Global smartphone market Q1 2015 – Samsung top but Xiaomi could be third

Samsung announced its quarterly earnings overnight and Strategy Analytics wasted little time in publishing its initial global smartphone vendor share numbers. They revealed Samsung has reclaimed the number one spot outright, but with a diminished share compared to the same quarter a year ago.

April 29, 2015

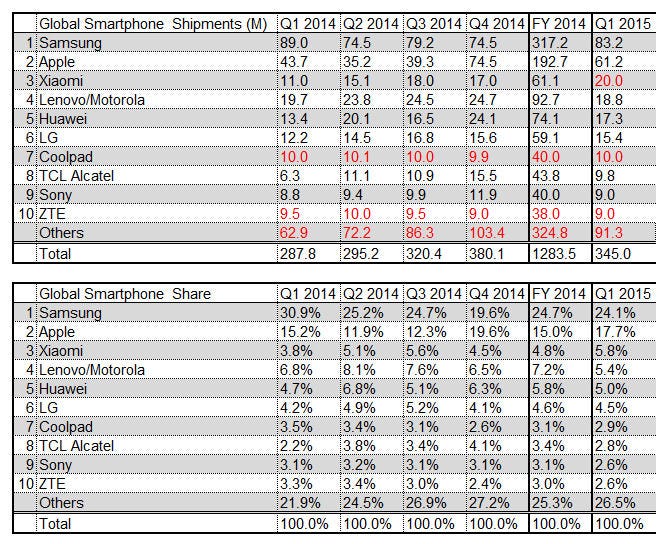

Samsung announced its quarterly earnings overnight and Strategy Analytics wasted little time in publishing its initial global smartphone vendor share numbers. They revealed Samsung has reclaimed the number one spot outright, but with a diminished share compared to the same quarter a year ago.

“Samsung shipped 83.2 million smartphones worldwide and captured 24 percent marketshare in Q1 2015, dipping from 31 percent a year earlier,” said Neil Mawston, analyst at SA. “Samsung continued to face challenges in Asia and elsewhere, but its global performance has stabilized sufficiently well this quarter to overtake Apple and recapture first position as the world’s largest smartphone vendor by volume.”

Outside of Q4 Samsung tends to significantly outsell Apple due to having products at all price tiers, while Apple is premium-only. But the loss of 7 points of global smartphone market share is a pretty major negative for Samsung as it continues to feel the effects of an underwhelming Galaxy S5, and Samsung also reported significantly diminished margins from its mobile division. On the other hand Apple continues to go from strength to strength.

As Mawston alluded to, Asia remains a challenge for Samsung and it could be that Samsung largely missed out on Chinese holiday season due to the strength of domestic players such as Xiaomi. Neither SA nor the company itself has published any Xiaomi Q1 smartphone numbers yet, but given the apparent success of its recent Fan Festival and relatively weak quarters from Chinese competitors such as Lenovo and Huawei, we estimate it hit around 20 million units for the quarter, which would take it into third place globally.

Our global smartphone summary below is a combination publicly announced numbers, analyst data and, in red, our own estimates. The numbers may undergo revision as the quarterly earnings season progresses.

About the Author(s)

You May Also Like

_1.jpg?width=700&auto=webp&quality=80&disable=upscale)

.png?width=800&auto=webp&quality=80&disable=upscale)