Ericsson starts to get returns on its Chinese investments

Swedish kit vendor Ericsson reported a strong Q3 2020 on the back of 5G revenues from China.

October 21, 2020

Swedish kit vendor Ericsson reported a strong Q3 2020 on the back of 5G revenues from China.

When Ericsson won 5G business at all three Chinese MNOs, it revealed it would have to take an initial hit on the write-down of a bunch of inventory. We interpreted that as Ericsson having to offer some kit as a loss-leader in order to win the business, while the company insisted the deals would pay off in the long run.

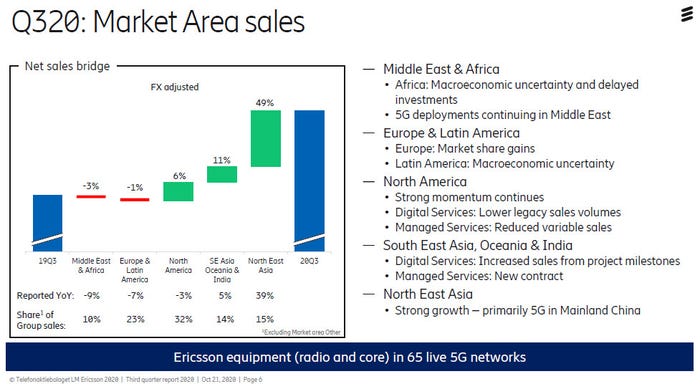

Now it looks like it has only taken a quarter for that to happen, with Ericsson’s Q3 2020 numbers benefitting from Chinese 5G revenues, which accounted for half of its 7% year-on-year sales increase. As the 5G rollout continues in the world’s largest mobile market, that initial investment should continue to pay dividend. It also serves as a reminder that Huawei and ZTE should be fine for cash so long as the rollout continues, so long as they can continue to supply kit.

“Underlying business fundamentals remain strong in North America driven by consolidation in the US operator market, pending spectrum auctions, and increased demand for 5G,” said Ericsson CEO Börje Ekholm. “The 5G contracts in Mainland China have developed according to plan, contributing positively to profits in Q3 and are expected to improve further.

“Our business in Europe grew based on several footprint gains. While the pandemic has hurt revenues for several of our customers, and in some cases this has led to a reduction of capex, we have not seen any negative impact on our business, largely due to footprint gains. However, the pandemic negatively impacted our sales in Latin America and Africa.”

Footprint seems to mean market share in this case, which Ericsson remains very cagey about detailing. This was confirmed by our conversation with Ericsson’s Head of Networks, Fredrik Jejdling, who wouldn’t be drawn on specific market share gains. He did, however, point to the fact that revenues for the networks division grew by 13%, versus Dell’Oro’s estimate of overall RAN market growth of 8%, and encouraged us to do the maths.

The easy assumption to make is that those share gains came at the expense of Huawei in Europe, where political decisions to ban the vendor from 5G networks are gathering momentum. On the earnings call, however, Ekholm appeared to indicate that most of the gains are coming at Nokia’s expense and pushed back at the suggestion that his successes are due to Huawei bans.

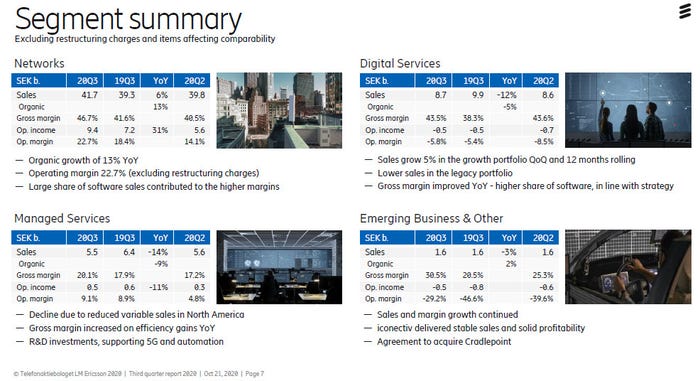

As you can see from the above slide, while networks registered healthy growth, for whatever reason, the other main business units declined. We asked Jejdling about this and he indicated it due to a combination of factors, including COVID-19, but also noted their improved gross margins. It seems those units are still in the process of streamlining to the point of profitability that the networks division successfully completed a while ago.

“We remain positive on the longer-term outlook for the industry and Ericsson,” concluded Ekholm. “The year to date results strengthen our confidence in delivering on the 2020 Group target.” The longer-term target remains unchanged too, so everything look solid for Ericsson, so long as China doesn’t decide to retaliate for Sweden’s Huawei ban. Its share price was up 8% at time of writing.

About the Author

You May Also Like

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)