UK extracts £1.36 billion from UK operators for 700 MHz and 3.6 GHz spectrum

The latest UK spectrum auction has completed its preliminary stage, with EE and O2 UK emerging as the biggest spenders.

March 17, 2021

The latest UK spectrum auction has completed its preliminary stage, with EE and O2 UK emerging as the biggest spenders.

The baffling auction process resulted in operators managing to not only avoid going very far over the total reserve price of £1.1 billion, but also paying almost exactly the same amount for each type of spectrum. As you can see from the table below the price per lot (base price) was identical in each case except for Vodafone, which paid a little bit more for its 3.6 GHz spectrum. That doesn’t look like the hallmark of a truly competitive auction.

Bidder | Lots won | % of spectrum on offer | Base price | Total base price |

EE | 8 x 3.6 GHz lots (a lot = 5 MHz) | 33% | £21,000,000 | £168,000,000 |

4 x 700 MHz individual frequency lots | 100% | £1,000,000 | £4,000,000 | |

2 x 700 MHz paired frequency lots | 33% | £140,000,000 | £280,000,000 | |

Totals | £162,000,000 | £452,000,000 | ||

3 UK | 2 x 700 MHz paired frequency lots | 33% | £140,000,000 | £280,000,000 |

O2 UK | 8 x 3.6 GHz lots | 33% | £21,000,000 | £168,000,000 |

2 x 700 MHz paired frequency lots | 33% | £140,000,000 | £280,000,000 | |

Totals | £161,000,000 | £448,000,000 | ||

Vodafone UK | 8 x 3.6 GHz lots | 33% | £22,050,000 | £176,400,000 |

Grand totals | £485,050,000 | £1,356,400,000 |

“EE has secured vital new spectrum in this auction which, when rolled out into the network, will allow us to grow our position as the UK’s number one 5G network,” said Marc Allera, CEO of BT’s Consumer Business. “EE was first to launch 4G and 5G, and this auction outcome is great news for our network, our customers and BT.”

“We are delighted to have won two 10MHz blocks of low frequency spectrum at the auction,” said Three CEO Robert Finnegan. “This triples the amount of low frequency spectrum we own and will have a transformative effect on our customers’ experience indoors and in rural areas. Coupled with our existing low frequency spectrum and the UK’s largest 5G spectrum holding, we are in a fantastic position to deliver a great network experience for our customers now and in the future.”

“This auction will boost our 5G network capacity,” said Ahmed Essam, Chief Executive of Vodafone UK. “It means we will have the spectrum we need to further the roll-out of 5G to our customers, bringing high speed connectivity and opening up new opportunities for products and services. We have been successful in the 3.6 GHz band and have avoided expenditure on low band spectrum, where it is our strategy to refarm over time our significant 900 MHz holdings to carry 5G traffic.”

“With bidding in the principal stage concluded, we now move to the next stage of the auction where the operators will have an opportunity to negotiate the position of their spectrum holdings in the wider band,” said Philip Marnick, Group Director, Spectrum at Ofcom. “This is an important step forward in bringing better mobile services to people – wherever they live, work and travel. These airwaves will help improve coverage for the mobile services people use today, as well as supporting the UK’s position as a world leader in 5G.”

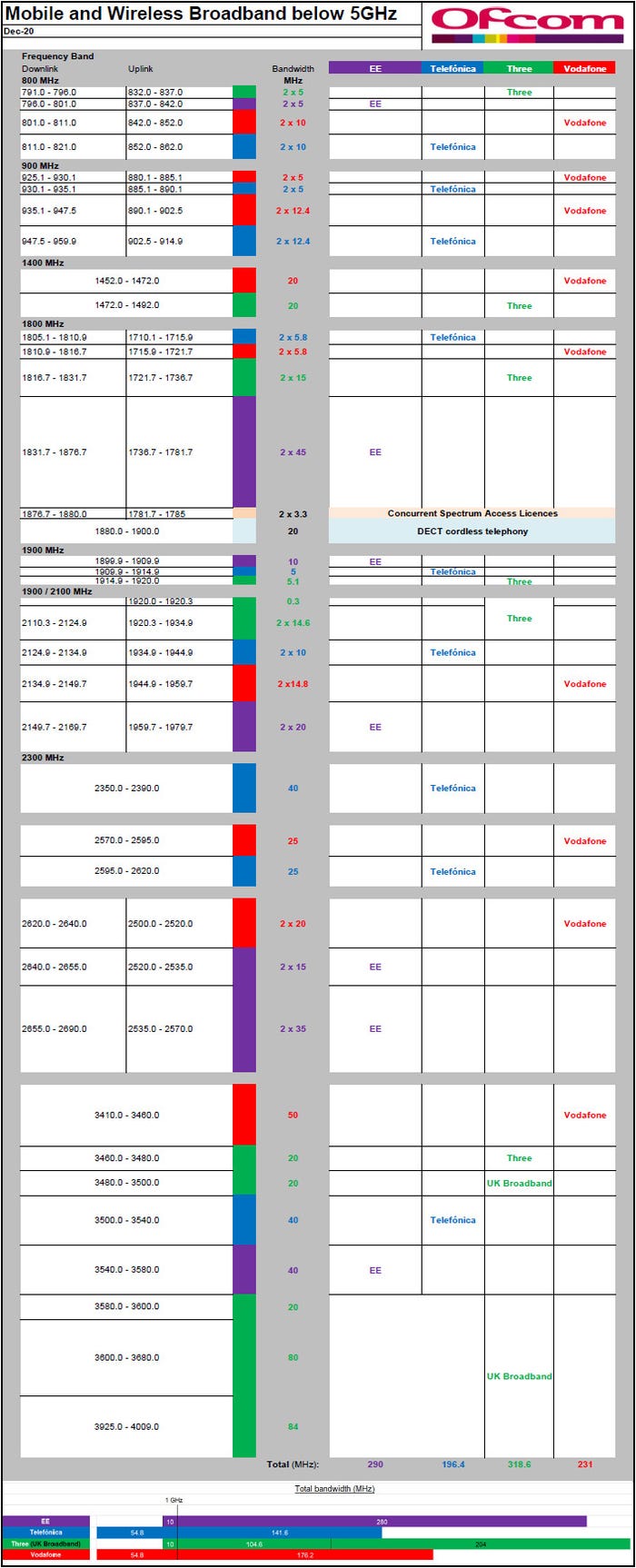

Contiguous spectrum is more useful than fragmented chunks as it enables operators to create a ‘fatter pipe’, so the next stage will be all about everyone trying to get as much contiguous spectrum as possible. As you can see from the Ofcom table below (from December 2020) Three already has a bunch of 3.6 GHz spectrum as part of its UK Broadband acquisition, which is why it didn’t bother to bid for any more.

Where the other three operators sit in the 3680 MHz-3800 MHz chunk they just won would seem to be irrelevant, therefore, since it will be separate from the rest of their mid-band spectrum regardless. The real business will involve trading existing frequency holdings in order to create bigger contiguous holdings. The obvious deal would involve a swap between EE and O2 such that each gets an 80 MHz chunk.

At the other end we have the 80 MHz of low-frequency Ofcom spent years getting the broadcast sector to hand over. It’s not clear whether any of the lots are adjacent to the stuff Three has but O2 would presumably like to swap its newly acquired 2×10 MHz of 700 MHz band spectrum with Vodafone’s 800 MHz band holding to create a contiguous 20 MHz chunk. Whether Vodafone would be inclined to grant that favour, however, is another matter entirely.

“The main process concluded so quickly as all providers were successful in securing the spectrum they needed,” said Analyst Paolo Pescatore of PP Foresight. “Expect to see some haggling behind closed doors in the next assignment stage. Fingers crossed this new spectrum can be used by the summer. However, Vodafone remains the only operator not to secure any 700 MHz spectrum as it will refarm 900 MHz for 5G services.”

“The swift conclusion of the auction and the relatively modest overall spend is good news for UK 5G,” said Analyst Kester Mann of CCS Insight. “The UK was fast out of the blocks with early 5G launches in 2019, but progress has been hindered by the government ban on Huawei.”

The spend may have been relatively modest, but its still millions more pounds operators will have to recover from their customers just for the right to use a sliver of air. On top of that, the fact that the operators are now forced into what will presumably be a fraught bartering process before they can make best use of this premium air once more brings attention to the inherently flawed way in which supposedly vital mobile spectrum is made available.

About the Author

You May Also Like

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)