Jio is running riot again, but more synergies (sigh) are on the horizon

The Indian telecommunications industry might be crumbling around it, but Reliance Jio is still reaping the rewards of disruption and chaos, and there is much more to come.

May 1, 2020

The Indian telecommunications industry might be crumbling around it, but Reliance Jio is still reaping the rewards of disruption and chaos, and there is much more to come.

Although the telco is now considered a staple of the Indian connectivity diet, it is easy to forget this is a company which is only five years old. This was not the first firm to emerge as a disruptive influence on the telco industry, but few could say they have enjoyed the rip-roaring success of Reliance Jio.

But most importantly, this might only be the tip of the iceberg, after all, this is only one business unit of a wider corporation.

“Our consumer businesses further strengthened their leadership positions and recorded robust growth on all operating and financial parameters during the year,” said Mukesh Ambani, Chairman and Managing Director of Reliance Industries.

“Both Retail and Jio, continue to work towards providing superior products and services to Indian consumers. We are fully committed on our investment plans in our consumer businesses and new initiatives.

“We are at the doorsteps of a huge opportunity and our rights issue and all other equity transactions will strengthen Reliance and position us to create substantial value for all our stakeholders.”

Reliance Jio results for financial year ending March 31 (USD ($), millions)

Total | Year-on-year | |

|---|---|---|

Total revenue | 9,038 | +40.7% |

Profit | 1,896 | +63.5% |

Subscribers | 387.5 | +26.3% |

Source: Reliance Industries Investor Relations

With all the numbers heading in the right direction, you can see why Reliance Jio is an exciting business. Interestingly enough, not only are the total subscriber numbers shooting north, the team is also maintaining ARPU at roughly $1.73, while data usage is also increasing. There has been a surge of traffic on the network during the COVID-19 crisis as Indians are placed under lockdown orders, as much as a 50% increase on normality, but the network is holding steady.

These numbers are impressive, especially compared to the woes of competitors during this period, but Reliance Jio is still primarily a wireless business. Now it has established dominance in the mobile arena, the potential to lean into other areas is exciting. This means broadband and content, but also ventures into parallel industries.

It is a dreaded word, but there are synergies throughout the Reliance Industries portfolio.

The Reliance Industries business brought in revenues of roughly $87 billion through the last 12 months, with the business growing 5% year-on-year. The group has access to markets in 108 countries with operations in energy, petrochemicals, textiles, natural resources and retail, as well as telecoms.

Split of revenues by business unit for Reliance Industries (USD ($), millions)

Business unit | Total revenue | Year-on-year |

|---|---|---|

Telecoms | 9,038 | +40.7% |

Retail | 21,510 | +24.8% |

Refining | 51,159 | -1.6% |

Petrochemicals | 19,177 | -15.6% |

Oil and Gas | 423 | -35.8% |

Media | 707 | +4.7% |

Every telco in the world wants to develop new products and services for enterprise customers and co-create new business ventures to marry connectivity and traditional business, while forward-looking enterprise organisations want to embrace connectivity. Cross-pollination within an existing corporation to meet these objectives creates a very exciting opportunity to Reliance Industries to become an industrial giant with connectivity at the core.

Part of this expansion into the novel and unknown is already being demonstrated with Reliance Jio’s partnership with Facebook.

In recent weeks, Facebook was announced a new investor in the digital business unit, taking a 9.9% stake for $5.7 billion. As part of this transaction, Facebook entered into a partnership with the digital and retail business units to create a digital payments platform, with WhatsApp playing a significant role, for a society which largely lacks traditional banking infrastructure.

This is a new venture for Reliance Industries, bringing in a third-party to help bridge the gap between two already successful business units. Many people talk about innovation, but this is a genuine example, creating new revenues without cannibalising existing units with the help of an industry partner. It is a case of 1+1+1=4.

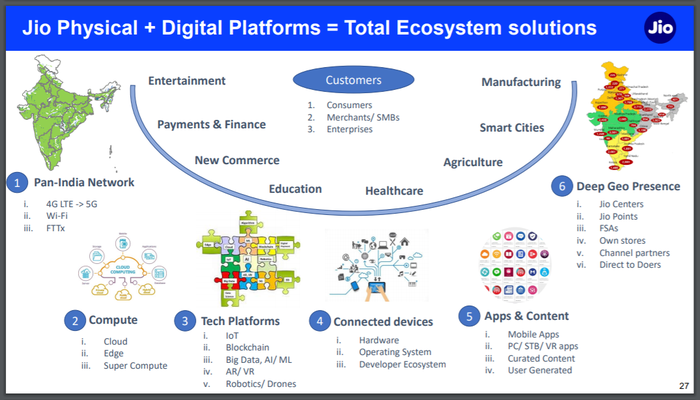

As you can see from the image above, Reliance Jio is much more than a telecoms company nowadays. It is spreading its wings to various different technologies, segments and concepts, all of which can be developed into different revenue streams. This creates a significant amount of diversification in the TMT segments, but when combined with the different units of the Reliance Industries parent company it creates almost countless new opportunities.

Reliance Jio has been a very interesting company to keep an eye on over the last few years, but with the gaps between business units being bridged, and the eclectic mix of existing ventures, the opportunities for the wider Reliance Industries are very exciting.

About the Author

You May Also Like

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)