Austria allows telcos to turn off new 5G spectrum

Austria's telecoms regulator has just auctioned off spectrum in the 3.6 GHz and 26 GHz bands with a noteworthy condition: the winners will be permitted to turn off the airwaves overnight.

April 2, 2024

The Austrian Regulatory Authority for Broadcasting and Telecommunications, known locally as the RTR, announced last week that it had concluded the auction of 5G frequencies, its third such sale in recent years. Bringing in just shy of €25 million for state coffers, the auction was barely worth mentioning, but a closer look at the regulator's announcement yields an interesting snippet.

The RTR is keen to point out that at this auction it is permitting "sustainable use for the first time," according to the translation from the original German courtesy of Google.

"For the first time, in connection with coverage requirements, the regulatory authority is allowing these frequencies to be switched off between 00:00 a.m. and 05:00 a.m., provided there is no reduction in performance compared to daytime operations," the RTR said.

It did not provide further information, but its intent is clear: the regulator has cut some red tape to help further the many energy-saving initiatives now being discussed in the telecoms space.

We have talked a lot in this industry about the power consumption of radio access networks. STL Partners claims that the RAN accounts for around 1% of total global energy consumption, while an oft-quoted statistic from the GSMA states that the RAN accounts for 73% of operators' energy consumption. And there has been endless discussion over ways to make savings, both from a sustainability angle, as well as from the cost perspective.

One such way is to turn off parts of the mobile network when demand is low. Technologies such as Advanced Sleep Modes essentially mean that when there is no data to transmit, mobile sites should be able to essentially put themselves to sleep, consuming little to no energy. 5G-Advanced and ultimately 6G will bring more of this type of thing from the outset, and clearly the regulators need to play their part.

Hence the RTR's decision to let operators rest their frequencies, as it were, at times of what are likely to be low demand. It's interesting that the condition only seems to apply to the 26 GHz frequencies sold though.

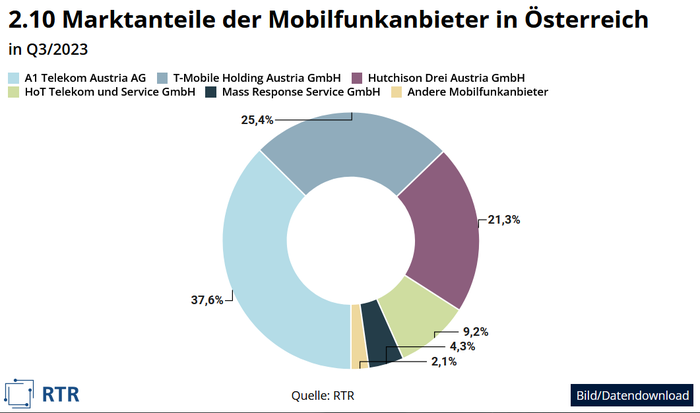

That spectrum accounted for around two thirds of the sum raised by the overall auction at €16.2 million for seven 200 MHz blocks. Market leader (see chart below) A1 Telekom Austria and T-Mobile's local unit picked up two blocks each, while third-placed Three Austria paid almost €7 million for three.

The big two shared the spoils in the 3.6 GHz sale, which consisted of regional spectrum left over from an earlier auction. The big spender, relatively speaking, was T-Mobile, which secured 40 MHz of spectrum covering an area close to Vienna for almost €5 million. The 3.6 GHz packages together brought in €8.49 million, with A1 accounting for much, although not all, of the remaining spend.

While it's always interesting to look at who bought what in a spectrum auction, whether the final total is in the tens of billions or a few million, the story here is not about who will light up the airwaves, but rather who will not. Or rather, who will turn off their spectrum at periods of low demand to shave a few euros of the electricity bill.

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)

.png?width=800&auto=webp&quality=80&disable=upscale)