XR headset shipments slumped in 2023 but Apple offers salvation

Despite semi-regular reminders that extended reality (XR) will soon be part and parcel of daily life, end users don't seem to be on the same page...yet.

March 27, 2024

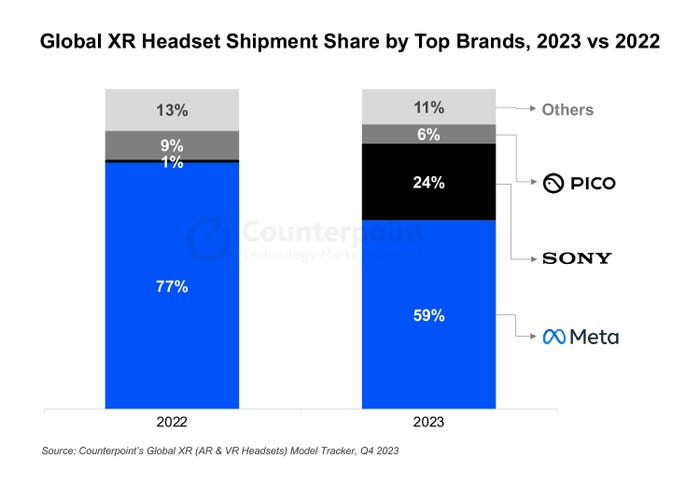

New stats from Counterpoint Research claim that global shipments of XR headsets slumped 19 percent year-on-year in 2023. The decline was driven by the absence of compelling new devices and a lack of engaging use cases apart from gaming.

That's a pretty damning assessment of the market by any measure. Without hardware and software, there is no XR market, and Counterpoint seems to be suggesting these two fundamental elements of the ecosystem are underwhelming.

Meta still holds the biggest share of the headset market, although it fell to 59% from 77% following the launch of Sony's PSVR2 headset, which enabled the latter to grab second place. Shipments of Meta Quest headsets also fell 38% last year, noted Counterpoint, which is not exactly ideal.

"The Quest 3's launch-quarter shipments were 33 percent lower than during the [preceding] Quest 2's launch quarter. The higher price point of the Quest 3, along with the continued availability of the Quest 2 and competition from other headsets contributed to the decrease in shipments for the latest model," Counterpoint explained.

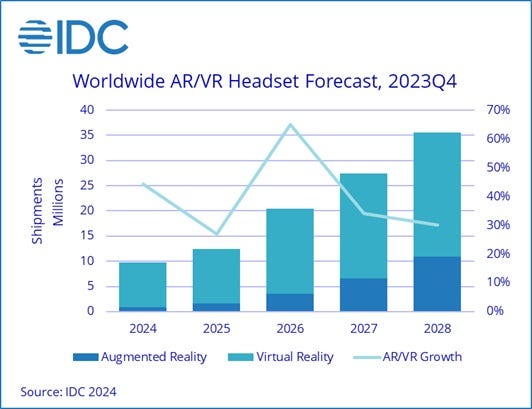

The headset market's fortunes could be looking up though. If separate stats from IDC prove to be on the money, then shipments this year will grow 44.2% to 9.7 million.

The analyst firm last week predicted growth will be driven by Apple's Vision Pro and the introduction of new models towards the end of this year.

"Apple's launch of the Vision Pro grabbed a lot of headlines and has raised awareness for AR and VR and although it's priced out of reach for most, it is helping raise the bar for competitors," said Jitesh Ubrani, research manager, mobility and consumer device trackers at IDC. "Along with Apple, many companies such as Meta and others have already begun their journey, transitioning from VR to mixed reality (MR); ultimately laying the groundwork for true AR experiences."

Indeed, Qualcomm is ready to help OEMs mount a challenge to Apple. Last September the chip maker unveiled two new 'spatial computing platforms' – the Snapdragon XR2 Gen 2 and the Snapdragon AR1 Gen 1. The former features hefty graphics processing capabilities and is pitched at VR headset makers, while the latter is designed more with smart glasses in mind.

Together they span a broad range of use cases, and might well convince more OEMs to design their own headsets – particularly if more content becomes available.

Content is king for Counterpoint. It reckons XR's appeal hinges on experiences other than gaming.

"Engaging content remains one of the primary keys that could unlock greater XR adoption," said Counterpoint. "The entry of major smartphone players in the segment could accelerate content production in the coming years. Particularly, Apple's entry with the Vision Pro will contribute to greater content and use case development, as well as attract other players to enter the segment."

Apple has a proven track record of stimulating the growth of device types that nobody knew they wanted.

The unveiling of the iPad raised iBrows™ all those years ago, and while smartwatches make for an obvious companion device to the smartphone, people at the time questioned the practicality of a watch that needed recharging every night.

Today, those same sceptics ask what people will do with a mixed reality headset that costs $3,500. The answer seems to be: we will find out.

"Mixed reality...has been the exception and not the norm, but Apple has shone a bright light on MR with the Vision Pro," said Ramon Llamas, research director with IDC's AR/VR programme. "Next, look at how companies will increasingly incorporate artificial intelligence to analyse data and generate virtual content for the user. Finally, display technology will move from content consumption to content interaction with more sophisticated sensors and displays."

IDC thinks that if all goes well, annual headset shipments could reach 24.7 million by 2028. This representing a five-year compound annual growth rate (CAGR) of 29.2%, driven by a broader range of consumer use cases beyond gaming, and uptake by businesses for training, design and so-on.

"It will be exciting to watch how the market will evolve from today's experiences and how end-users will adapt to them," Llamas said.

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)

.png?width=800&auto=webp&quality=80&disable=upscale)