Apple credit card is up-and-running

As promised by CEO Tim Cook during the last earnings call, the Apple Card is set to debut this month, with the team already taking applications from consumers.

August 6, 2019

As promised by CEO Tim Cook during the last earnings call, the Apple Card is set to debut this month, with the team already taking applications from consumers.

To start with, randomly selected Apple customers who signed up months ago have gotten access, though the team is now building a list of iLifers who would like to receive the card upon full-launch. To start with, the credit card will only be available to US citizens, though we can’t imagine it will be too long before the ambitious Applers spread their wings internationally.

For Apple, this is another step towards decreasing reliance on the iPhone, a product which has dominated the profitability column for quite some time. In the years of gluttony, few would have complained about this reliance, but nowadays, with smartphone shipments slowing down globally, the desire for diversification has intensified.

Working alongside Goldman Sachs, Apple has said customers can register their interest in the card in less than a minute, which perhaps seems irresponsible considering the seriousness of applying for credit. This little dose of reality will create little concern for either partner, both of whom will be relying on consumer over-indulgence to fuel profits.

That said, there are some interesting gimmicks being included with the service.

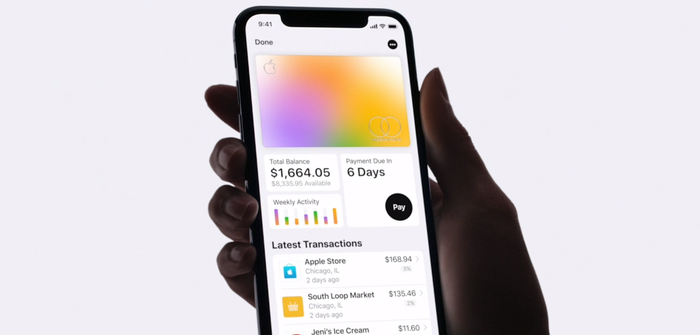

When using the card, all purchases will appear in the customers app, as is norm for the industry, but graphics will offer greater insight into spending habits. As you can see below, the distribution of colour on the card image and the graphs below detail how you are spending your money. Pink is for entertainment, yellow for shopping and orange for food, it is an interesting way to display purchasing patterns.

Other features include cash back and lower interest rates, though it is missing some of the perks which are so heavily hyped with traditional credit card providers.

What will be interesting to see over the next couple of months is the receptiveness of customers to a smartphone manufacturer entering into the financial world. Apple has one of the most admired brands worldwide and a cult-like following of customers, but whether this translates into something as important as financial services remains to be seen.

About the Author

You May Also Like

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)