Nokia thinks things might pick up later in the year

Finnish kit vendor Nokia has echoed its main rival in lamenting a weak macro environment but was a bit more optimistic about an imminent turnaround.

January 25, 2024

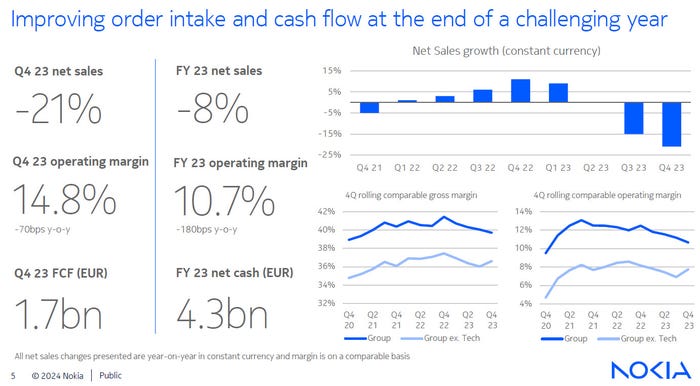

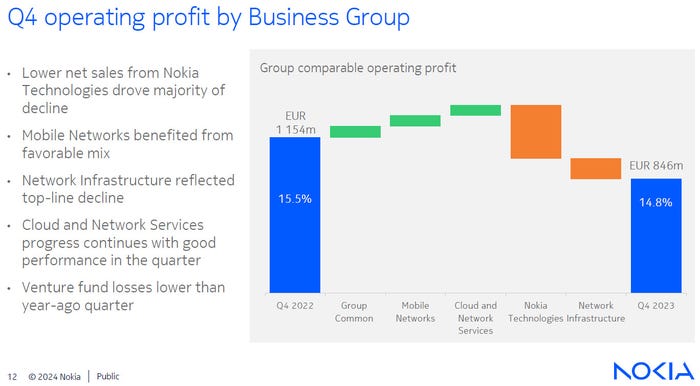

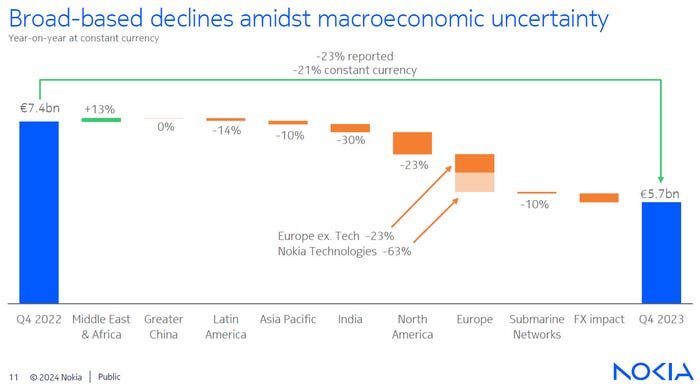

Across the telecoms and tech sectors there’s a general paradoxical trend towards lower revenues but durable margins. This can be largely explained by significant pre-emptive job cuts and other measures to ensure overheads fall at least as fast as earnings. In Q4 2023, Nokia’s sales fell 21% year-on-year but its operating margin sequentially improved, if you exclude the effect of a one-off licensing windfall in the year-ago quarter.

“In 2023 we saw a meaningful shift in customer behaviour impacting our industry driven by the macro-economic environment and high interest rates along with customer inventory digestion,” said Nokia CEO Pekka Lundmark. “Proactive action across our organization meant we were able to protect our profitability while continuing to invest in R&D and we delivered a comparable operating margin of 10.7% for the full year. This was a resilient performance considering the challenging environment and lower contribution from our high margin patent licensing business as some renewals remained outstanding.”

The IP licensing division should really be thought of as a standalone business since it exists in a very distinct economic environment. A year ago, one licensee opted to take up an option to extend its deal in perpetuity, which resulted in the whole lifetime of the deal being recognised on the books in that quarter. Similarly, the Oppo deal that has only just been finalised could easily have happened a month earlier.

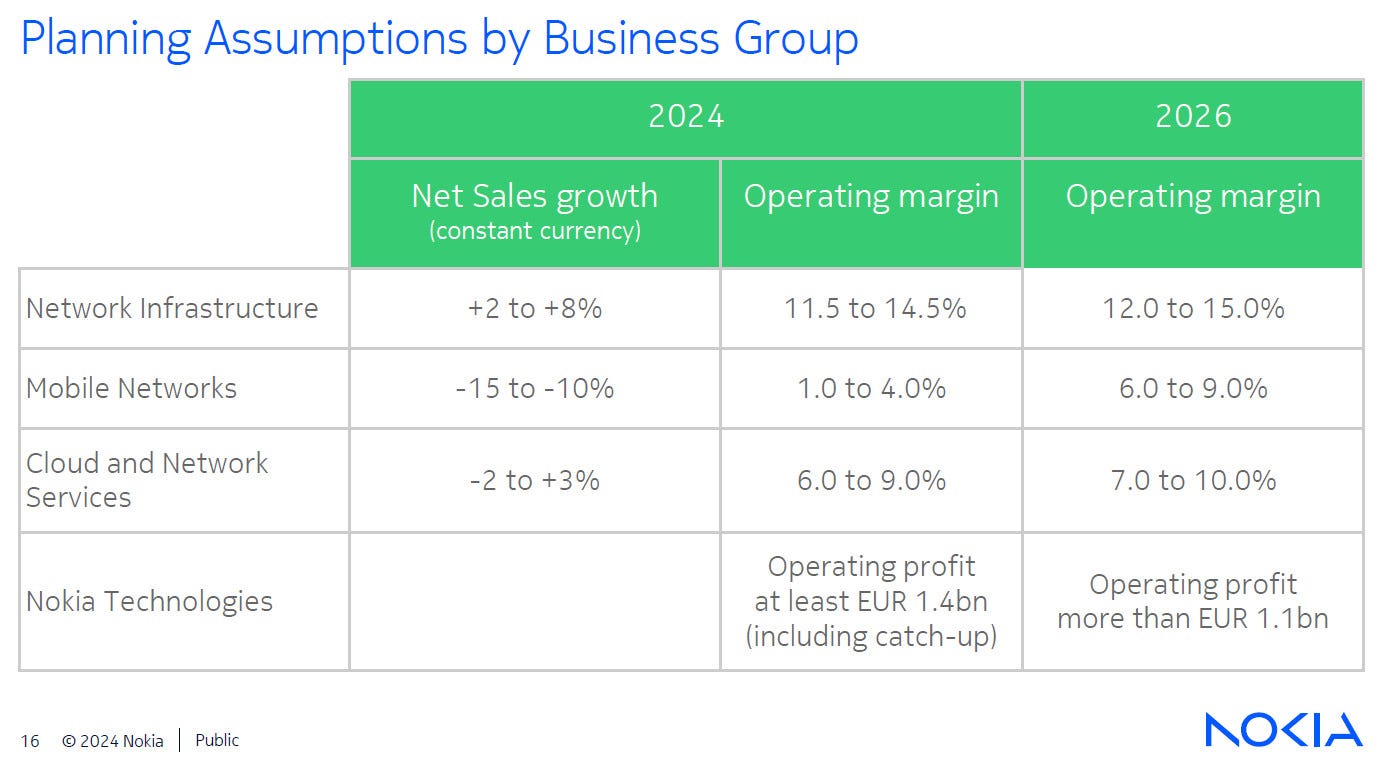

“Looking ahead, we expect the challenging environment of 2023 to continue during the first half of 2024, particularly in the first quarter,” said Lundmark. “However, we are now starting to see some green shoots on the horizon, with improving order intake for Network Infrastructure and some of the specific deals we have won.

“This is expected to drive a strong improvement in Network Infrastructure net sales growth in the second half of 2024 which we believe, even with a challenging first half, will drive solid growth for the full year. In Mobile Networks, we expect top line challenges in 2024 related to a more normalized pace of investment in India and the AT&T decision. “

The mobile division is clearly going to be Nokia’s Achilles Heel this year, not helped by AT&T’s defection to Ericsson. But Nokia has a more diverse set of business interests than its Swedish rival and seems to be counting on its fixed line Network infrastructure to pick up the slack. Either way, nobody seems to be expecting much good macro news for the first half of this year at least.

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)

.png?width=800&auto=webp&quality=80&disable=upscale)