Apple’s smartphone market share tanks in China, while Huawei’s surges

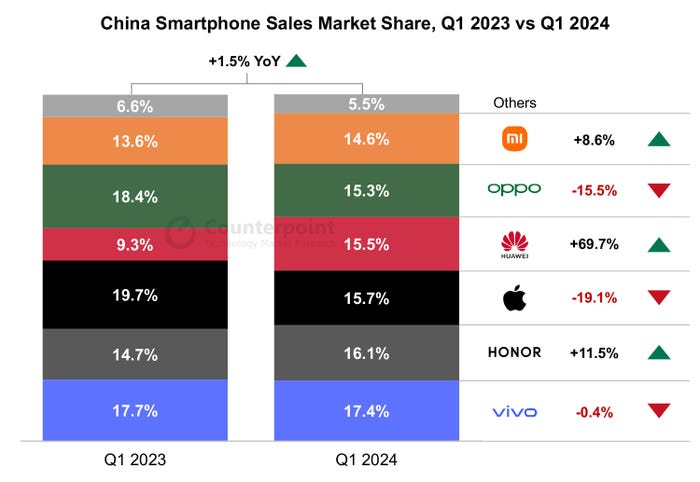

Apple’s market share dropped 19.1% YoY in China during Q1, while Huawei clocked a 69.7% YoY growth according to figures from Counterpoint.

April 23, 2024

Overall China’s smartphone sales grew 1.5% YoY in Q1 2024, marking the second consecutive quarter of positive YoY growth, according to Counterpoint’s Market Pulse Service.

Huawei was the biggest winner among the OEMs during Q1 with its 69.7% YoY growth in market share. Counterpoint largely attributes this to the successful launch of the 5G-capable Mate 60 series, as well as its ‘enduring brand reputation’, helping it to make gains in the $600+ premium segment. The same factors are seen as the cause of Apple’s 19.1% drop.

Honor also had a good quarter, growing 11.5% YoY in Q1. Counterpoint says this was driven by popular models such as the X50 and Play 40, and its expansion in offline channels.

“Q1 2024 was the most competitive quarter ever, with only 3% points separating the top six players in terms of market share,” said Counterpoint Senior Analyst Mengmeng Zhang. “Smartphone OEMs compete fiercely during the festive period, finalizing various marketing and promotional strategies well in advance. In particular, Chinese OEMs, with their ample cost-effective offerings, capitalize on the surge in sales in the low-end segment as migrant workers purchase more affordable, budget smartphones when returning home for the holidays. This trend further narrowed the market share gap among major players.”

Another Senior Research Analyst Ivan Lam pointed to the possibility of an iPhone recovery: “We are seeing slow but steady improvement from week to week, so momentum could be shifting. For the second quarter, the possibility of new colour options combined with aggressive sales initiatives could bring the brand back into positive territory; and of course, we are waiting to see what its AI features will offer come WWDC in June. That has the potential to move the needle significantly longer term.”

Going forward, Counterpoint estimates low single-digit YoY growth for China’s smartphone market in 2024, and notes that it expects smartphone OEMs to continue continue to explore new AI applications, and that these will trickle down to the mid-end segment.

Last week Huawei launched two variants of a new flagship phone range called Pura 70 to the Chinese market. As with the Mate 60, which Counterpoint points to a driver for much of Huawei’s success this quarter, most of the interest centred around what chips the new handsets are using since US led bans prohibit it from procuring them from the leading global manufacturers.

According to Reuters, multiple teardown reviews reveal that the Pura 70 features the Kirin 9010 chip, which ‘appears to be a slight upgrade’ from the Kirin 9000s in the previous Mate 60 Pro.

About the Author(s)

You May Also Like

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)

.png?width=800&auto=webp&quality=80&disable=upscale)