Global PC shipments tumble 33% in Q1

Canalys figures clock a 33% drop in global shipments of desktops and notebooks during Q1 2022, the fourth consecutive quarter of double-digit decline.

April 11, 2023

Canalys figures clock a 33% drop in global shipments of desktops and notebooks during Q1 2022, the fourth consecutive quarter of double-digit decline.

The report claims in total 54 million units were shipped during the quarter, and blames the decline on a weak holiday season toward the end of 2022 which extended into the new year as the channel prioritised inventory clearance.

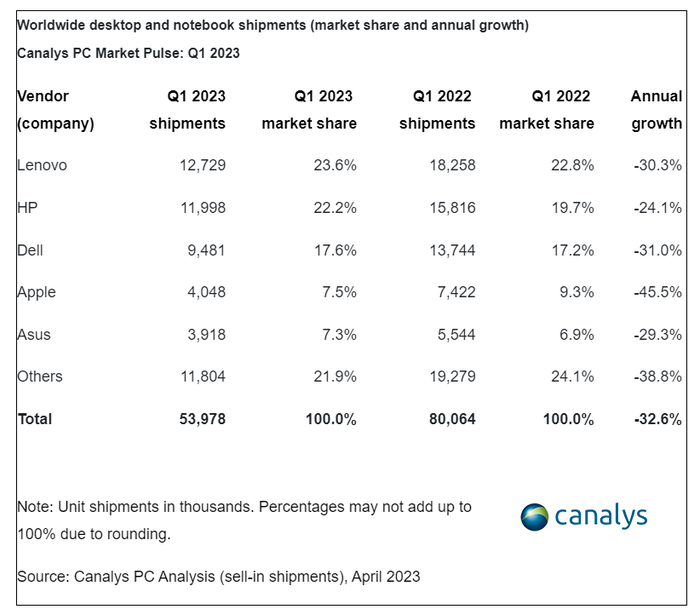

Notebook shipments dropped 34% year-on-year to 41.8 million units, while desktop shipments performed only slightly better registering a 28% decline to 12.1 million units. In terms of how the leading vendors were impacted, Apple faced the largest decline among the top five vendors, with total shipments of Macs dropping 46%.

While topping the market Lenovo suffered a decline of 30%, and HP in second place clocked a 24% drop. Dell was down 31%, falling below the 10 million unit mark for the first time since Q1 2018.

“Most of the issues that plagued the industry in the second half of last year have extended into the start of 2023,” said Ishan Dutt, Senior Analyst at Canalys. “Channel partners have indicated that their inventory levels have been reducing but remain high in absolute terms. 39% of partners surveyed by Canalys in January 2023 reported having more than five weeks of PC inventory, with 18% reporting nine weeks or more. Meanwhile, demand across all customer segments remains dampened, with more pressure arising from further interest rate increases in the US, Europe and other markets, where reducing inflation is a top priority.

“Consumers and businesses will remain cautious about outlays on new PCs in the short term, with significant market recovery only expected to kick in during the fourth quarter of 2023. The PC market has strong fundamentals to drive long-term growth, with shipment volumes higher than in the pre-pandemic era. A much larger installed base post-COVID-19, the transition to Windows 11, and both refresh and new demand from digital education will all be key drivers as the global economy enters a period of recovery in 2024 and beyond.”

Meanwhile fellow analyst IDC puts the decline at 29%, and blames weak demand, excess inventory, and a worsening macroeconomic climate.

The picture may be rosier for the rest of the year however – Canalys expects Q1 to represent the largest shipment decline for the year, and recovery to begin in the second half of this year and gather momentum in 2024. IDC appears to be slightly more cautious in its outlook, pointing out ‘if recession in key markets drags on into next year, recovery could be a slog.’

Get the latest news straight to your inbox. Register for the Telecoms.com newsletter here.

About the Author

You May Also Like

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)