EU contemplates splitting up Google’s advertising operations

The European Commission reckons Google controls too much of the digital advertising ecosystem and that the only remedy may be forced divestments.

June 15, 2023

The European Commission reckons Google controls too much of the digital advertising ecosystem and that the only remedy may be forced divestments.

Say what you like about the EU but when it decides to look into something it’s usually thorough, albeit at the expense of speed. In sending a Statement of Objections to Google over abusive practices in online advertising technology, the European Commission, which is the executive arm of the bloc, detailed all the ways in which Google dominates the advertising technology industry (adtech for short).

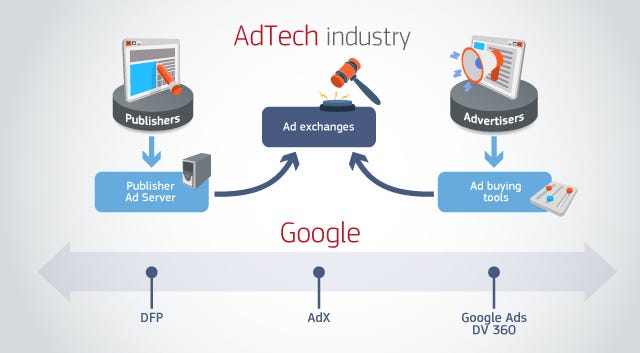

Google doesn’t just sell ads on its own sites, such as Google search and YouTube, it intermediates between advertisers and other media. The adtech tools used in this intermediation include publisher ad servers, ad buying tools, and ad exchanges. Google is involved in all of this via, respectively, DoubleClick For Publishers (DFP), Google Ads and DV 360, and AdX.

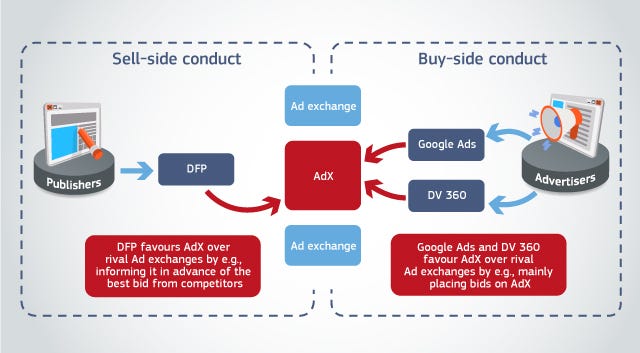

The EC allegation is that, through its dominance of both the server and buying spaces, Google is able to distort the market to favour its ad exchange business. Specifically it accuses of the following activities since 2014:

Favouring its own ad exchange AdX in the ad selection auction run by its dominant publisher ad server DFP by, for example, informing AdX in advance of the value of the best bid from competitors which it had to beat to win the auction.

Favouring its ad exchange AdX in the way its ad buying tools Google Ads and DV360 place bids on ad exchanges. For example, Google Ads was avoiding competing ad exchanges and mainly placing bids on AdX, thus making it the most attractive ad exchange.

“Our preliminary concern is that Google may have used its market position to favour its own intermediation services,” said Margrethe Vestager, EC EVP in charge of competition policy. “Not only did this possibly harm Google’s competitors but also publishers’ interests, while also increasing advertisers’ costs. If confirmed, Google’s practices would be illegal under our competition rules.”

Google, unsurprisingly, doesn’t concur. In a blog Dan Taylor, Google VP of Global Ads, insisted his company’s motives in this matter are benign, bordering on altruistic. “The digital advertising market enjoys competitive pricing, lively innovation, and robust competition — helping advertisers, publishers, and consumers,” he concluded. “We look forward to showing how our ad tech tools help make the internet open, and accessible — and how breaking them would diminish the availability of free, ad-supported content that benefits everyone.”

There will be plenty of opportunity for Google to defend itself in the likely exhaustive investigation that will follow this preliminary finding. The stakes are high, however, with the EC announcement concluding “The Commission’s preliminary view is therefore that only the mandatory divestment by Google of part of its services would address its competition concerns.”

The specifics of this matter are all somewhat arcane so it’s difficult to get a sense of the extent to which Google exploits its dominant position. A narrative is forming in the US that Europe is increasingly hostile to Silicon Valley but Big Tech is under plenty of domestic regulatory pressure too. Once a company becomes market-dominant its activities are automatically of regulatory concern, so in that respect Silicon Valley is a victim of its own success.

Get the latest news straight to your inbox. Register for the Telecoms.com newsletter here.

About the Author(s)

You May Also Like

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)

.png?width=800&auto=webp&quality=80&disable=upscale)