2023 shaping up to be even worse for smartphone market than first thought

Weak consumer demand has led analyst firm IDC to lower its outlook for the global smartphone market.

June 5, 2023

Weak consumer demand has led analyst firm IDC to lower its outlook for the global smartphone market.

The picture was already looking bleak back in February, when the same outfit predicted that shipments would fall this year to 1.19 billion from 1.2 billion in 2022. Last week, IDC said that even this forecast was a little optimistic.

“Our conversations with channels, supply chain partners, and major OEMs all point to recovery being pushed further out and a weaker second half of the year,” said Nabila Popal research director for IDC’s Mobility and Consumer Device Trackers, in a research note last week. “Consumer demand is recovering much slower than expected in all regions, including China. If 2022 was a year of excess inventory, 2023 is a year of caution.”

IDC now reckons global shipments will total 1.17 billion, which equates to a 3.2% decline on last year, compared to its previous forecast of a 1.1% decline.

“Channel inventory remains elevated in many regions and while things have improved, the confidence from suppliers is still low,” said Ryan Reith, group vice president of Mobility and Consumer Device Trackers at IDC.

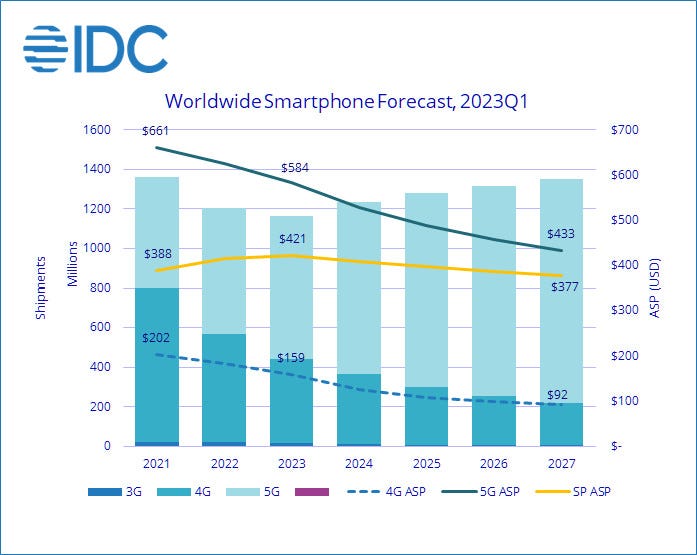

IDC expects the market to embark on a long road to recovery from next year. However, even by 2027, shipment volumes won’t quite have returned to where they were in 2021 (see chart).

IDC’s pessimism is hardly surprising given some of the other stats that have been coming out lately.

According to Assurant’s latest Mobile Trade-in and Upgrade Industry Trends report, published last week, the average age of traded-in smartphones was 3.35 years in Q1, compared to 3.26 years in Q4 2022. Trade-in values for handsets climbed too, with the average for iPhones topping $200 for the first time. In addition, late last year, Counterpoint Research predicted that 2023 will see smartphone replacement cycles increase to 43 months on average, the highest ever level.

All this indicates that consumers are reluctant to splash out on a new handset at the moment, and when they do, they are increasingly inclined to try and save some money by looking for a refurbished model.

It could also suggest that the current crop of smartphones offer only an incremental performance upgrade on earlier models, which – in addition to the economy – could also be contributing to longer replacement cycles, higher trade-in values and lower shipment volume.

OEMs are trying to drum up enthusiasm with new form factors, with foldables the current flavour of the month. Lenovo-owned Motorola last week became the latest to make an attempt, unveiling its new range of Razr flip-phones, which feature a full-length foldable display.

It comes hot off the heels of Google, which unveiled its hotly-anticipated Pixel Fold in May.

Meanwhile, Samsung is expected to showcase its new Galaxy Z Fold and Z Flip smartphones at its next Unpacked event. Yonhap news agency reported (in Korean) last week that the launch will take place in Samsung’s home market, Korea. A separate report from Sammobile claims it is due to happen in late July.

Rumour has it that Apple is also keen to enter the fray. A compendium of rumours compiled by Tom’s Guide suggests that a foldable iPhone is in the works and could make its debut any time between this year and 2025.

Separate IDC stats published in March claimed that the market for foldable phones increased by 75.5% in 2022, and the segment is expected to be one of the few bright spots in an otherwise gloomy market this year.

However, despite foldable phone prices coming down, they remain at the high end of the market, which is likely to limit their appeal.

“We continue to see more foldable designs in the market, which is a great technological step forward for the industry, but the timing is unfortunate given the headwinds,” Reith warned.

Get the latest news straight to your inbox. Register for the Telecoms.com newsletter here.

About the Author(s)

You May Also Like

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)

.png?width=800&auto=webp&quality=80&disable=upscale)