UK surpasses rest of Europe in fibre growth but coverage still lags

The UK tops the charts in Europe in terms of growth in full fibre deployment, according to new statistics published this week, but it is still lagging behind many European economies when it comes to coverage.

March 21, 2024

The UK added 4.7 million homes to its fibre footprint in the year to September 2023, the FTTH Council Europe's latest FTTH/B Market Panorama shows, more than any other country in its EU39 ranking; that's the 27 European Union members, plus the UK, and 11 other European markets. There were 17.1 million homes passed in the UK at that date, putting the country in third place behind France, with a significantly bigger 26.3 million, and Turkey at 18 million.

Given the size of the UK population and its need to play catch-up on fibre, that leadership position in volume terms is not wholly unexpected. However, it's also worth noting that the UK ranks second in terms of percentage growth, increasing its number of homes passed by 38%, just behind Belgium with 43%.

And the UK was also the second fastest-growing in terms of new subscribers, adding 1.8 million during the 12 months. France came out some way ahead though, with 3.4 million. The only other market to hit the 1 million mark was Turkey.

The UK ranks fifth by subscribers in the EU39 with 5.1 million as of last September. Italy and Germany are not too far behind with 4.2 million and 4.1 million respectively, but all three remain dwarfed by France with 20.6 million and to a lesser extent Spain, with 14.5 million.

And uptake is still an issue. The UK comes in 32nd out of 39 in Europe with a take-up rate – that's take-up of full fibre services out of the number of homes passed – just shy of 30%. The market average is just under 50% – 49.6% to be exact – while the EU27+UK averages fares slightly better at 52.7%. Spain is the market leader at 85.8%, surpassing now second-placed Iceland at 82.5%. Portugal, Sweden, France and Finland can all boast uptake in excess of 75%.

Coverage also leaves something to be desired in the UK. 57% of UK households had FTTH/B coverage as of September, while the EU39 average was at almost 70%. Five markets have exceeded the 90% mark, topped by Romania, which leads the way by some margin at 96.5% FTTH/B coverage.

While the UK has clearly made significant progress in the rollout of full fibre over the past couple of years, it is also one of the countries identified by the FTTH Council as having a lot of work to do to reach full coverage. Germany has the most work left to do, with 24.4 million homes still to be passed with fibre, followed by the UK, with a more manageable – but still significant – 12.9 million. Italy comes in third with 10.7 million homes still to pass.

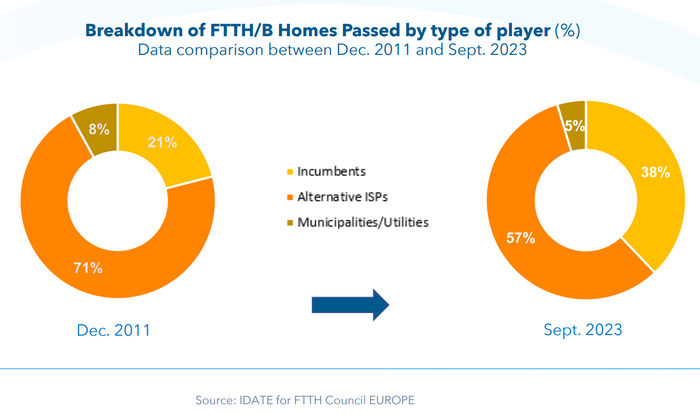

The council's data, provided by IDATE, shows that altnets and alternative ISPs still dominate the market for fibre rollout in Europe, but that incumbents are starting to come to the fore; the incumbents now account for 38% of homes passed, up from just 21% at the end of 2011 (see chart).

That data helps to explain why big markets like Germany and the UK still have so much work left to do. While incumbent operators Deutsche Telekom and BT's Openreach are now keen to talk about their fibre rollout progress, they were notably slow to get off the ground and were arguably driven into action by the strength of the altnets.

But progress is now underway and shows no sign of abating.

The FTTH Council expects the number of homes passed in the EU39 to reach 312 million in 2029, with the EU27+UK accounting for 215 million, up from 244 million and 147 million respectively in September. The top three countries in the EU27+UK will be Germany, with 38.6 million homes passed, France with 33.3 million and the UK with 29.6 million.

With a total of 349 million homes across the EU39, that still leaves work to be done in the next decade.

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)

.png?width=800&auto=webp&quality=80&disable=upscale)