Ericsson shares spike… because of fundamentals

Swedish kit vendor Ericsson has managed to improve its share price the old-fashioned way, by doing a bit better than investors thought it would.

January 29, 2021

Swedish kit vendor Ericsson has managed to improve its share price the old-fashioned way, by doing a bit better than investors thought it would.

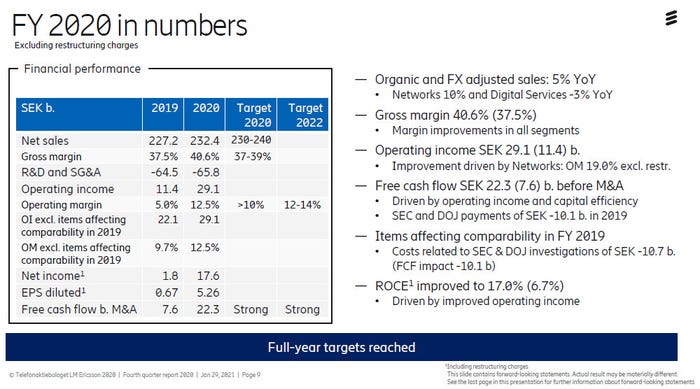

Sales were up 13% year-on-year, when adjusted for adjustments, in Q4 2020. Even more impressive was a 60% increase in net income. The full year was pretty healthy too, with sales up 5% and net profit almost 10x higher than in full-year 2019. All in all CEO Börje Ekholm is entitled to feel pleased with how things are going and Ericsson’s shares were up 10% at time of writing.

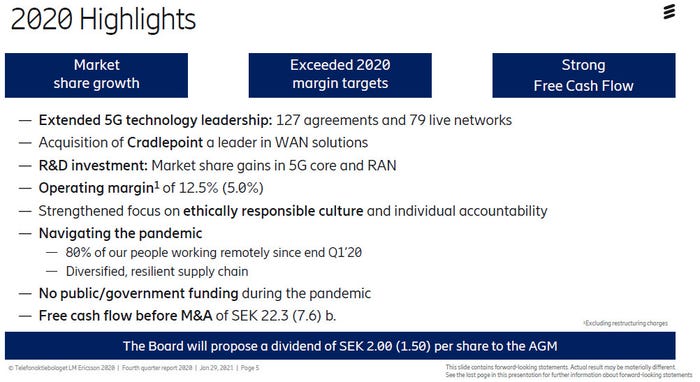

“Our R&D investments have continued to drive both technology leadership and cost efficiency which have led to increased market share and improved financial performance,” said Ekholm. “We are today a leader in 5G with 127 commercial contracts and 79 operating networks around the world. Organic sales grew by 5% for the full year. Our operating margin of 12.5% exceeded our 2020 target and reached the 2022 Group target range two years early.”

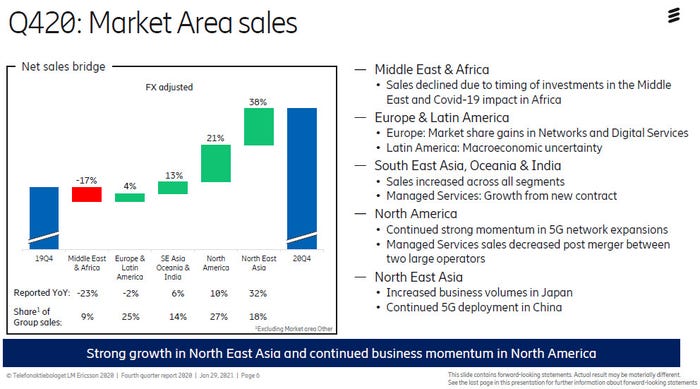

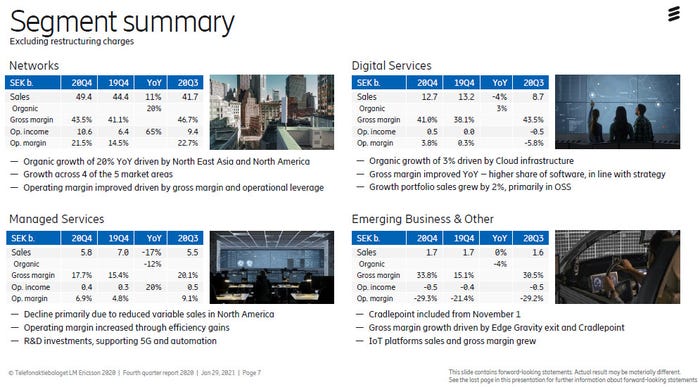

As ever Ericsson’s fortunes were determined by the networking division, which increased sales by 20%. A lot of this was due to China, on which more later, but there was some decent growth from North America too. The other divisions continued to decline in sales, but are at least not losing money thanks to the restructuring Ericsson has been doing for the past few years.

We had a chat with the head of the networks division, Fredrik Jejdling, and started by asking him if he’s worried about China retaliating in-kind for the Swedish ban on Huawei. Jejdling said the situation has had no material impact on Ericsson’s China business yet but conceded it “may cause some repercussions.”

Warming to the theme of raining on Ericsson’s parade by asking about strategic threats, we asked Jejdling for his thoughts on what the growing momentum behind OpenRAN technology means for Ericsson. He reiterated the position that, while Ericsson is an active participant, and integrated RAN is still better. He also stressed that a bigger immediate concern was deploying 5G, in whatever form, ASAP and that he’s worried about Europe’s competitiveness in this regard.

Nokia’s quarterlies are coming up and it will be interesting to compare their fortunes. If the Finnish vendor deviates significantly from market expectations it will be interesting to see if the market manipulators decide to toy with its share price once more, but they seem to have moved on for now. Here are some Ericsson tables.

About the Author(s)

You May Also Like

_1.jpg?width=700&auto=webp&quality=80&disable=upscale)

.png?width=800&auto=webp&quality=80&disable=upscale)