Vodafone balances Indian nightmare with solid numbers elsewhere

The latest numbers from telecoms group Vodafone are a mixed bag, with India casting a shadow over some solid performances elsewhere.

November 12, 2019

The latest numbers from telecoms group Vodafone are a mixed bag, with India casting a shadow over some solid performances elsewhere.

In the UK Vodafone said it had its best ever quarter for new customers, with nearly double the number of mobile contract customers joining in Q3 2019 than in the year-ago quarter. On top of that the prepaid business grew for the first time in a decade and Vodafone managed to steal Virgin’s MVNO business from BT, so not a bad quarter at all for Vodafone UK.

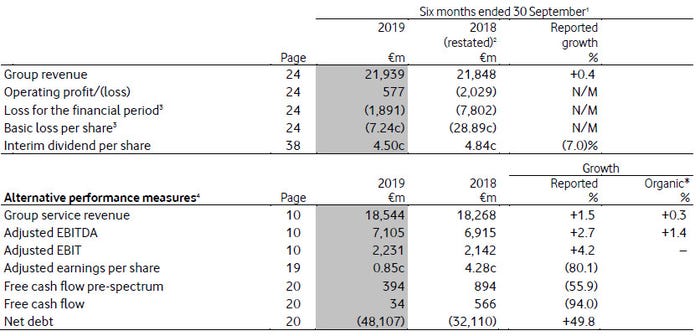

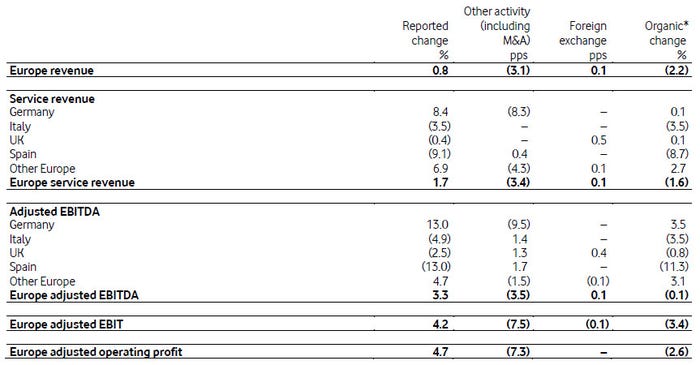

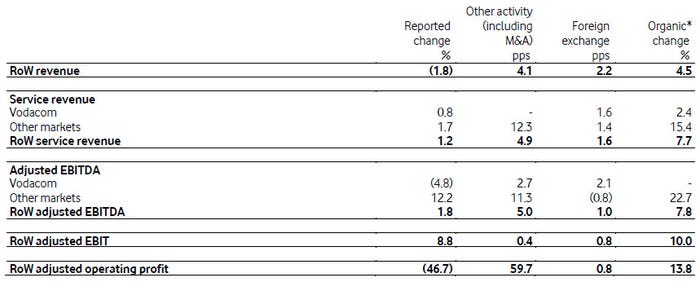

Across the whole group revenue was flat year-on-year, EBITDA was up a bit and operating profit was back in black. As you can see from the table below Europe is pretty stable and Vodafone has upgraded its EBITDA guidance by around a billion euros, thanks mainly to the completion of its Liberty Global acquisition. That has massively increased its debt, however, and any optimism is tempered by Vodafone’s exposure to the dire situation in India.

“I am pleased by the speed at which we are executing on the strategic priorities that we announced this time last year,” said Nick Read, Vodafone Group Chief Executive. “This is reflected in our return to top-line growth in the second quarter, which we expect to build upon in the second half of the year in both Europe and Africa.

“The consistency of our commercial performance has improved in both regions, and we have made a fast start on integrating the acquired Liberty Global businesses, where we see significant long-term opportunity. Our digital transformation is already creating a better experience for our customers, improving our differentiation, supporting growth and at the same time reducing our structural costs.

We have now secured network sharing agreements across most of our major European markets, and we recently announced a major long-term wholesale partnership with Virgin Media in the UK, in order to improve the utilisation of our network assets. And we expect our European TowerCo to be operational by May next year, enabling us to continue to unlock the significant value embedded in our tower infrastructure.”

Amit Pau, former Vodafone Managing Director and currently Chief Operating Officer of Accloud, had this to say. “It has been a year of two halves for Vodafone and their new CEO. Nick had a tough start with the reaction to his dividend cut, but Vodafone has fought back and today sees one of the best set of results from across its peers in 2019 thanks to successes in key markets, including Germany. Vodafone now seems to be operationally stable and gives the impression it’s turned the corner of organic growth.

“But, dig a little deeper, and the top-line results disguise the fact that there has been little innovation, which would drive Vodafone’s long-term growth and expansion. Given the phenomenal levels of innovation in the mobile world, it is strange that it is in decline at the business. A clear example is how they have failed to recognise the vast opportunity that exists in the Indian market. A decision that is likely to prove unwise in time, simply because they are ignoring one of the largest and most diverse mobile economies in the world.”

We don’t know the extent of Vodafone Group’s exposure to the Vodafone Idea joint venture, but it presumably remains a major shareholder and, even if it doesn’t have to cover the Indian government’s cash grab, still has a massive interest in the company’s success. Considering how much debt Vodafone is already in, it’s questionable how much more cash it will be prepared to chuck at the Indian market.

About the Author

You May Also Like

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)