Ericsson insists 5G is triggering telco revenue growth

The rollout and growing usage of 5G services is triggering a welcome uptick in telco revenues, according to Ericsson, which makes the observation in the latest issue of its Mobility Report.

February 9, 2023

The rollout and growing usage of 5G services is triggering a welcome uptick in telco revenues, according to Ericsson, which makes the observation in the latest issue of its Mobility Report.

The Swedish vendor’s new report, the first to be dubbed a Business Review, highlights a correlation between 5G uptake and revenue growth, something that surely makes encouraging reading for operators for whom flat and even declining top lines have become a cause for concern.

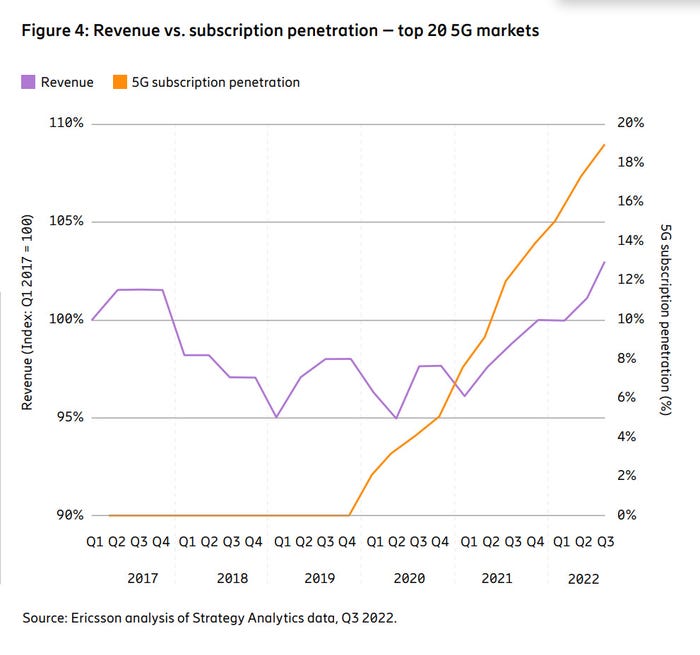

Specifically, Ericsson says it has seen a positive revenue growth trend since the start of 2020 in the world’s top 20 5G markets – which together account for around 85 percent of all 5G subscriptions – that correlates with growing 5G subs penetration rates in those markets. The top 20 markets, all of which can claim 5G penetration in excess of 15 percent, are for the most part located in Asia, Northern Europe and the US; see below for a full list.

World’s top 20 5G markets

Australia, Bahrain, China, Denmark, Finland, Hong Kong, Ireland, Japan, Kuwait, Monaco, Norway, Qatar, Saudi Arabia, Singapore, South Korea, Switzerland, Taiwan, the UAE, the UK and the US.

Average revenue growth in those 20 markets over the past two years came in at 6.5 percent, or 3.2 percent per year (see chart). While those numbers are not huge, they are an improvement on what many telcos are becoming used to. Vodafone, for example, saw service revenues slide in Europe in Q3 and reported growth of just 1.8 year-on-year at group level, propped up in no small part by a positive performance in the UK, one of the few Vodafone markets that features on Ericsson’s top 20 list.

Ericsson’s 6.5 percent figure “points firstly to the positive impact 5G has had upon the markets, and secondly to the way in which service providers in leading markets have been successful in converting the potential of 5G into consumer value and revenue growth,” the vendor said.

Network performance is key to future monetisation of mobile services, Ericsson points out, and naturally the more advanced 5G markets have seen an increase in network performance. This in turn allows operators to implement incremental pricing models that will help them address customer needs as well as continuing to drive long-term revenue growth.

Operators are spending – or have spent, in the case of some of the most advanced markets – huge sums on 5G. In the US, for example, Verizon and T-Mobile US have both recently confirmed that they are past the peak of 5G capex, having ploughed tens of billions of dollars into network rollout alone. Verizon famously spent US$53 billion on C-band spectrum and then committed another $10 billion to rolling it out. But it’s starting to look like those investments are paying off.

“While network investments have been substantial in the initial phase of 5G, with yearly capex levels of the top 20 5G markets increasing by around 30 percent between 2017 and 2022, there are now signs of positive returns on those investments,” Ericsson said.

There are plenty of industry players who will be happy to hear that.

Get the latest news straight to your inbox. Register for the Telecoms.com newsletter here.

About the Author

You May Also Like

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)