven by the Magic series.

To this last point, it sort of depends how the ongoing trade/security dispute between the US and its allies and China goes. Honor, once an arm of Huawei, which is banned in various forms already in the West, was sold in 2020 to Shenzhen Smart City Technology Development Group, which is owned by the Chinese state.

For those of a mind to insist security threats from Chinese technology stems from the close relationship companies have to the government, the case could theoretically be made Honor kit is actually even more of a risk due to its current ownership status. The way things are going, it doesn’t seem beyond the realms of possibility that we could see more US led bans for more Chinese things in the months and years to come, to which firms like Honor are presumably not immune.

Get the latest news straight to your inbox. Register for the Telecoms.com newsletter here.

About the Author(s)

You May Also Like

_1.jpg?width=700&auto=webp&quality=80&disable=upscale)

.png?width=800&auto=webp&quality=80&disable=upscale)