January 30, 2024

The consumer group, like many in the UK, is on a mission to help bring down the cost of mobile and broadband services, and its latest salvo is pretty simple: it wants operators to implement the proposals outlined by Ofcom earlier in the year and ditch inflation-linked price increases.

It is unlikely to get very far with its quest, but its comments will shine yet more light on what is fast becoming a hot button issue in the UK as consumers grapple with the cost-of-living crisis.

"We think it is unconscionable that broadband and mobile providers are still planning to go ahead with this year's inflation-linked price rises, which will impact millions of people, even after the regulator declared this practice causes substantial consumer harm and proposed a ban," Which? said.

"We're calling for all providers to scrap this year's above-inflation hikes and implement Ofcom's proposals as soon as possible so new customers are not trapped in these unfair contracts," it added.

In December Ofcom indicated that it would like to ban inflation-linked mid-contract price rises in a bid to give customers greater clarity on what their bills will cost going forward. It is currently consulting on the matter and is due to make a final decision in the spring, but it looks like the proposal will go through.

Indeed, incumbent operator BT has already indicated that it will move to the pounds-and-pence price hike model suggested by the regulator as of this summer.

For now though, BT and its peers are sticking with their existing price rise models that are based on the rate of inflation. For most, that means the consumer price index figure for December published earlier this month, plus a set percentage, although it's worth noting that Virgin Media O2 – a sizeable player in fixed and mobile – bases its increases on the retail price index for January and will therefore confirm its new prices at a later date.

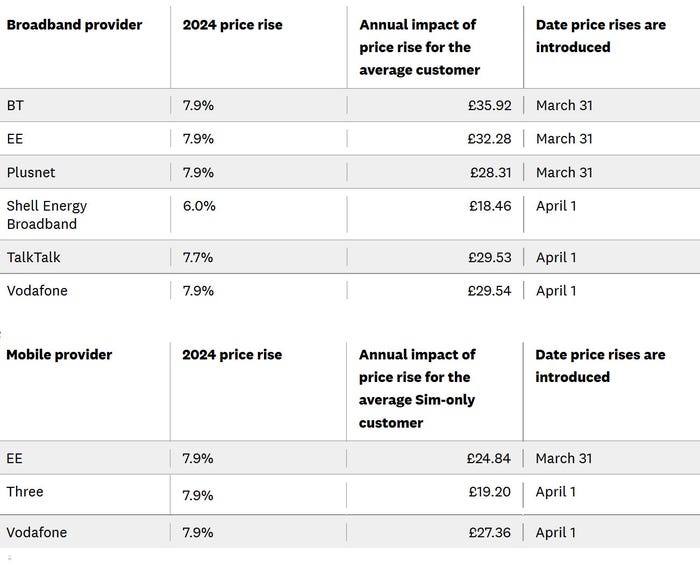

According to Which?, the annual impact of upcoming price increases for the major broadband firms will for the most part come in at around the £30 mark, dropping as low as £18.46 for Shell Energy customers and rising to almost £36 for BT. On the mobile side, EE, Three and Vodafone are all introducing 7.9% increases, which means an annual impact of between £19.20 for an average SIM-only Three customer and £27.36 for a Vodafone customer (see charts). Which? notes that TalkTalk disputes its calculations as to the actual financial impact on its customers, but does not seem to have shared an alternative figure.

It's easy to see from the data how an average UK customer could see an annual increase of £60, with both their mobile phone and broadband bill increasing at the same time.

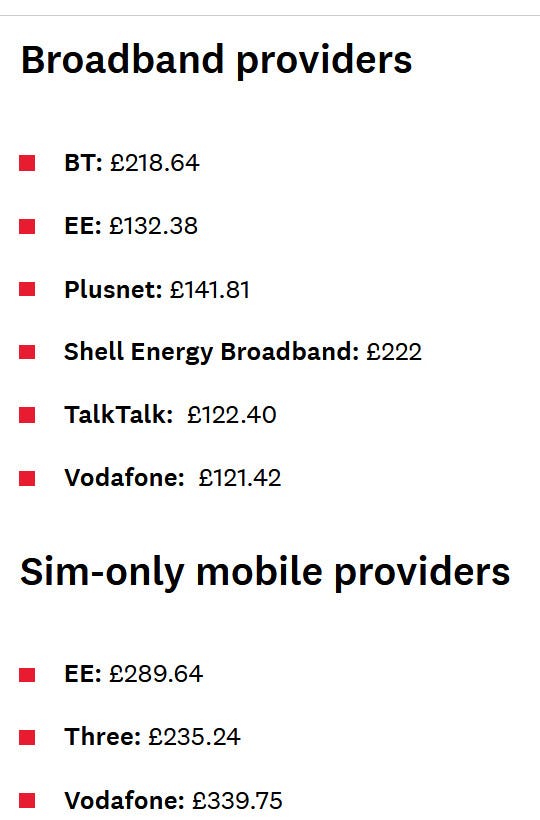

Currently, customers' only real alternative is to seek an early exit from their contract, but such a move often comes with an even more eye-watering financial penalty. Although Shell Energy Broadband is raising prices at a lower rate than its rivals, its customers face the steepest exit charge at £222. Mobile operators levy even greater fees, Vodafone topping the list at £339.75 (see charts). Which? calculated those exit fees based on the average customer of each provider with 12 months remaining on their contract.

"Given the cost of living crisis, we don't think it's fair if the only way for people facing price rises to switch to a better deal is for them to have to pay exit fees that can cost hundreds of pounds," Which? declared.

And it's quite possibly right. But although it is pretty clear that overall it is looking to get a better deal for consumers, the group's specific message is a little muddied...which arguably accurately reflects the situation in the UK at present.

Which? is hitting out at operators for their inflation-linked price rises, claiming that it is "unconscionable" that they are going ahead with the hikes now, despite the likely upcoming rule change from Ofcom. But the regulator's new rules are unlikely to alter the fact that customers will face mid-contract price rises; it will simply make those rises easier to understand and to predict. Ofcom's role is not to keep prices down for consumers.

Doubtless what Which? really wants is for operators to scrap the practice of mid-contract price rises altogether; not just this year – although that would be a start – but in future too. It's also what certain UK altnets, Hyperoptic being the most vocal, have lobbied for for some time.

Given that broadband and mobile contracts tend to run for around two years, it does not seem unreasonable to suggest telcos ought to be able to predict any price rises they might face during the period and write that in from the start. Unless it's not really about inflation at all and the whole pricing scheme is essentially a marketing bait-and-switch. Surely not.

But anyway, for now, Which? would be content with operators U-turning on this year's increases – which they almost certainly won't – so it will have to settle for using its position to at least make customers aware of what's going on.

"These CPI-linked hikes mean affected customers essentially end up paying approximately the cost of a thirteenth month on top of their existing annual contract, despite not benefitting from any additional services for the extra cost," Which? pointed out. "Given many of these providers also increased customers' bills by around 14% in 2023, this is another blow for consumers trying to keep spiralling costs under control."

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)

.png?width=800&auto=webp&quality=80&disable=upscale)