India smartphone sales on the up

Most of the world might be experiencing dip with smartphone shipments, but with India playing catch-up in the digital economy, device sales are continuing to rise.

August 13, 2019

Most of the world might be experiencing dip with smartphone shipments, but with India playing catch-up in the digital economy, device sales are continuing to rise.

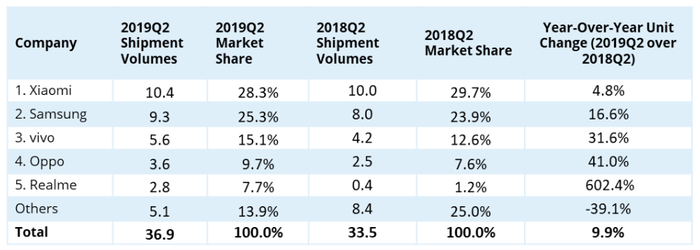

According to new estimates from IDC, Q2 registered the second-highest ever number of smartphone shipments in India. 36.9 million smartphones were shipped in the quarter, 9.9% year-on-year and 14.8% quarter-on-quarter growth, while a total of 69.3 million mobile phones were shipped to India.

This is a country which is under-going its own digital revolution, admittedly a few years after some of the Westernised markets, though it does present opportunities for bewildered and down-beaten smartphone manufacturers.

“Despite the efforts towards multi-channel retailing by almost all vendors, the online channel continued its growth momentum fuelled by multiple new launches, attractive offers and affordability schemes like EMIs/cashbacks,” said analyst Upasana Joshi.

“This resulted in YoY growth of 12.4% for the online channel with an overall share of 36.8% in 2Q19.”

Globally, smartphone shipments are on the decline. Estimates suggest shipments are at the lowest levels since 2014, which can be attributed to a number of different factors. A lack of innovation might be putting people off purchasing new devices, with new flagships offering little more than incremental upgrades. The price of these new devices might also have the same impact, though it is providing a surge for the second-hand market.

Another factor to consider is the up-coming 5G revolution. Telcos are building the hype around 5G, and if consumers buy into the euphoria, why would they consider purchasing a 4G device when more affordable 5G-compatible devices might just be around the corner. The last thing the consumer wants is buyer’s remorse.

These are not necessarily factors which are that influential in India however.

Although it has been considered a growth market for decades, the reality never really fulfilled the promise in telco and technology. Sluggish telcos were happy to sit back and quietly collect profits as aging networks and a pre-historic approach to business slid India down the global digital rankings. And then Jio entered the fray.

Taking a data-centric approach to telecommunications, Jio forced a digital revolution onto the Indian society and dragged the traditional telcos into the 21st century. The result is better and more inclusive networks, consumers using more data and digital applications, leading to increased sales of smartphones.

As IDC points out, 2G and 3G device shipments are gradually declining, while 4G smartphones are on the up. The average cost of devices is also increasing, the $400-$600 segment is the second-fastest growing segment, though the premium segment ($500+) is also starting to gather momentum. 72% of purchases are below the $200 threshold, though $200-300 is the fastest growing area.

This is market which still has a lot of growth potential, not only because of smartphone penetration, but also the ability to upgrade customers to more premium handsets. Let’s not forget, this is a country with a population of 1.339 billion; there will be plenty of opportunities to make money as long as Jio continues to drag the industry forward.

But who are making the most of this digital boom:

These are the smartphone manufacturers who are embracing the mid-tier smartphone segment. Numerous other, more established players, are scaling back in this market, choosing to more dutifully embrace the high-tier. This is an interesting decision.

Firstly, it not necessarily a bad strategy. A significant refreshment cycle for premium smartphones is on the horizon as 5G gets a better grip around the world. There are billions of users who will want to upgrade over the next couple of years; this is big business for those who make a name for themselves in the premium 5G market.

However, there might also be the negative consequence of brand loyalty. India is upgrading to 4G now, prioritising the purchase of mid-tier devices. This is where numerous Western markets were 4-5 years ago. Some might not want to engage mid-tier purchases, bigger profits are elsewhere, but they will miss out on forming a loyalty relationship with this monstrously large market.

India is surging forward into the digital economy, and there are many brands who are embracing the market through this transition. The likes of Xiaomi, OnePlus, Oppo and Realme are using this momentum to challenge the status quo. There might well be a horde of new device manufacturers to consider in a few years.

About the Author

You May Also Like

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)