Ericsson treated harshly by investors after another margin decline

Swedish kit vendor Ericsson revealed a lower-than-expected gross margin in its Q2 2022 report but a share price hit of -8%, at time of writing, as a result seems excessive.

July 14, 2022

Swedish kit vendor Ericsson revealed a lower-than-expected gross margin in its Q2 2022 report but a share price hit of -8%, at time of writing, as a result seems excessive.

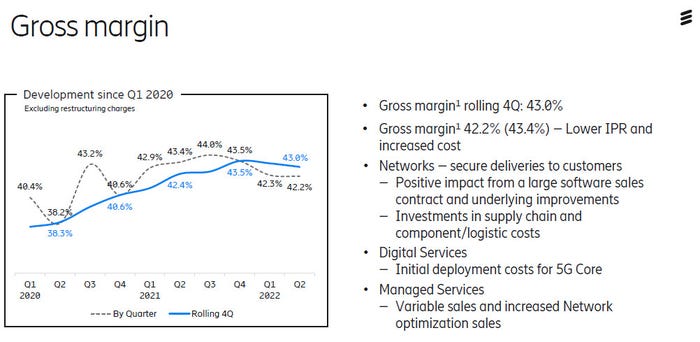

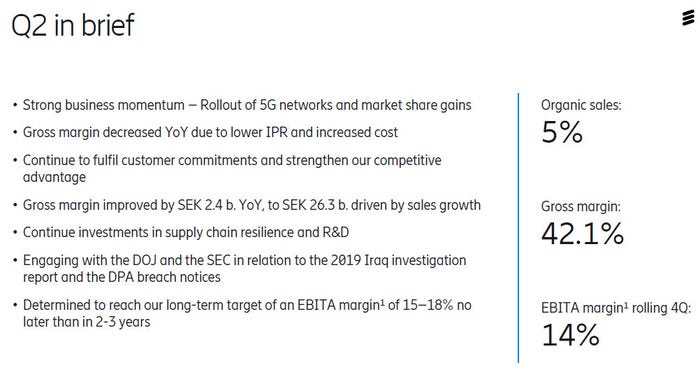

Overall sales grew by 5% when adjusted for adjustments which, inflation notwithstanding, seems healthy enough. But gross margin was 42.2%, excluding restructuring charges, which is down a fair bit from the 43.4% Ericsson managed in the year-ago quarter. Sequentially, however, there was barely any decline at all, so it’s not obvious why the stock market decided to have such a panic attack.

We had a chat with Fredrik Jejdling, Head of Business Area Networks at Ericsson, who kindly accommodated our lateness due to an inability to deal with the concept of time zones. He pointed to a few exceptional circumstances affecting the margin, including the delayed renewal of a major IPR deal (possibly with Apple), the tough supply chain environment and rampant inflation. Underneath it all, however, lies Ericsson’s desire to invest for the long term, something many investors seem inclined to scoff at.

“Technology leadership is a foundation for our growth strategy. Since 2017, our increased R&D investments have created significant value,” said Ericsson CEO Börje Ekholm in his statement. “The geopolitical situation has also required proactive investments to de-risk our supply chain and ensure that we can deliver on our strategy to gain footprint.

“The global supply chain situation remains challenging and inflationary pressures are strong. Combined, this results in cost increases which we work hard to mitigate as far as possible. As contracts expire, we aim to adjust pricing. However, we believe the best way to compensate for cost increases is the continued investment in technology to increase the cadence of bringing new innovative solutions to the market.

“Fulfilling customer commitments under current challenging conditions, comes at a cost which dilutes gross margin. The increased costs have been largely absorbed through our investments in innovation and continuous improvements. Increased sales resulted in a gross income improvement in absolute terms of SEK 2.4 b. compared with Q2 last year, despite lower IPR revenues of SEK 0.9 b. YoY.”

Ericsson’s shares took a kicking last quarter too, but that was assumed at the time to be at least in part down to the ongoing awkwardness with the US DoJ. Perhaps it was more about margin then, too, but whatever the reasons, Ericsson’s share price has declined by 37% in the past 12 months. Its sales and long term strategy still seem solid but if this decline keeps up for much longer Ekholm will come under increasing investor pressure to come up with short term fixes.

Get the latest news straight to your inbox. Register for the Telecoms.com newsletter here.

About the Author

You May Also Like

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)