Economic situation could hit fibre uptake – analyst

Fibre accounts for more than two thirds of broadband connections globally, according to new research published this week, but there's a question mark over whether growth will continue against a tricky economic backdrop.

July 18, 2023

Fibre accounts for more than two thirds of broadband connections globally, according to new research published this week, but there’s a question mark over whether growth will continue against a tricky economic backdrop.

There were 1.377 billion fixed broadband connections worldwide as of the first quarter of this year, according to Point Topic. That’s a growth rate of 1.59% compared with the final quarter of 2022, or 21.6 million net adds, which is about on par with the average additions over the past half dozen quarters. However, net adds were slightly below the same quarter a year earlier and the growth rate slower, which reflects the impact of inflation and economic instability, the analyst firm said.

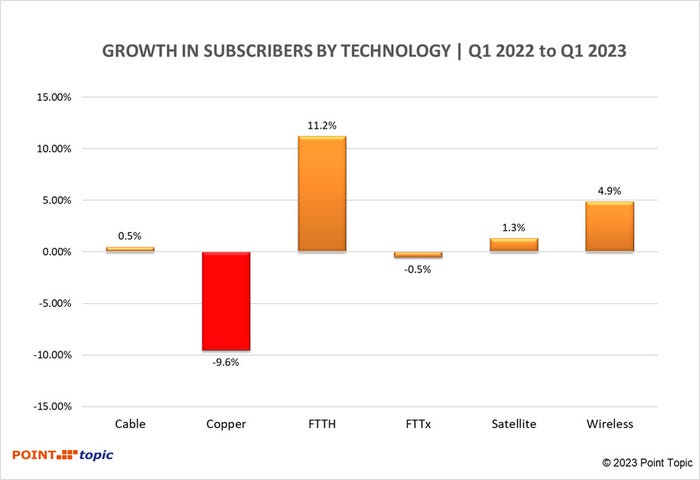

Fibre-to-the-home and building (FTTH/B) connections counted for 66.7% of the Q1 2023 total, up by 0.7 percentage points on Q4 2022 and up 11.2% per cent year-on-year.

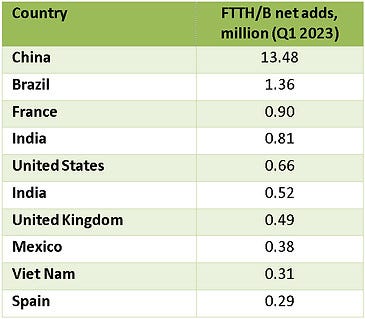

Quarterly net adds were driven by China, with 13.5 million, followed (not very closely) by Brazil at 1.4 million then France and India with just shy of a million each (see chart below). On the back of rapid rollouts from multiple providers, the UK recorded just under half a million adds and recorded a growth rate of 11.6% during the quarter; the latter figure sees it ranked third behind Algeria with 32.1% growth and Peru with 14.3%.

But while the analyst firm remains upbeat on full fibre broadband growth rates, it sounds a note of caution for the future.

“It remains to be seen whether consumers will continue to gravitate toward fibre broadband offerings, particularly as global economies face potential slowdown and inflationary pressures,” Point Topic noted.

It’s a fair point. We have long been in a place, at least in developed markets, where decent broadband is viewed as a must-have rather than a luxury. But there are doubtless many people who will manage for a little longer on a moderately fast connection when they might have upgraded to fibre had the cost of living crisis not started to bite.

FTTH/B is growing at the expense of other technologies. Copper connections are – unsurprisingly – on the slide, recording a 9.6% fall in Q1 (see chart below), while FTTx, which is mainly VDSL has seen its share of the global market drop to 6.7%, despite growth in 10 countries including Turkey, the Czech Republic, Greece and Germany.

Perhaps most pertinently, giving the rising profile of both technologies on the global stage, fibre broadband alternatives like satellite and fixed wireless access (FWA) are showing pretty solid growth, albeit from low bases. Satellite broadband subscribers increased by 1.3% in Q1, while wireless broadband was up by 4.9%.

“These trends can be attributed to the demand for connectivity in remote or underserved areas where traditional broadband infrastructure is not feasible,” Point Topic said, echoing the sentiments of the raft of companies now offering high-speed Internet based on these technologies, driven by the proliferation of 5G mobile and the increase of LEO satellites in orbit.

“The diverse growth rates among different broadband technologies highlight the dynamic nature of the industry as consumers seek more reliable and high-speed connections,” Point Topic said. “The significant increase in FTTH/B connections and the growth of satellite and wireless broadband underline the ongoing efforts to bridge the digital divide and ensure connectivity for all.”

And that will doubtless continue to be the case, no matter how much the economic situation hits the full fibre growth rate in the near term.

Get the latest news straight to your inbox. Register for the Telecoms.com newsletter here.

About the Author(s)

You May Also Like

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)

.png?width=800&auto=webp&quality=80&disable=upscale)