Satellite disruption: how LEO and D2D are impacting telecoms

With an increasing number of satellites being launched into orbit, low earth orbit (LEO) constellations promise ubiquitous coverage and new opportunities for telcos, while direct-to-device (D2D) acts as a challenger.

March 7, 2024

Driven by Starlink’s SpaceX – the company that was considered by some to hold a LEO connectivity constellation monopoly until recently – non-terrestrial-networks (NTN) via LEO and D2D are increasingly being hailed as the new telco opportunity. Both as support in backhaul as well as to deliver ubiquitous coverage for enterprises and IoT, which some experts believe will particularly be an early opportunity for telcos.

In this article we explore the latest developments, use cases, and challenges of satellite networks while looking for telecom opportunities and potential business models for operators.

But before we delve into it, let’s briefly look at the origins of communication satellites.

A brief history of communication satellites

While the first satellite, a low earth orbit called Sputnik1, was launched by the Soviet Union in October 1957 – kicking off a space race between the US and Soviet Union – the first satellite relaying voice signals was launched in 1958 by the US under the project name Signal Communication by Orbiting Relay Equipment (SCORE).

The first message that was broadcast via a communication satellite was a hopeful one speaking of peace on earth from the US president Dwight D. Eisenhower:

“Peace on earth and goodwill toward men everywhere”

Much of the 50s and 60s constituted key technology developments making today’s commercial communication satellites possible. One such key step included the 1962 launch of the first active and two-way communications satellite, Telstar1, developed by Bell Labs for AT&T, transmitting the first satellite phone call.

Despite initially being a testbed for basic features of communication via space, Telstar1 became a pioneer, demonstrating how feasible satellites could be for the use in communication services. The US then decided satellites should be run by the government (which remained the case for over two decades), rather than the private sector, and created two new institutions, COMSAT and INTELSAT.

Meanwhile, the first commercial communication satellite, Intelsat1 (nicknamed Early Bird), was a geosynchronous orbit satellite launched in April 1965. For the first time a satellite was able to provide direct and near instantaneous contact between Europe and North America and handled three transmissions: television, telephone, and facsimile transmission (also known as fax).

Fast forward to 2003 and the first successful internet connectivity via satellite was launched. This was achieved by Eutelsat’s eBird. Specifically designed for the use of broadband services, this satellite service provided much of Europe with internet broadband and broadcast services in Asymmetric Digital Subscriber Line (ADSL) not-spots, the then predominant fixed broadband technology.

Advancements in the following decade saw an increase in bandwidth through High-Throughput Satellites, the first of which was launched by Eutelsat in 2010. This was achieved by leveraging high frequency Ka-Band.

2014-2021 saw the rise of satellite constellations (more on this below) which led to an increase in in-orbit spacecrafts and reduction of time delay. This advancement also enabled the effective use of LEO satellites, creating mesh networks, with Iridium as an early pioneer.

Today, there are more than 7,500 satellites in orbit, according to analyst house STL Partners and an estimated 72% of those in orbit (or around 5,400) are Starlink satellites. Advancements in data transmission and devices are surging interest in commercial satellite connectivity with particular interest in LEO and D2D.

Communication satellite types and altitude versus density

In satellite connectivity data is transmitted and received typically through a dish or receiver device at a ground station using different types of satellites.

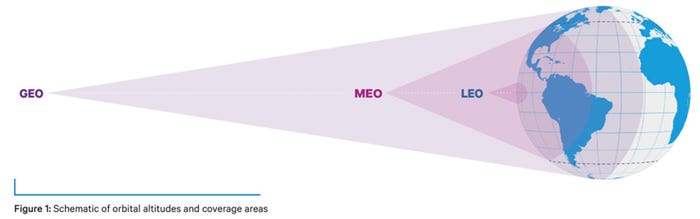

Traditionally, geostationary orbit (GEO; a type of geosynchronous orbit with an altitude of 36,000 km) and medium earth orbit (MEO; with an altitude of 7,000 – 20,000 km) satellites have been deployed for communication services. While their capacity is sufficient and their altitude good for coverage, their distance from the earth results in a very high latency (~600ms for GEOs), meaning they are often considered a last resort solution.

Meanwhile, LEO satellites, orbiting at 300 – 1,500 km above the earth (other sources cite slightly varying altitudes such as LEO at 500 – 1,200 km), are closest to our planet and have a much lower latency of roughly 40ms, making LEO satellites more advantageous.

Source: SES, Satellite Today

But altitude isn’t everything. LEOs orbit the earth at a relatively fast speed (16 times per day for a full circle orbit). Moving so fast means individual LEO satellites are much more effortful to connect to ground stations. As such, density is key for user experience and to achieve seamless connectivity.

This has led to the creation of LEO satellite constellations (grouping satellites together). A higher density increases effectiveness and throughput, improves coverage, and enables a more seamless signal handover.

In addition to connecting to a ground station, satellites can also connect directly with devices. In that, a smartphone or other device enabled for satellite connectivity can, for instance, directly connect to a LEO constellation. Advancements in D2D are expected to eventually lead to more growth and opportunity in satellite connectivity.

LEO and D2D developments and use cases in telecoms

Satellite connectivity is expected to create several opportunities for telcos. LEO and constellations that offer D2D are increasingly being considered cost efficient. This is especially true for D2D as compared to peer constellations which rely on satellite stations on the ground.

By embedding the receiver function into end-user devices, i.e. eliminating the need for a ground station, satellite operators can reduce the total cost of ownership (TCO) while adding the benefit of mobility and increasing the addressable market.

Using 3GPP standards with LEO constellations, is also believed to open the satellite market to more than one billion existing connected devices while making the D2D industry worth $1 billion in the next five years.

Some of the big players in satellite connectivity are backed by tech giants including Elon Musk’s Starlink and Jeff Bezos’ Project Kuiper. Other satellite operators include Eutelsat OneWeb which is considered a European challenger to Musk’s Starlink and the rising star AST SpaceMobile.

There are more players increasingly emerging and partnering with telcos to offer connectivity services, both smaller satellite firms and those specialising on specific use cases. With the momentum gained, here are some of the latest developments in LEO and D2D and their relevant use cases, as well as collaborations with telcos.

Connectivity and closing the digital divide. Today, satellite connectivity in telecommunications aims to address some of the issues mobile and fixed networks have struggled to solve. One such use case is the elimination of network dead zones once and for all to connect remote and off grid areas such as rural areas to help bridge the connectivity divide.

While existing satellite communication services already serve many rural communities and may be viewed as closing a gap, as discussed above latency remains an issue for most. Meanwhile, LEO and constellations can level the playing field between businesses and homes in urban and rural/remote areas with low latency and high throughput.

In the UK, the government selected OneWeb for trials to test remote locations as part of its ‘Very Hard to Reach Premises connectivity’ project in partnership with BT and Clarus. The government has committed £8m for satellite connectivity to cover most remote locations with what it calls ‘5G Plus’ technology, which in turn is part of its Wireless Infrastructure Strategy. This, it hopes, will see all populated areas covered by 2030 with fast broadband.

Further, beyond remote and rural areas, another use case includes connectivity on the sea or in air. For instance, in 2022 Hawaiian Airlines signed an agreement with Starlink for the use of inflight connectivity through SpaceX constellations. Starlink terminals were installed on top of select aircrafts and the first service was launched in February of this year. Interestingly, it doesn’t seem as though there was a (need for) a telco to collaborate to provide in-flight connectivity.

The SpaceX satellite internet service for airlines is provided through the company’s Starlink Aviation business division and promises download speeds of 40-220Mbps and uploads of 8-25Mbps with a latency of less than 99ms. SpaceX has also announced inflight connectivity deals with several other airlines including Qatar Airways and Japan Zipair.

Enterprise and private networks. Private networks, one of 5G’s key use cases, has not spared the satellite industry either. An example includes tech giant Amazon who has been talking up its Project Kuiper through potentially new options for data traffic management with its existing Amazon Web Services (AWS) solutions.

AWS CEO Adam Selipsky has revealed that the company plans to enable enterprises and the public sector to “move data from virtually anywhere over private, secure connections, and use these connections to reach your data in the AWS cloud.” Its pilot partners from the telco industry include NTT, Verizon, and Vodafone, while partnerships for the pilot are also open to other enterprises and government entities.

NTN IoT Connectivity. One of communication satellites’ key use cases includes ubiquitous connectivity for IoT services. Applications are varied and some of the early telco partnerships have included remote monitoring, disaster management, and weather monitoring.

Developments include the Telefonica Germany partnership with Skylo, a satellite provider specialising in IoT connectivity to assist with IoT coverage gaps. Skyo also has a partnership with Telit Cinterion and floLive, both IoT connectivity and solutions providers, which aims to enable 100% global coverage through satellite. This collaboration exploits 3GPP Release-17 NB-IoT-over-NTN standard. This means, the satellite network and the IoT protocols can be used without integration changes needed.

Satellite for 5G backhaul. In 2019, Vodafone claimed a world first in satellite (LEO) 5G backhaul. The trial was conducted with Telesat and was installed at the University of Surrey. A fully operational LEO backhaul example includes the February 2024 Eutelsat OneWeb LEO backhaul rollout for Telstra in Australia for remote base stations.

According to research house Analysis Mason the opportunity in backhaul constitutes the largest share of all satellite use cases today. As fibre, the technology that typically is considered for 5G backhaul, is often considered too costly and time consuming for rural rollout, it is not surprising to see the growth of this use case in recent years.

But not all industry professionals believe that the opportunity itself is large enough for telcos. Satellite for backhaul will likely be limited to mobile sites in rural and remote areas, many such areas e.g. in North America, it is argued, likely have already been laid with fibre.

Further, the uptake of D2D could render backhaul in itself as redundant with the direct connection between end-user devices and satellites.

Integrated and seamless connectivity. While today the industry relies on special terminals on the ground to connect to constellations, it is believed that in future satellite terminals could be integrated within radio stations, LTE or 5G, to seamlessly switch between terrestrial and NTNs. Similar to D2D, the benefits of this integration could include reduced TCO and increased mobility.

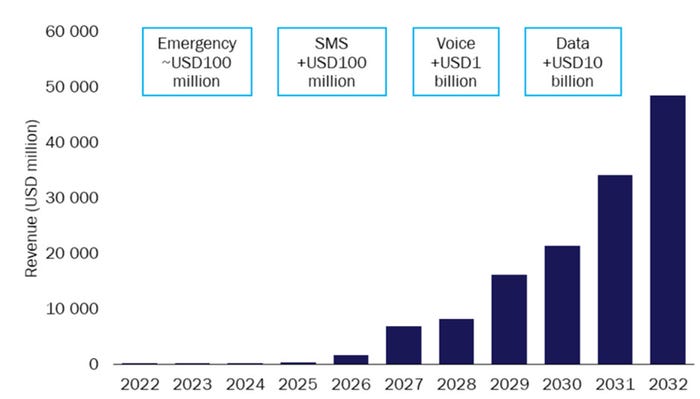

Meanwhile, as for D2D, there are some exciting news on the horizon with potential cumulative service revenue between 2022 and 2032 globally reaching some $137 billion. As such there is no surprise that existing telco partnerships and tests are already underway. They include those by AT&T in collaboration with AST SpaceMobile, T-Mobile US in collaboration with SpaceX. The latter launched the first tests in January. These D2D communications would be conducted inside the telcos’ existing spectrum and with customers’ existing smartphones, pending regulatory approval.

More recently, Japan’s Rakuten and AST SpaceMobile also signed a deal for direct-to-cell services which underlines the relevance for D2D in natural disasters and very hard to reach areas. Especially in Asia Pacific, which is one of the most natural disaster-prone regions in the world and thus, at higher risk of terrestrial networks being impacted.

Japan also has several remote islands and mountainous regions which present their own unique challenges, according to Mickey Mikitani, Rakuten CEO. These use cases particularly underscore the need for D2D satellite communication.

More on existing D2D-enabled smartphones further below in the upcoming challenges section.

Satellite D2D service revenue, worldwide, 2022–2032. Source: NSR, Analysis Mason

Satellite as a lifeline in war and areas of conflict. While President Eisenhower’s first satellite message in 1958 was one of hope and peace, in our day and age conflict, oppression, and wars seem inescapable, and satellites have a potentially key role they can play.

In 2022 Starlink activated 25,000 terminals, in Ukraine to support both civilians and the military defence against Russia. The satellite connectivity provided was hailed a success and a lifeline in those early months of the invasion. Since, there have been some controversies around Russia having gained access which if true raises significant security concerns.

Starlink connectivity was also promised to combat the internet blackouts in Iran during the Woman Life Freedom movement 2022/23. But this came with several caveats. The number of terminals provided to Iranian organisers/protesters (especially as compared to Ukraine) was not nearly enough to create any effective shadow web, thus creating a significant barrier to access.

The distribution of terminals involved another significant barrier, reportedly resulting in the devices having to be smuggled into the country. This highlights the relevance of satellite’s wider infrastructure maturity and more importantly, the advantages D2D would have created for protesters to remain connected had we already progressed with direct-to-cell.

Satellite connectivity challenges

Spectrum scarcity. Just as mobile technology relies on spectrum frequency availability for the transmission of data, communication satellites also require spectrum for the transmission of satellite signals. But spectrum is scarce and can be expensive. As a result, close collaboration among telcos and spectrum sharing is needed.

Once again SpaceX has been exploiting such operator partnerships in particular as it counts more than seven operator partners using their LTE frequency bands in the 1.6 GHz-2.7 GHz range for the use of satellite communication. The collaboration also enables the telcos to act as roaming partners to each other for D2D services, once regulatory approval is in place.

Satellite-enabled device availability. To date, few Original Equipment Manufacturers (OEMs) have launched satellite smartphones. Apple’s iPhones 14 and 15 were first to launch satellite connectivity for emergency communication purposes in partnership with Globalstar. But Android has been much slower to follow suit.

While Qualcomm collaborated with Iridium for the developments of a two-way satellite communication for Android devices, the partnership was called off as the likes of Motorolla, Nothing, Xiaomi etc have signalled disinterest in proprietary solutions. As a result of seeking standard-based solutions, Android OEMs have faced delays.

Further, not all satellites are inherently designed to send data directly to a device or a cell. Starlink’s SpaceX is one of few projects to have sent off D2D satellites into space so far, although phone-to-satellite is being tested by others inside existing spectrum and not just for those with new devices (as per the AT&T and T-Mobile examples).

Ground station production. Satellite ground station production and distribution can be time consuming and challenging. It can take months to get satellite dishes produced. But emerging startups are aiming to address this challenge through mass producing ground stations, such as the newly announced Northwood startup.

The company’s goal is to produce ground stations fast and with flexibility in mind. CTO and co-founder, Griffin Cleverly, reportedly states that a “colossal” amount of data is trying to travel between satellites and the earth now. This is why a new strategy is needed, “so that companies can get the data down reliably and in the quantities that they need”.

By aiming to deliver ground stations within “days rather than months” Northwood aims to solve a bottleneck and wants to ensure satellite operators don’t waste time reconfiguring networks. The focus of the company will be on LEO to begin with, and the goal is to provide a customer experience that resembles renting server capacity from the likes of AWS or Azure. The first tests to connect to an orbiting spacecraft are planned for later this year.

Space weather. Conditions in near-Earth space can drastically affect a satellite’s operations. Even the most modest of changes can have a significant impact on a satellite’s electronics and orbits or cause collision. These can lead to disruptions in communication reception and power grids on Earth, alongside a host of other hazards on critical systems.

To mitigate these challenges of space weather, global space weather monitoring is needed. It can mitigate the effects of disruptions in real time and help us understand better how and why they happen.

Space junk and collision hazard. Finally, there is also the question about the technology’s footprint. While satellites are predominantly powered by solar energy through large collections of solar panels and only use a small amount of fuel to maintain orbit, their footprint sadly includes the growing problem of space debris and the risk of collisions. The latter is especially true for Starlink as many astronomers are reportedly concerned over size and scale of the project.

The proximity of the LEOs to the earth, which we clearly identified as a benefit for connectivity, equally poses a climate challenge. With a distance of 550 km, visible to the naked eye without the need for any special equipment, Starlink satellites are within our thermosphere, that is the fourth layer of earth's atmosphere. The amount of metal that will be burnt in this layer causes some scientists concerns when old satellites are deorbited, which reportedly they believe could trigger (even more) unpredictable changes to our climate.

And while the space is luckily not a legal blackhole – as the Federal Communications Commission’s first space junk fine shows some regulation is taking place – it is questionable how effective monetary fines on their own can be. Especially, when faced with a sector that is dominated by Big Tech and led by the likes of Elon Musk and Jeff Bezos who have in the past shown little regard for regulation and following the rules of law.

It is worth noting here that other tech giants with influence entering the sector include Google who has made a substantial strategic investment into AST SpaceMobile. This agreement also includes product development, testing, and plans to rollout SpaceMobile connectivity on Android and other relevant devices.

The telecoms industry, especially the mobile sector, fancies itself a low carbon industry with a conscience. But with the sector already having emissions of around 2% of the global footprint, roughly the same as in the aviation sector, it is important to consider the footprint of any new or existing technology being used or expanded in order to avoid so-called greenwashing and creating new problems. Perhaps this calls for a new meaning to the saying ‘the sky is the limit’.

The future of satellite connectivity and the telco opportunity

According to research by analyst house Analysis Mason, satellite-related revenues in the telecom sector are set to grow by $32.5 billion between 2022 and 2027. These include revenues from D2D, broadband access, and backhaul (and trunking). The latter being reported as the largest share already and set to remain the lion share of total satellite revenues for telcos worldwide by 2027. Although other satellite backhaul forecasts are wide-ranging.

As discussed further above, satellite backhaul for mobile traffic is being considered as an alternative to fibre, with the latter often thought of as economically unviable in remote areas. But backhaul’s role itself could become less relevant as the tables tip in favour of D2D once device compatibility takes up and smartphones for instance can directly connect to satellites while people move in and out terrestrial dead zones.

In an email exchange David Martin, Senior Analyst and Telco Cloud Lead at STL Partners and co-author of New satellite connectivity: Rising star or pie in the sky?, said that the main opportunity for operators will likely revolve around “enabling ubiquitous coverage.”

“The ability for mobile operators to promise 100% network coverage via direct-to-device (D2D) satellite connectivity is a significant opportunity in itself, of course. It might not seem like a massive step up from, say, 98% or 99% geographical coverage to 100%. But if, as a customer, a mobile provider was truly able to guarantee you an outdoor signal 100% of the time, and its competitors were unable to match that promise, which provider would you choose?” he said.

In the same vein “many industrial and enterprise use cases” will benefit from ubiquitous coverage, “particularly involving industries such as logistics, mining or agriculture”. Further, Martin explains satellite IoT connectivity in these and other industries could well be “a bigger early opportunity for operators than consumer voice, text or broadband, in fact”.

Another question that arises in this debate is about the telco business model. Martin believes, while we are still in the early days of commercial offers, “operators are forming partnerships with satcos to incorporate satellite connectivity into their portfolios, and are generally offering satellite as a dedicated offering or as an add-on to their existing services, be that IoT or managed enterprise services, for example”.

On D2D and cost of delivery he told us that “the satellite part will eventually be subsumed within standard tariffs. If just a few leading operators start boasting about 100% coverage, all other providers will have to follow suit; and the incremental cost to telcos of providing the service will be driven down.”

To sum up, there is an increasing interest in NTNs by telecom operators, especially in LEO and D2D. There are also a growing number of satellite providers, some with niche focus on certain use cases such as IoT, others with bigger ambitions, keen to dominate the space (no pun intended), such as SpaceX.

But while the technology creates several opportunities for telecom operators and to provide that much sought after ubiquity, satellites will still remain another complementary technology. This means, while we are not ditching mobile stations and ripping out fibre cables in favour of satellite as our access technology, there are a range of LEO and D2D use cases where NTN will likely complement existing terrestrial broadband technologies and it appears as though the early adopter advantage might be on the horizon.

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)

.png?width=800&auto=webp&quality=80&disable=upscale)