Intel’s revenue slumped 32% in the last quarter

Intel posted some grim numbers in its most recent financials, showing big drops in its Q4 and full year 2022 revenues.

January 27, 2023

Intel posted some grim numbers in its most recent financials, showing big drops in its Q4 and full year 2022 revenues.

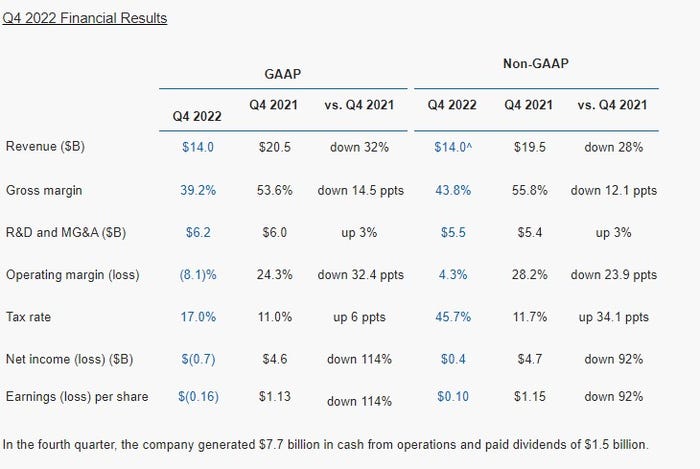

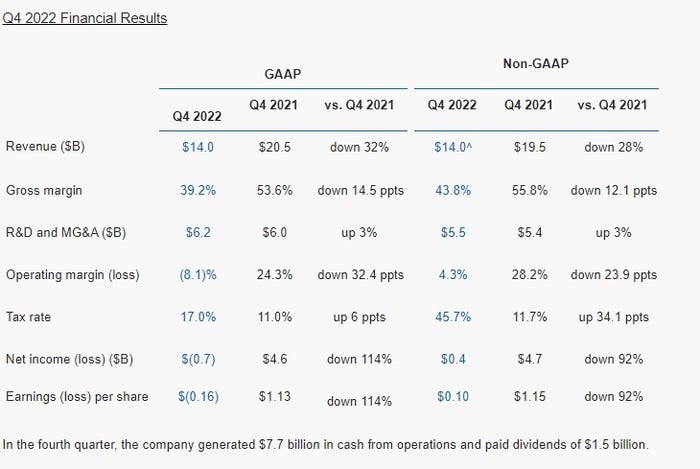

Intel’s Q4 2022 revenue came in at $14.0 billion which was down 32% YoY, while gross margin was 39.2%, down from 53.6% YoY. Revenue for the full year clocked in at $63.1 billion, down 20% YoY.

In terms of where the leaks are coming from, Intel’s Client Computing Group generated $6.6 billion in revenue (down 36% YoY in Q4), while the Data Centre and AI division made $4.3 billion (down 33%), and the Network and Edge unit scooped up $2.1 billion, which was down a less devastating 1%.

Intel’s shares are reported to have dropped 9.5% in trading following the news. Despite these grim numbers, Intel was keen to put a positive spin on things:

“Despite the economic and market headwinds, we continued to make good progress on our strategic transformation in Q4, including advancing our product roadmap and improving our operational structure and processes to drive efficiencies while delivering at the low-end of our guided range,” said Pat Gelsinger, Intel CEO. “In 2023, we will continue to navigate the short-term challenges while striving to meet our long-term commitments, including delivering leadership products anchored on open and secure platforms, powered by at-scale manufacturing and supercharged by our incredible team.”

It is forecasting 2023 Q1 revenue of $10.5 billion to $11.5 billion, but is declining to make a full year forecast. In a Q and A during the earnings call, David Zinsner Corporate Vice President, Investor Relations said “We’re trying to avoid guiding beyond the first quarter given the murkiness. I would just say we are very focused on the appropriate level of investment necessary for the long-term strategy of IDM 2.0, while being very thoughtful around how much CapEx we spend to manage our free cash flow.

He later added: “We’re a high fixed cost model. So we suffer the consequence of that, obviously, when revenue is declining, but we also get the benefit when revenue is expanding. And so what will — what is currently a headwind does turn to a tailwind as the business recovers.”

In terms of what’s behind the decline, Reuters reported that Chief Executive Pat Gelsinger told investors on a conference call that the firm has been losing market share in the data centre market, presumably to AMD. “We stumbled, right, we lost share, we lost momentum. We think that stabilizes this year.”

But many of the US tech giants are having hard time at the moment and are shedding staff. There are probably a few main factors driving this. The cost of living crisis and general economic gloominess experienced last year (which doesn’t look like it’s going away anytime soon) effected all manor of sectors and businesses no matter how big or small.

Tech firms in particular though experienced something of a boom during the pandemic as people snapped up devices and services that might make being locked indoors slightly more bearable, and offices around the world suddenly had to distribute themselves into everyone’s homes to continue operating.

Intel provides the processors for a huge array of devices – and perhaps now the lockdowns are all over (unless you’re in China) this represents something of a correction for that boom. But for Intel, which in 2022 announced a $30 billion investment with Brookfield to ramp up its chip making capabilities in the US, it’s a particularly tricky time for such a huge slump in revenue.

Get the latest news straight to your inbox. Register for the Telecoms.com newsletter here.

About the Author

You May Also Like

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)