Fitbit IPO pop suggests speculative bubble around wearables and IoT

Fitness band maker Fitbit had the initial public offering (IPO) of its shares yesterday and their price closed nearly 50% higher than the initial asking price, indicating extreme optimism about its future prospects.

June 19, 2015

Fitness band maker Fitbit had the initial public offering (IPO) of its shares yesterday and their price closed nearly 50% higher than the initial asking price, indicating extreme optimism about its future prospects.

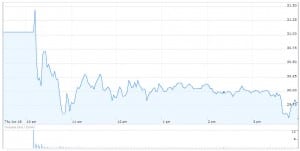

With a starting price of $20, trading opened at $31 and stayed at around $30 for the rest of the day, closing just below that level, valuing the company at around $6 billion and giving its stock a price to earnings ratio of 24.3. P/E ratios above 25 can sometimes indicate a speculative bubble, with most tech giants, such as Apple, having a P/E in the mid teens. Having said that Google’s P/E is currently 28 and Facebook’s is an astonishing 83 so if there is a speculative bubble it’s not limited to wearables.

Fitbit First Day Share Trading – Google Finance

Fitness bands alone are a relatively niche product category with a limited total available market. However they do currently dominate the nascent wearables market, which has tripled in size over the past year. What’s likely to have really got speculators excited, however, is Apple’s move into smart watches.

While anything with an Apple logo on it isn’t necessarily guaranteed to succeed, Apple’s involvement in a market does guarantee exposure and mainstream recognition. Wearables are no longer a geek thing and it’s fair to assume that interest around the Apple Watch will generate some degree of ‘halo effect’ for other wearables players.

Fitbit is currently the number one wearables player, commanding a third of the market by units shipment volume and more than doubling its shipments year on year. But its share of the overall market is actually in decline thanks to the arrival of Xiaomi and Apple’s involvement is likely to erode that share further.

So this IPO has probably been timed perfectly to capitalise on the hype generated by the Apple Watch and, to some extent, the broader hype around IoT, but before larger players further diminish Fitbit’s wearables market share. That’s not to say this initial speculative optimism is unjustified as a rising tide lifts all boats, but Fitbit might need to diversify beyond fitness bands to maintain the hype.

About the Author

You May Also Like

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)