EE and AT&T are winning the early 5G performance races

Two reports analysing operators’ 5G performances in the US and the UK have put EE and AT&T slightly ahead of their peers respectively, but there are no sweeping winners.

April 15, 2021

Two reports analysing operators’ 5G performances in the US and the UK have put EE and AT&T slightly ahead of their peers respectively, but there are no sweeping winners.

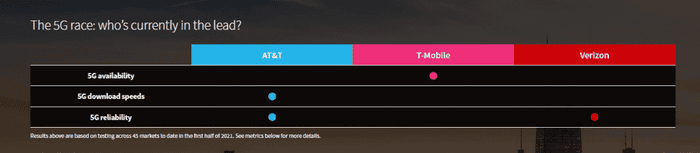

Research firm RootMetrics published its latest “5G in the US” report to analyse 5G performance by the three national operators in the first half of 2021. Live 5G networks by AT&T, Verizon, and T-Mobile have been test across 45 US cities, and been compared on three key parameters: 5G availability, 5G download speed, and 5G data reliability.

AT&T led in 5G download speed and jointly with Verizon offered the best 5G data reliability (which means 5G data connection should reach 99.5% of time when running testing apps). T-Mobile was slightly ahead in the competition of 5G availability, being the only operator that has 5G coverage in all the 45 cities tested, compared with AT&T’s 44 and Verizon’s 43.

Putting all three parameters together, the report concluded that “when considering that critical combination of availability plus performance, you’re currently more likely to find fast 5G speeds plus broad availability with AT&T than with T-Mobile or Verizon.”

Source: RootMetrics, 5G in the US, 1H2021, p.8

When measuring download speeds, the firm tested best case speeds (95th percentile 5G download speeds), worst case speeds (5th percentile), as well as median speeds. AT&T delivered best results in all three measurements in more cities (14) than T-Mobile (6) and Verizon (3) combined.

The difference in speeds looks to come from the different 5G rollout strategies adopted by the operators. AT&T is the most aggressive in using mmWave to cover densely populated areas, such as city centres, event venues, and campuses. T-Mobile has adopted a so-called “Layer Cake” strategy to roll out its 5G networks but have relied heavily on low band, its unique 600 MHz frequency holdings, to achieve broader coverage, but paid the price of lower speed. The authors of the report believed the mid-band T-Mobile acquired through the Sprint merger and through the recent C-Band auction should help it improve the speed in the future. Verizon started its 5G rollout on the mmWave bands then used dynamic spectrum sharing (DSS) to make the limited initial coverage.

The results may come as a surprise for Verizon, which has made 5G its top priority. It would be specially disappointing to see that T-Mobile has clocked up speeds over 250 Mbps in “best case” tests in more cities (13) than the other two combined (2, both on Verizon networks though). On the other hand, Verizon, being the heaviest spender in the C-Band auction ($45 billion, compared with $23 billion paid by AT&T and $9 billion by T-Mobile), we can expect big improvement in Verizon’s 5G speeds when the newly acquired frequencies come into use next year.

In general, however, the report authors believed that despite the improvements by all three operators, “the 5G speed results we’ve seen in the US to date trail what we’ve found in the UK and (especially) South Korea.”

Which takes us across the Atlantic.

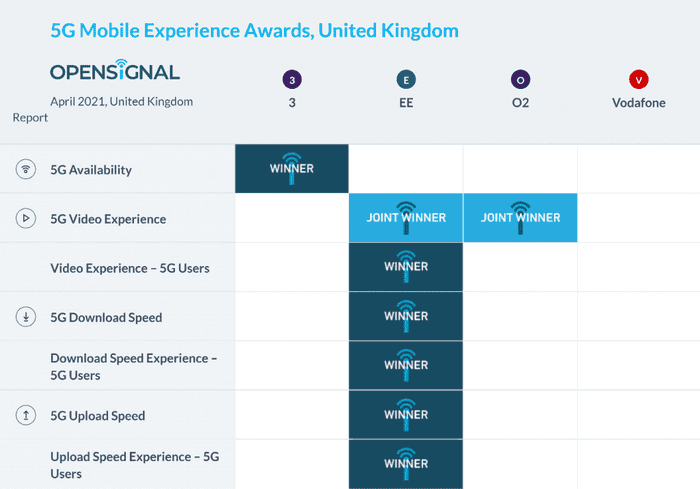

On the same day, Opensignal, a firm that measures consumer experience, published its UK 5G report measuring and comparing the experiences on the country’s four operators, or, as the firm called it, its first 5G awards in the U.K.

The experiences measured cover 5G availability, 5G video experience, and 5G download and upload speeds. While EE led in speed tests and jointly led, together with O2, on video experience, 3UK came out on top in 5G availability.

Source: Opensignal, 5G User Experience Report April 2021

Different from the methodology used by RootMetics when measuring download speed, Opensignal reported average download and upload speeds. However the results do broadly corroborate with the conclusion made by RootMetrics: while the median download speeds of AT&T were mostly clustered in the 50-100 Mbps bracket (and Verizon and T-Mobile both concentrated in the 25-50 Mbps bracket), all four UK operators delivered over 100 Mbps average 5G download speed. EE, the winner clocked up 140 Mbps, with Vodafone, ranked the fourth, at 103 Mbps.

When measuring video experience, the company used ITU-based approach to quantify factors such as load times, stalling, and video resolution. The difference between 5G experience / speed and those experienced by 5G users in the table above is that, while the former measures 5G experience only, the latter also includes the average experience that 5G users have on 3G or 4G networks when they are not connected to 5G.

We can expect further improvement in the overall 5G experience by all the four operators in the near future following the recent Ofcom auctions of 700 MHz and 3.6 GHz bands. Opensignal also highlighted that in addition to the 20 MHz spectrum that 3UK just acquired, it had already had 140 MHz of spectrum between 3.4GHz and 3.8GHz in its possession prior to this auction, partly through its acquisition of UK Broadband in 2017, which implies that more visible improvement could be expected from 3UK.

About the Author

You May Also Like

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)