5G Advanced – What does it mean for the RAN market?

5G has come a long way since the Korean operators launched mobile 5G in early 2019. In just four years, operators have invested more than $300 B globally in 5G-related capex, deploying 15 M+ macro and small cell radios. Adoption has been mixed.

December 4, 2023

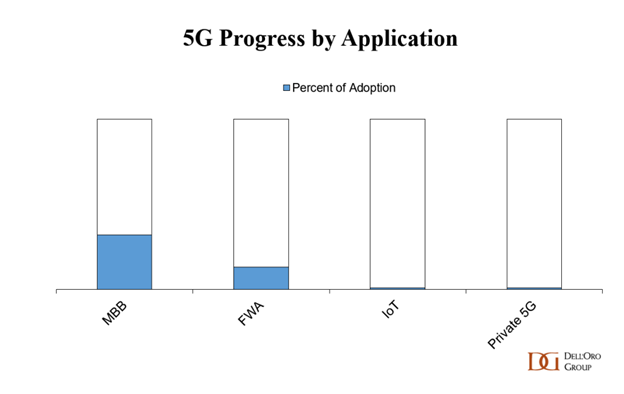

5G has come a long way since the Korean operators launched mobile 5G in early 2019. In just four years, operators have invested more than $300 B globally in 5G-related capex, deploying 15 M+ macro and small cell radios. Adoption has been mixed. On the one hand, 5G has been a massive success for the typical Mobile Broadband (MBB) use cases, providing operators with pivotal tools to support data traffic growth and driving down the cost per bit. On the other hand, 5G is still mostly about MBB and Fixed Wireless Access (FWA). The technology has not touched the surface yet when it comes to connecting machines and industries. As we look to the next part of this 5G journey, any incremental technology advancements that can improve the spectral efficiency will come in handy in a world where spectrum is limited and humans/machines steadily consume increasingly greater amounts of data. More importantly, any enhancements that can improve the growth prospects for Enterprise/Private 5G and Cellular IoT (cIoT)—ultimately helping to realize more aspects of the broader 5G vision—will play an important part in this next phase. In this blog, the objective is to update the 5G Advanced blog we previously posted and review the technologies, opportunities, and RAN implications.

What is 5G-Advanced?

The 3GPP roadmap is continuously evolving to fulfill the larger 5G vision. In this initial 5G wave that began in 2018, 3GPP has already completed three major releases (new releases every 1.5 to 2 years): 15, 16, and 17.

The schedule for 3GPP Release 15 included three separate steps: the early drop, focusing on NSA option 3; the main drop, focusing on SA option 2; and the late drop, focusing on completion of 4G to 5G migration architectures. While MBB is dominating the capex mix in this initial 5G phase, the 3GPP roadmap is advancing to address opportunities beyond MBB.

Release 16, also known as Phase 2, was completed in July 2020. The high-level vision is that Release 16 will provide the initial foundation for taking 5G to the next level beyond the MBB phase, targeting broad-based enhancements for 5G V2X, Industrial IoT/URLLC, and NR-U.

Release 17, also known as continued 5G expansion, was completed in early 2022. This 5G version provides more enhancements, extending operations up to 71 GHz with enhancements to IoT, Massive MIMO, Non-terrestrial networks (NTN), and DSS, among other things. With 3GPP Rel-17, a new device type (“NR Light”) was introduced, to address industrial sensors.

These initial releases have been key to the success of both MBB and FWA. But there are still shortcomings that need to be addressed, in order to fulfill the broader 5G vision. The current thinking with Release 18 and beyond (5G-Advanced or 5.5G) is that gradual technology improvements will help to take 5G to the next level, creating a foundation for more demanding applications and a broader set of use cases.

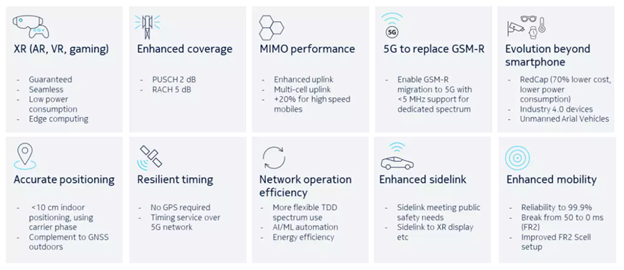

Current priorities with 5G-Advanced include:

More capacity and better performance. Some estimates suggest that MIMO enhancements, better beam management, and full duplex technologies taken together with other advancements will deliver another 20% of speed improvements relative to today’s 5G. Enhanced uplink (UL) and multi-cell UL improvements could pave the way for greater data rate and latency improvements in the UL.

Expanded coverage. In addition to MIMO and IAB coverage enhancements, 5G-Advanced also includes Non-Terrestrial Network (NTN) connectivity improvements, building on the NR/LTE-based NTN support that was introduced with Release 17.

More intelligence. Releases 15-17 already include some AI/ML features. 5G-Advanced will likely offer AI/ML enhancements in the RAN (including the air interface) and the management layers. In addition, Intelligent RAN and AI-powered analytics will help operators to proactively address network issues before they become a major problem.

Energy savings. Release 18 includes a confluence of static and dynamic power-saving enhancements for the radios and the overall RAN. Also, the specification is targeting to define a base station energy consumption model with various KPIs to better evaluate transmission and reception consumption/savings.

Flexible spectrum (FD, DSS, CA). NR is currently based on TDD or FDD spectrum. Full duplex (FD), a 5G-Advanced contender, improves spectrum utilization by allowing UL and DL to share the same spectrum (FD should improve capacity and latency, especially in the UL). Release 18 also includes DSS capacity enhancements (increasing PDCCH capacity by allowing NR PDCCH to be transmitted in symbols overlapping with LTE CRS). Other spectrum-related upgrades with 5G-Advanced include multi-carrier enhancements and NR support for dedicated spectrum bandwidths below 5 MHz.

Critical IoT. 5G-Advanced includes multiple industrial and IoT related advancements. Release 17 included support for Time Sensitive Networking (TSN), which will be expanded in 5G-Advanced to support Deterministic Networking (DetNet). NR-Light or Reduced Capability (RedCap) was introduced with 3GPP NR Release 17. 5G-Advanced will introduce lower-tier RedCap devices, seeking to find a better set of tradeoffs between cost, performance, and power consumption.

Sensing. Harmonized communication and sensing (HCS) is a Release 19 study item.

Positioning. Positioning is already supported in Release 16/17, however, 5G-Advanced is expected to improve positioning accuracy and power consumption (Nokia has said sub-10 cm positioning is doable). In addition, Release 18 will include support for RedCap devices.

Where are the opportunities?

With 5G growth now slowing in the public service provider-driven market, the search is on for the next growth vehicle that can help to offset the more tepid consumer MBB trends. All things considered, it is tempting to assume the growth opportunities will align perfectly with the PowerPoint vision, meaning enterprise 5G, new MBB scenarios, cIoT, and FWA all stand to benefit in the 5G-Advanced era. We remain optimistic about most of these potential gold mines, but we also need to keep in mind that disconnects between vision and reality are common.

It might not be the most exciting revenue growth opportunity for the carriers but one fundamental aspect with 5G-Advanced will be to support more demanding consumer MBB applications. Currently, total mobile data traffic (including FWA traffic) is projected to advance another 3 to 4x by 2027. More spectrum is always helpful but given the lack of global coordination in the Upper-6 GHz spectrum, operators will need to rely on sub-6 GHz spectrum, spectral efficiency gains, DSS enhancements, and more favorable mmWave economics to support more data traffic and reduce the cost per bit.

But the real excitement with 5G-Advanced is the enterprise opportunity. Private LTE/5G is developing at a slower pace than initially expected and the market remains small, with private 5G still accounting for less than 1% of the overall 5G RAN market. Operators outside of China are also reporting that the incremental revenue upside from industry verticals remains negligible. The slower start is not impacting the long-term growth thesis: proliferating cellular connectivity into enterprises and industrial settings where WiFi or public cellular connectivity is poor remains a massive growth opportunity. Although LTE and 5G NR Releases 15-17 are enough to address the lion’s share of the existing use cases, 5G-Advanced will provide important IoT and industry-focused enhancements.

One of the enterprise contenders with 5G-Advanced is the warehouse segment. Per Nokia’s industrial site assessment, warehouses comprise around 20% to 25% of the overall industrial site opportunity. Covering around 2.3 B square meters globally (Warehouse Building Stock), a shift toward 5G warehousing could move the enterprise needle.

Helping to explain the excitement with 5G-Advanced is the promise of Passive IoT. In addition to the improved economics relative to RFID based sensors, Passive 5G-Advanced IoT solutions should be favorable from a power consumption perspective (according to Huawei, passive IoT devices consume 100x less power than a NB-IoT device).

Fueled by the vision that 5G has a growing role to play in the Factory of the Future, 5G and 5G-Advanced manufacturing expectations are rising. While WiFi and LTE still address the great majority of the smart manufacturing connectivity market, our assessment is that 5G RAN revenues to support the manufacturing vertical are improving. In fact, the manufacturing already accounts for a double-digit share of Huawei’s, Nokia’s, and Ericsson’s ongoing private wireless projects. In the case of Huawei, manufacturing makes up roughly half of its enterprise ToB revenues. Nonetheless, it is still early days here and the majority of the enterprises are in the exploratory phase when it comes to using 5G based AGVs, Digital Twin, AR/VR, and quality inspections. The improved reliability, latencies, device costs, positioning accuracy, and UL throughput should all help to improve the industrial 5G business case but as with most enterprise verticals, it will take time. Leading industrial players such as Siemens, GE, and ABB, however, have all taken actions expressing the belief that the timing to introduce more 5G is right.

Sensing has potential with both public and private deployments. Per Huawei’s MWC Shanghai update, 5.5G sensing features have been verified in various traffic and low-altitude scenarios. The improved accuracy and range relative to traditional traffic sensors could help the IoV (Internet-of-Vehicles) segment.

What does this mean for the RAN forecast?

Following a couple years of exponential growth, 5G RAN investments are slowing. At the same time, it is still early in the broader 5G cycle. The message we have communicated for some time still holds: Our baseline scenario rests on the assumption that the 5G cycle will be longer and deeper than the LTE investment phase. And even though the base case is not hinging on the premise that 5G-Advanced will drive another capex cycle, Release 18 and future releases are expected to play important roles in this next part of the 5G journey.

Predicated on the assumption that the first part of the 5G-Advanced standard will be frozen in early 2024, commercial deployments could become a reality by 2025. If so, a significant portion of the 5G base stations deployed in 2027 will include some 3GPP Release 18 features.

In short, 5G-Advanced represents an important part of the 5G roadmap. The excitements levels for the various 5G segments will vary. Before we set unrealistic expectations, it is important to keep in mind that it took more than 10 years for enterprises to achieve an enterprise Wi-Fi installed base of 5% to 10% of the projected 2027 installed base. The enterprise is a major opportunity but 5G-Advanced is not going to change Amara’s Law (the effect of a technology in the short run tends to be overestimated, while underestimated in the long run).

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)

.png?width=800&auto=webp&quality=80&disable=upscale)