Chinese vendor ZTE has reported close on 50 per cent year-on-year growth in shipments of its handset products worldwide, selling 90 million units in 2010. The firm said that it had been ranked as the leading Chinese 3G handset vendor by research firm iSuppli, and pledged to boost its branding activities to help it achieve a place among the top three handset vendors worldwide within five years.

January 5, 2011

Chinese vendor ZTE has reported close on 50 per cent year-on-year growth in shipments of its handset products worldwide, selling 90 million units in 2010. The firm said that it had been ranked as the leading Chinese 3G handset vendor by research firm iSuppli, and pledged to boost its branding activities to help it achieve a place among the top three handset vendors worldwide within five years.

ZTE was keen to stress that it is not solely reliant on its enormous domestic market for its sales growth, with Europe proving the fastest-growing region. ZTE saw growth of 150 per cent in European markets combined, with growth in the US hitting 100 per cent year on year. High growth can often indicate a lower starting point and ZTE did not disclose its shipment volumes by regional markets.

Success in the smartphone segment is now essential for handset players, as evidenced by the presence of Apple and RIM—both of which operate exclusively in the high end of the handset market—among the top five handset vendors in the world. ZTE said that it, along with other Chinese vendors—had been helped in its efforts by the growing popularity of the Android platform.

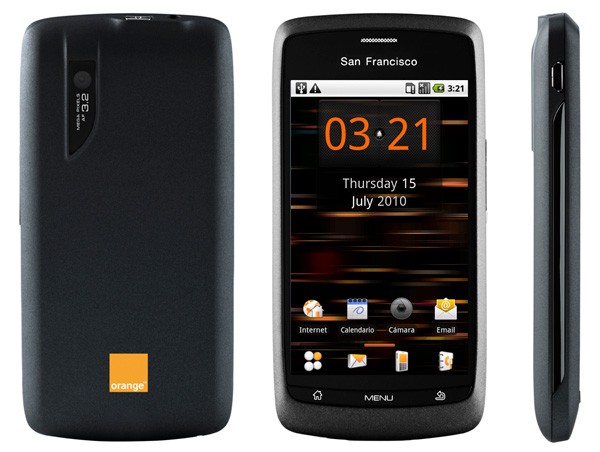

ZTE launched a sub-£100 Android handset with UK player Orange during the third quarter of last year, demonstrating the increasing breadth of demand for smartphones. Analyst Gartner put ZTE in ninth place in the handset vendor rankings for Q310, behind Taiwan’s HTC in eighth position. Gartner said ZTE had sold six million units to end users for the quarter.

Worldwide Mobile Terminal Sales to End Users in 3Q10 (Thousands of Units)

Company | 3Q10 Units | 3Q10 Market Share (%) | 3Q09 Units | 3Q09 Market Share (%) |

Nokia | 117,461.0 | 28.2 | 113,466.2 | 36.7 |

Samsung | 71,671.8 | 17.2 | 60,627.7 | 19.6 |

LG | 27,478.7 | 6.6 | 31,901.4 | 10.3 |

Apple | 13,484.4 | 3.2 | 7,040.4 | 2.3 |

Research In Motion | 11,908.3 | 2.9 | 8,522.7 | 2.8 |

Sony Ericsson | 10,346.5 | 2.5 | 13,409.5 | 4.3 |

Motorola | 8,961.4 | 2.1 | 13,912.8 | 4.5 |

HTC | 6,494.3 | 1.6 | 2,659.5 | 0.9 |

ZTE | 6,003.6 | 1.4 | 4,143.7 | 1.3 |

Huawei Technologies | 5,478.1 | 1.3 | 3,339.7 | 1.1 |

Others | 137,797.6 | 33.0 | 49,871.1 | 16.1 |

Total | 417,085.7 | 100.0 | 308,894.7 | 100.0 |

Source: Gartner, November 2010

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)

.png?width=800&auto=webp&quality=80&disable=upscale)