Wearables on the up again as prices slide

The global market for wearable devices returned to growth in the second quarter of the year, but while the rise of smaller players helped to drive shipments, it also contributed to falling prices.

September 22, 2023

The global market for wearable devices returned to growth in the second quarter of the year, but while the rise of smaller players helped to drive shipments, it also contributed to falling prices.

So says IDC, which this week shared new market data and forecasts for the wearables space. Its headline finding showed unit shipments grew by 8.5% year-on-year in the three months to the end of June to 116.3 million devices, the growth coming after two quarters of decline.

Those Q2 numbers mean that IDC now forecasts the wearable device shipments will reach 520 million units for the full year, an increase of 5.6% on last year. And by 2027 the market will expand to reach 625.4 million shipments, a CAGR of 4.7%.

While the return to growth is positive news for the makers of wearable devices, there is a down side too. The hike in shipments in Q2 “came at the expense of overall market value,” IDC noted. Average selling prices fell due to increased competition and retailers applying discounts in a bid to reduce excess inventory, it explained. The analyst firm did not share figures on average prices or the value of the whole market, but clearly this will be a concern for all involved.

And the data shows that there are more parties involved than there were previously, or at least that the number of companies with a reasonable level of involvement is growing.

“Most consumers think of popular brands like Apple, Samsung, and Fitbit when it comes to wearables, and they would be correct,” said Ramon T. Llamas, research director with IDC’s Wearables team.

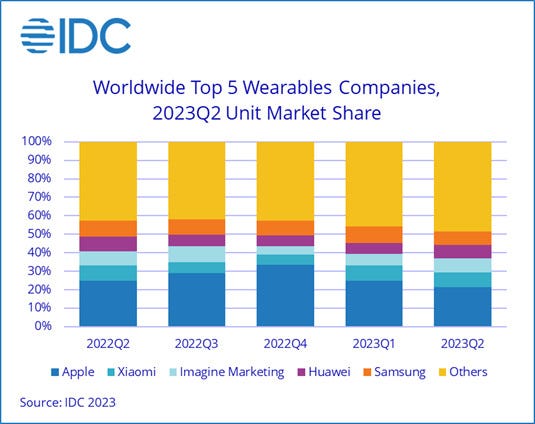

Indeed, big names on the technology stage still dominate the market (see chart).

“But driving growth are numerous smaller companies that may not have the global aspirations as the market leaders, but instead focus on specific geographies such as China and India with fully featured devices that meet price expectations,” Llamas said. “Looking ahead, it isn’t too hard to imagine some of these brands being mentioned in the same breath as the world’s most popular ones, or to imagine moving into adjacent markets where pent-up demand has yet to be fully satisfied.”

It’s not just competitiveness on price that is driving the market share of smaller players. There are also wearables makers emerging that produce devices – including lesser-known form factors such as connected rings – that address consumers’ growing desire for a more holistic to health tracking, IDC says, highlighting demand for features like sleep monitoring, exercise recovery metrics, readiness scores, and stress level tracking.

“This is where smaller brands, such as Oura, Whoop, and Withings, have been able to carve out a niche, though many big name brands and some local companies are closely eyeing this space and are expected to launch products in the coming months,” said Jitesh Ubrani, research manager, Mobility and Consumer Device Trackers at IDC. Oura produces a smart ring, Whoop is focused on health and fitness, particularly exercise recovery, and Withings is a smart watch maker.

Smart watches are one of the biggest wearable device categories and will account for almost 32% of unit shipments in 2023, IDC predicts. But they are dwarfed by the earware – or hearables, if you prefer – category, which includes smart headphones, earbuds and the like, and is set to deliver 320.7 million unit shipments worldwide this year, or 62% of the market. Smartwatches will experience a higher growth rate in the 2023-2027 period – a CAGR of 6.3% to hearables’ 4.5% – and therefore increase their market share to 34%.

Wristbands will see negative growth over the period, reducing their market share to below 5%, but there will be significant growth in the ‘other’ category, albeit from a very low start. Indeed, ‘other’ wearable devices will account for less than half a percent of the market in 2027…but with devices like connected rings starting to emerge, it could well be an interesting 0.5%.

Who knows what we’ll be wearing in four years’ time?

Get the latest news straight to your inbox. Register for the Telecoms.com newsletter here.

About the Author(s)

You May Also Like

_1.jpg?width=700&auto=webp&quality=80&disable=upscale)

.png?width=800&auto=webp&quality=80&disable=upscale)