Pop to the rescue of the music industry

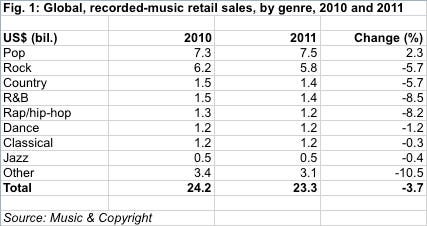

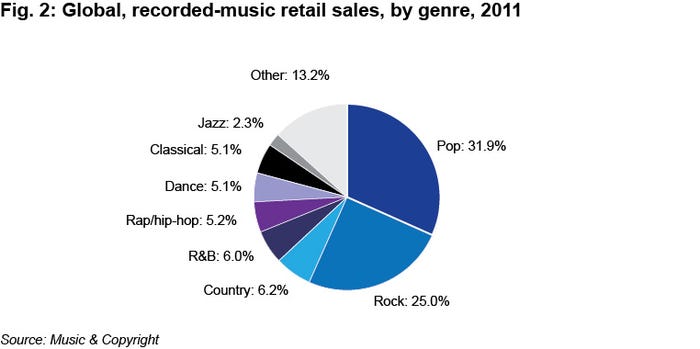

Global retail sales of pop music increased 2.3 per cent last year, to $7.5bn, according to research published this week in Informa’s Music & Copyright report. Pop ended 2011 as the world’s favorite music genre, accounting for 31.9 per cent of global music sales. Total retail sales slipped 3.7 per cent last year, to $23.3bn, so the growth of pop sales was all the more impressive.

June 13, 2012

By Simon Dyson

Global retail sales of pop music increased 2.3 per cent last year, to $7.5bn, according to research published this week in Informa’s Music & Copyright report. Pop ended 2011 as the world’s favorite music genre, accounting for 31.9 per cent of global music sales. Total retail sales slipped 3.7 per cent last year, to $23.3bn, so the growth of pop sales was all the more impressive.

The second biggest genre in 2011 was rock, accounting for a quarter of the world’s music sales. Sales of rock were down 5.7 per cent, to $5.8m. Pop and rock have dominated music sales for years. In 2000, Pop had a global sales share of 27.8 per cent with Rock at 22.7 per cent.

Aside from pop, all other genres suffered a fall in sales last year. However, the bigger fall in rap, R&B and hip-hop sales allowed country to become the world’s third most popular music genre with a 6.2 per cent share.

According to Simon Dyson, editor of Music & Copyright, “massive sales of Adele’s album “21” clearly boosted pop sales last year. The unstoppable rise in the popularity of Justin Bieber, Michael Buble and Lady Gaga also made sure pop’s bubble didn’t burst. Despite lower viewing figures for the music-based reality TV show, artists and groups created by

those shows, such as One Direction, Susan Boyle and Olly Murs, just keep on selling.”

In contrast to previous years, which have seen retail sales of some of the smaller genres such as classical music and jazz fall the fastest, the reverse was the case in 2011. Sales of classical music and jazz were only marginally down last year. Smaller genres have suffered more than most in recent years from retailers giving less floor space to slow-selling, low-margin genres in favor of better-selling items, such as DVDs, video games and consumer electronics.

You May Also Like

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)