Ericsson optimism grows after another solid quarter

Swedish networking vendor Ericsson reckons it’s capturing market share after announcing sales growth of 3% in Q3 2019.

October 17, 2019

Swedish networking vendor Ericsson reckons it’s capturing market share after announcing sales growth of 3% in Q3 2019.

Ericsson derives much of its market sizing estimate from analyst firm Dell’Oro and last we heard they were saying the overall market is currently growing at 2%. That does point towards Ericsson increasing its market share and also makes us wonder about Huawei’s 24% growth, unless nearly all of that was down to its smartphone division.

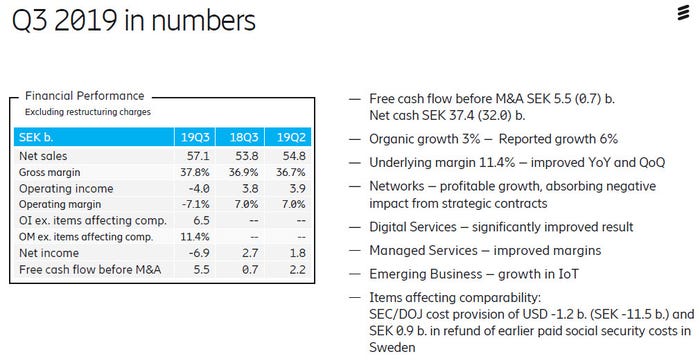

As you can see from the first slide above, quarterly profits were more than wiped out by the one-off hit from the US fine for historical dodgy dealings. But that was already priced in and investors seem to be pleased by the sales and margin numbers, as well as an improved outlook on both fronts that you can see in the second slide blow.

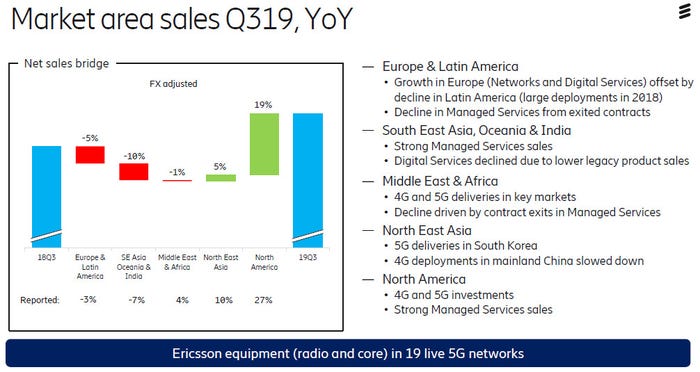

“We continue to see strong momentum in our business, based on the strategy to increase our investments for technology leadership, including 5G,” said Ericsson CEO Börje Ekholm. “We saw organic sales growth of 3% in the quarter, driven by the early adopters of 5G, in North America and North East Asia.”

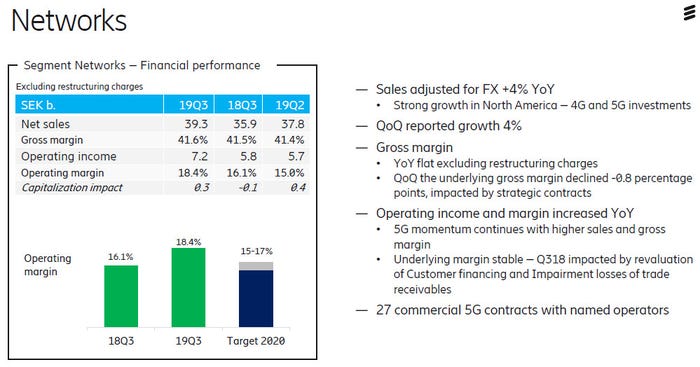

We spoke to Ericsson’s networks head Fredrik Jejdling about the numbers and he echoed Elkolm’s words about the 5G market ramping earlier than previously expected. However he insisted that the improved sales outlook was more down to Ericsson’s underlying strategy paying off than broader market movement, hence the claimed increased share. China remains the biggest market for 5G gear and Ericsson is doing its best to compete there but it will be tougher than the US.

For the longer term enabling operators to compete in the industrial IoT market, which is increasingly viewed as the biggest commercial opportunity created by 5G, is a major strategic priority for Ericsson, according to Jejdling. But he was keen to avoid downplaying the consumer applications of 5G and pointed to South Korea as the best current example of where some of this is becoming reality.

Once more Ericsson has delivered a solid but unspectacular set of results, which seems to be just fine by Ekholm, Jejdling and co. Ericsson’s share price was up 7% at time of writing, which implies investors were pleased by the slightly improved outlook. The networks division remains the driver of the majority of Ericsson’s revenue, but as the industrial IoT market starts to mature, investors will presumably look for a greater contribution from the other divisions as evidence that Ericsson is seizing that opportunity.

About the Author

You May Also Like

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)